Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that Arlington's 2024 pretax accounting income is $95,200 and that Arlington reports $40,000 more depreciation expense for tax purposes than it shows in

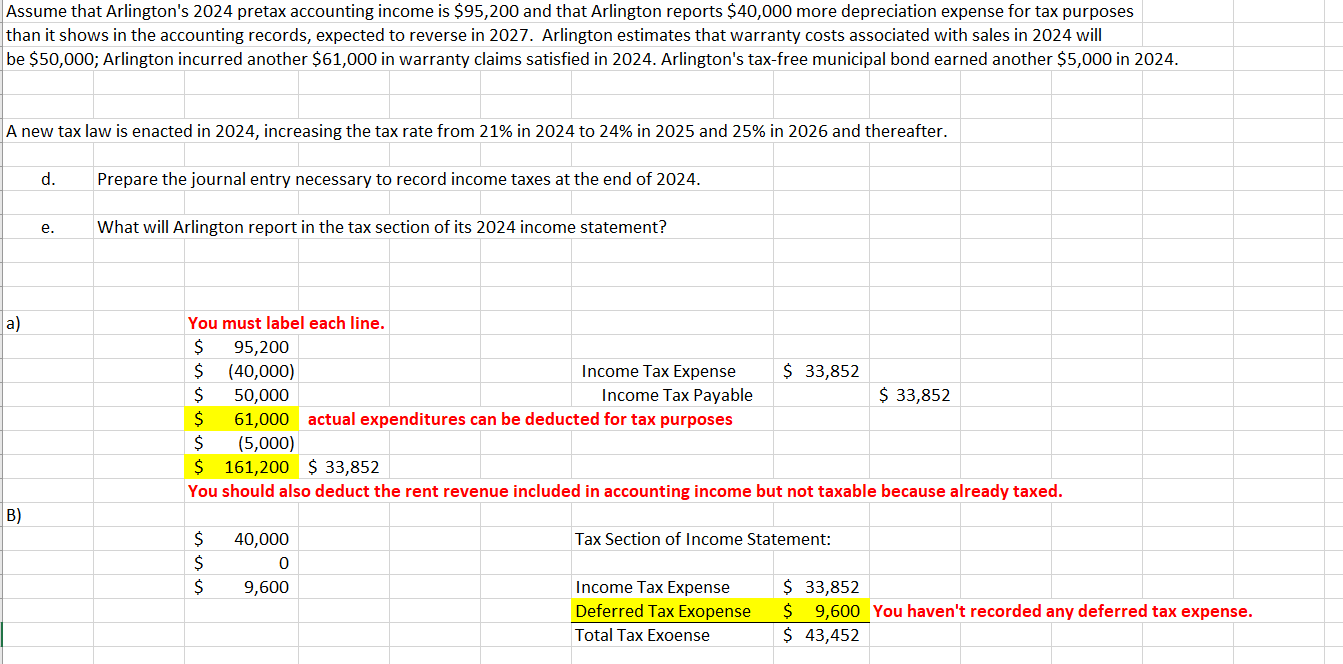

Assume that Arlington's 2024 pretax accounting income is $95,200 and that Arlington reports $40,000 more depreciation expense for tax purposes than it shows in the accounting records, expected to reverse in 2027. Arlington estimates that warranty costs associated with sales in 2024 will be $50,000; Arlington incurred another $61,000 in warranty claims satisfied in 2024. Arlington's tax-free municipal bond earned another $5,000 in 2024. A new tax law is enacted in 2024, increasing the tax rate from 21% in 2024 to 24% in 2025 and 25% in 2026 and thereafter. d. Prepare the journal entry necessary to record income taxes at the end of 2024. e. What will Arlington report in the tax section of its 2024 income statement? a) You must label each line. $ 95,200 $ (40,000) Income Tax Expense $ 33,852 $ 50,000 Income Tax Payable $ 33,852 $ 61,000 actual expenditures can be deducted for tax purposes $ (5,000) $ 161,200 $ 33,852 You should also deduct the rent revenue included in accounting income but not taxable because already taxed. B) $ $ 40,000 0 $ 9,600 SSS Tax Section of Income Statement: Income Tax Expense Deferred Tax Exopense Total Tax Exoense $ 33,852 $ 9,600 You haven't recorded any deferred tax expense. $ 43,452

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the deferred tax expense related to the rent revenue included in accounting inco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started