Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that on March 1, 2015, Wells Corporation issues $1 million of 6 percent, 20-year bonds payable. These bonds are dated March 1, 2015,

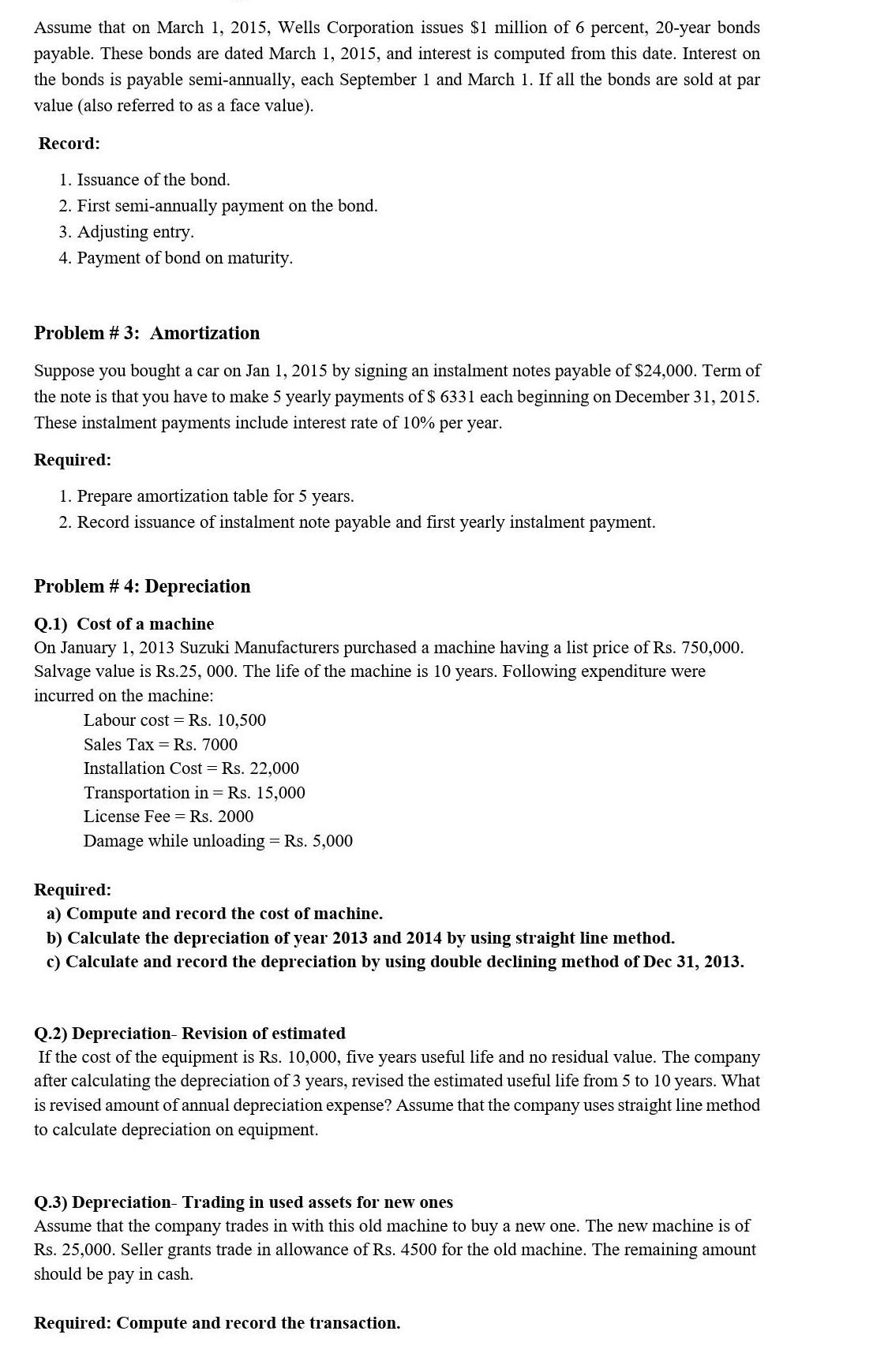

Assume that on March 1, 2015, Wells Corporation issues $1 million of 6 percent, 20-year bonds payable. These bonds are dated March 1, 2015, and interest is computed from this date. Interest on the bonds is payable semi-annually, each September 1 and March 1. If all the bonds are sold at par value (also referred to as a face value). Record: 1. Issuance of the bond. 2. First semi-annually payment on the bond. 3. Adjusting entry. 4. Payment of bond on maturity. Problem # 3: Amortization Suppose you bought a car on Jan 1, 2015 by signing an instalment notes payable of $24,000. Term of the note is that you have to make 5 yearly payments of $ 6331 each beginning on December 31, 2015. These instalment payments include interest rate of 10% per year. Required: 1. Prepare amortization table for 5 years. 2. Record issuance of instalment note payable and first yearly instalment payment. Problem #4: Depreciation Q.1) Cost of a machine On January 1, 2013 Suzuki Manufacturers purchased a machine having a list price of Rs. 750,000. Salvage value is Rs.25, 000. The life of the machine is 10 years. Following expenditure were incurred on the machine: Labour cost = Rs. 10,500 Sales Tax Rs. 7000 Installation Cost = Rs. 22,000 Transportation in = Rs. 15,000 License Fee = Rs. 2000 Damage while unloading = Rs. 5,000 Required: a) Compute and record the cost of machine. b) Calculate the depreciation of year 2013 and 2014 by using straight line method. c) Calculate and record the depreciation by using double declining method of Dec 31, 2013. Q.2) Depreciation- Revision of estimated If the cost of the equipment is Rs. 10,000, five years useful life and no residual value. The company after calculating the depreciation of 3 years, revised the estimated useful life from 5 to 10 years. What is revised amount of annual depreciation expense? Assume that the company uses straight line method to calculate depreciation on equipment. Q.3) Depreciation- Trading in used assets for new ones Assume that the company trades in with this old machine to buy a new one. The new machine is of Rs. 25,000. Seller grants trade in allowance of Rs. 4500 for the old machine. The remaining amount should be pay in cash. Required: Compute and record the transaction. Assume that on March 1, 2015, Wells Corporation issues $1 million of 6 percent, 20-year bonds payable. These bonds are dated March 1, 2015, and interest is computed from this date. Interest on the bonds is payable semi-annually, each September 1 and March 1. If all the bonds are sold at par value (also referred to as a face value). Record: 1. Issuance of the bond. 2. First semi-annually payment on the bond. 3. Adjusting entry. 4. Payment of bond on maturity. Problem # 3: Amortization Suppose you bought a car on Jan 1, 2015 by signing an instalment notes payable of $24,000. Term of the note is that you have to make 5 yearly payments of $ 6331 each beginning on December 31, 2015. These instalment payments include interest rate of 10% per year. Required: 1. Prepare amortization table for 5 years. 