Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that a company is choosing between two alternatives-keep an existing machine or replace it with a machine. The costs associated with the two alternatives

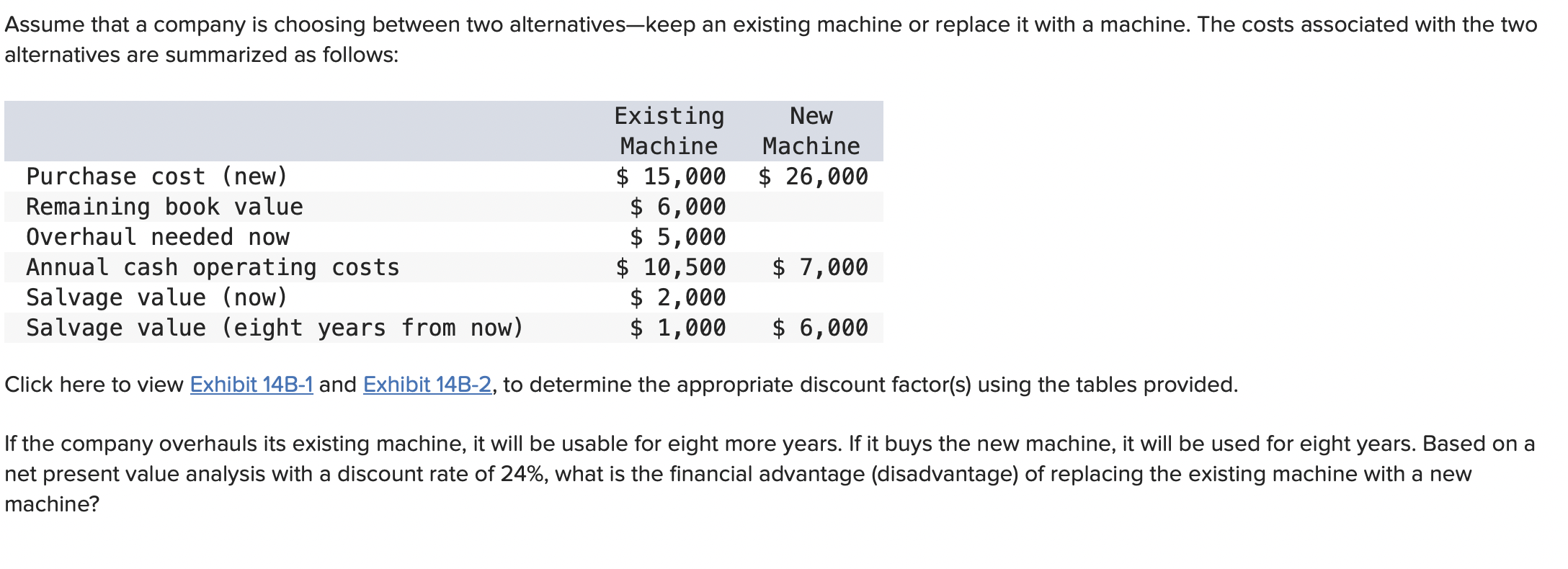

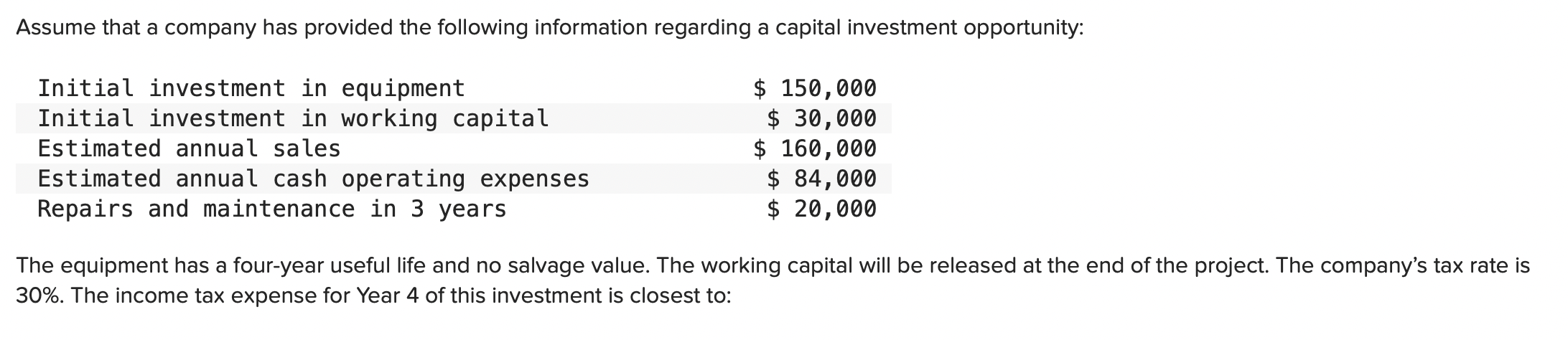

Assume that a company is choosing between two alternatives-keep an existing machine or replace it with a machine. The costs associated with the two alternatives are summarized as follows: Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. If the company overhauls its existing machine, it will be usable for eight more years. If it buys the new machine, it will be used for eight years. Based on a net present value analysis with a discount rate of 24%, what is the financial advantage (disadvantage) of replacing the existing machine with a new machine? Assume that a company has provided the following information regarding a capital investment opportunity: The equipment has a four-year useful life and no salvage value. The working capital will be released at the end of the project. The company's tax rate is 30%. The income tax expense for Year 4 of this investment is closest to

Assume that a company is choosing between two alternatives-keep an existing machine or replace it with a machine. The costs associated with the two alternatives are summarized as follows: Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. If the company overhauls its existing machine, it will be usable for eight more years. If it buys the new machine, it will be used for eight years. Based on a net present value analysis with a discount rate of 24%, what is the financial advantage (disadvantage) of replacing the existing machine with a new machine? Assume that a company has provided the following information regarding a capital investment opportunity: The equipment has a four-year useful life and no salvage value. The working capital will be released at the end of the project. The company's tax rate is 30%. The income tax expense for Year 4 of this investment is closest to Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started