Question

Assume that the following three bonds are available: a. Calculate price, modified duration, and convexity for these three bonds. b.Now, suppose you have $1,000,000 worth

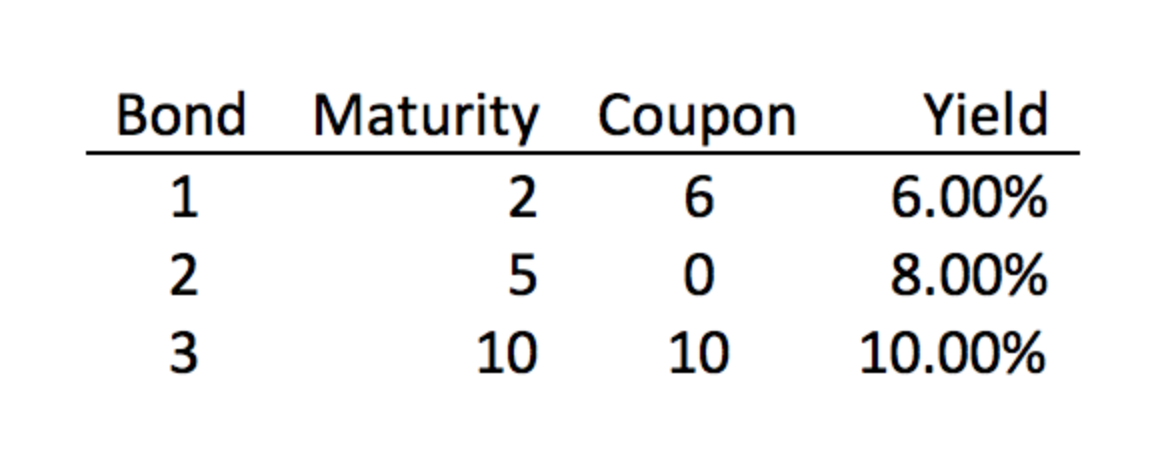

Assume that the following three bonds are available:

a. Calculate price, modified duration, and convexity for these three bonds.

b.Now, suppose you have $1,000,000 worth of the 5-year bond. You want to carry out a butterfly spread, that is to sell the 5-year bond and buy the 2-year and 10-year bonds such that the value of your final portfolio is the same as the sale proceeds, that is 1,000,000, and the modified duration of the final portfolio is equal to the modified duration of the 5-year bond. Rounding off to the nearest $1000, calculate the dollar value of the 2-year and the 10-year bonds you buy.

c.Does your portfolio or the initial 5-year bond have greater convexity?

d.What is the rationale of the butterfly spread?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started