2. Record issuance of instalment note payable and first yearly instalment payment. Problem #4: Depreciation Q.1) Cost of a machine On January 1, 2013 Suzuki Manufacturers purchased a machine having a list price of Rs. 750,000. Salvage value is Rs.25, 000. The life of the machine is 10 years. Following expenditure were incurred on the machine: Labour cost = Rs. 10,500 Sales Tax Rs. 7000 Installation Cost = Rs. 22,000 Transportation in = Rs. 15,000 License Fee = Rs. 2000 Damage while unloading = Rs. 5,000 Required: a) Compute and record the cost of machine. b) Calculate the depreciation of year 2013 and 2014 by using straight line method. c) Calculate and record the depreciation by using double declining method of Dec 31, 2013. Q.2) Depreciation- Revision of estimated If the cost of the equipment is Rs. 10,000, five years useful life and no residual value. The company after calculating the depreciation of 3 years, revised the estimated useful life from 5 to 10 years. What is revised amount of annual depreciation expense? Assume that the company uses straight line method to calculate depreciation on equipment. Q.3) Depreciation- Trading in used assets for new ones Assume that the company trades in with this old machine to buy a new one. The new machine is of Rs. 25,000. Seller grants trade in allowance of Rs. 4500 for the old machine. The remaining amount should be pay in cash. Required: Compute and record the transaction. Assume that on March 1, 2015, Wells Corporation issues $1 million of 6 percent, 20-year bonds payable. These bonds are dated March 1, 2015, and interest is computed from this date. Interest on the bonds is payable semi-annually, each September 1 and March 1. If all the bonds are sold at par value (also referred to as a face value). Record: 1. Issuance of the bond. 2. First semi-annually payment on the bond. 3. Adjusting entry. 4. Payment of bond on maturity. Problem # 3: Amortization Suppose you bought a car on Jan 1, 2015 by signing an instalment notes payable of $24,000. Term of the note is that you have to make 5 yearly payments of $ 6331 each beginning on December 31, 2015. These instalment payments include interest rate of 10% per year. Required: 1. Prepare amortization table for 5 years. 2. Record issuance of instalment note payable and first yearly instalment payment. Problem #4: Depreciation Q.1) Cost of a machine On January 1, 2013 Suzuki Manufacturers purchased a machine having a list price of Rs. 750,000. Salvage value is Rs.25, 000. The life of the machine is 10 years. Following expenditure were incurred on the machine: Labour cost = Rs. 10,500 Sales Tax Rs. 7000 Installation Cost = Rs. 22,000 Transportation in = Rs. 15,000 License Fee = Rs. 2000 Damage while unloading = Rs. 5,000 Required: a) Compute and record the cost of machine. b) Calculate the depreciation of year 2013 and 2014 by using straight line method. c) Calculate and record the depreciation by using double declining method of Dec 31, 2013. Q.2) Depreciation- Revision of estimated If the cost of