Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that the final stock price is $18, in order to fill in the payoffs and profits. DO NOT COPY PASTE EARLIER ANSWERS!!! I WILL

Assume that the final stock price is $18, in order to fill in the payoffs and profits.

DO NOT COPY PASTE EARLIER ANSWERS!!! I WILL REPORT SPAM!!! IF YOU ARE CONFIDENT ABOUT THE ANSWER THEN ONLY ANSWER IT OR ELSE STAY AWAY FROM THE QUESTION!!!

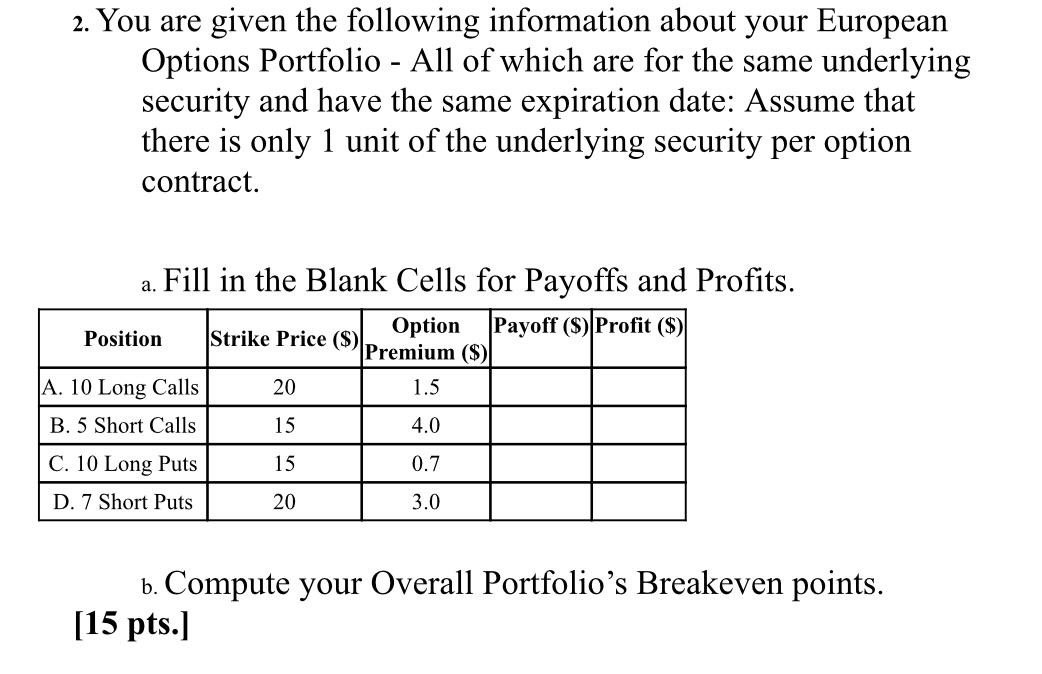

- 2. You are given the following information about your European Options Portfolio - All of which are for the same underlying security and have the same expiration date: Assume that there is only 1 unit of the underlying security per option contract. a. Fill in the Blank Cells for Payoffs and Profits. Option Payoff (S) Profit ($) Position Strike Price ($) Premium ($) A. 10 Long Calls 20 1.5 B. 5 Short Calls 15 4.0 0.7 C. 10 Long Puts D. 7 Short Puts 20 3.0 b. Compute your Overall Portfolio's Breakeven points. [15 pts.]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started