Question

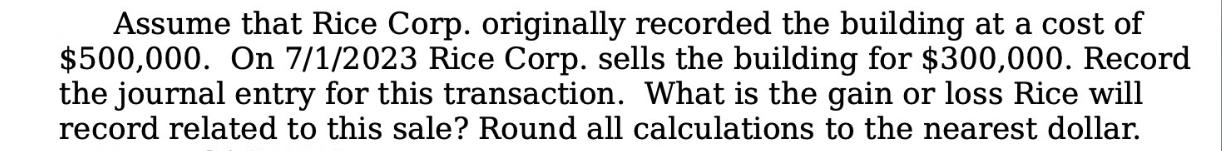

Assume that Rice Corp. originally recorded the building at a cost of $500,000. On 7/1/2023 Rice Corp. sells the building for $300,000. Record the

Assume that Rice Corp. originally recorded the building at a cost of $500,000. On 7/1/2023 Rice Corp. sells the building for $300,000. Record the journal entry for this transaction. What is the gain or loss Rice will record related to this sale? Round all calculations to the nearest dollar.

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The journal entry for the sale of the building by Rice Corp would be as follows Date 712023 Debit Ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting an introduction to concepts, methods and uses

Authors: Clyde P. Stickney, Roman L. Weil, Katherine Schipper, Jennifer Francis

13th Edition

978-0538776080, 324651147, 538776080, 9780324651140, 978-0324789003

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App