the equipment is Rs. 10,000, five years useful life and no residual value. The company after calculating the depreciation of 3 years, revised the estimated useful life from 5 to 10 years. What is revised amount of annual depreciation expense? Assume that the company uses straight line method to calculate depreciation on equipment. Q.3) Depreciation- Trading in used assets for new ones Assume that the company trades in with this old machine to buy a new one. The new machine is of Rs. 25,000. Seller grants trade in allowance of Rs. 4500 for the old machine. The remaining amount should be pay in cash. Required: Compute and record the transaction. Assume that on March 1, 2015, Wells Corporation issues $1 million of 6 percent, 20-year bonds payable. These bonds are dated March 1, 2015, and interest is computed from this date. Interest on the bonds is payable semi-annually, each September 1 and March 1. If all the bonds are sold at par value (also referred to as a face value). Record: 1. Issuance of the bond. 2. First semi-annually payment on the bond. 3. Adjusting entry. 4. Payment of bond on maturity. Problem # 3: Amortization Suppose you bought a car on Jan 1, 2015 by signing an instalment notes payable of $24,000. Term of the note is that you have to make 5 yearly payments of $ 6331 each beginning on December 31, 2015. These instalment payments include interest rate of 10% per year. Required: 1. Prepare amortization table for 5 years. 2. Record issuance of instalment note payable and first yearly instalment payment. Problem #4: Depreciation Q.1) Cost of a machine On January 1, 2013 Suzuki Manufacturers purchased a machine having a list price of Rs. 750,000. Salvage value is Rs.25, 000. The life of the machine is 10 years. Following expenditure were incurred on the machine: Labour cost = Rs. 10,500 Sales Tax Rs. 7000 Installation Cost = Rs. 22,000 Transportation in = Rs. 15,000 License Fee = Rs. 2000 Damage while unloading = Rs. 5,000 Required: a) Compute and record the cost of machine. b) Calculate the depreciation of year 2013 and 2014 by using straight line method. c) Calculate and record the depreciation by using double declining method of Dec 31, 2013. Q.2) Depreciation- Revision of estimated If the cost of the equipment is Rs. 10,000, five years useful life and no residual value. The company after calculating the depreciation of 3 years, revised the estimated useful life from 5 to 10 years. What is revised amount of annual depreciation expense? Assume that the company uses straight line method to calculate depreciation on equipment. Q.3) Depreciation- Trading in used assets for new ones Assume that the company trades in with this old machine to buy a new one. The new machine is of Rs. 25,000. Seller grants trade in allowance of Rs. 4500 for the old machine. The remaining amount should be pay in cash. Required: Compute and record the transaction.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Sure lets address Problem 4 under Depreciation Q1 Cost of a machine To compute the cost of the machine we need to add all the expenditures related to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started