Answered step by step

Verified Expert Solution

Question

1 Approved Answer

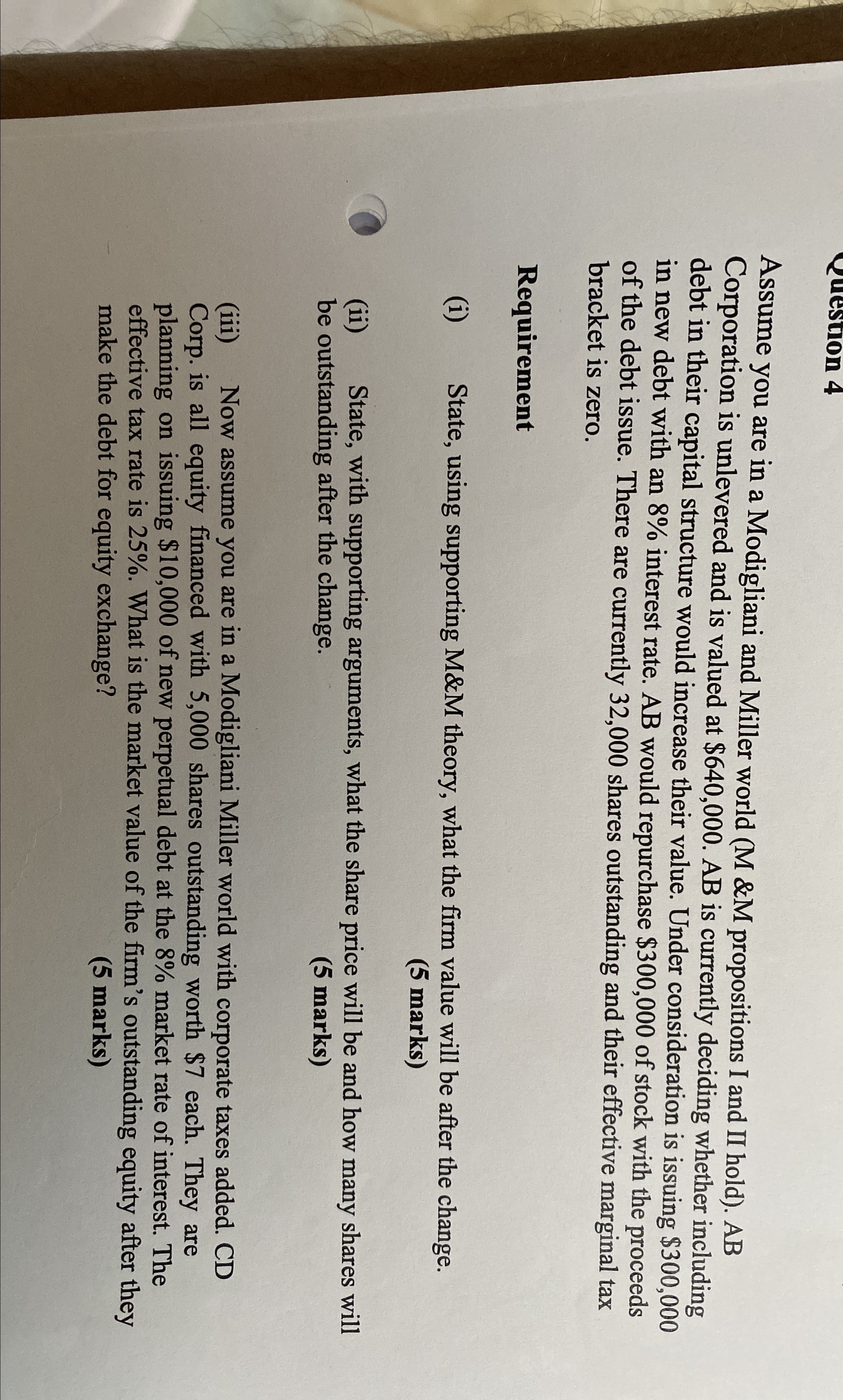

Assume you are in a Modigliani and Miller world ( M &M propositions I and II hold ) . AB Corporation is unlevered and is

Assume you are in a Modigliani and Miller world M &M propositions I and II hold AB Corporation is unlevered and is valued at $ is currently deciding whether including debt in their capital structure would increase their value. Under consideration is issuing $ in new debt with an interest rate. would repurchase $ of stock with the proceeds of the debt issue. There are currently shares outstanding and their effective marginal tax bracket is zero.

Requirement

i State, using supporting M&M theory, what the firm value will be after the change. marks

ii State, with supporting arguments, what the share price will be and how many shares will be outstanding after the change.

marks

iii Now assume you are in a Modigliani Miller world with corporate taxes added. CD Corp. is all equity financed with shares outstanding worth $ each. They are planning on issuing $ of new perpetual debt at the market rate of interest. The effective tax rate is What is the market value of the firm's outstanding equity after they make the debt for equity exchange?

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started