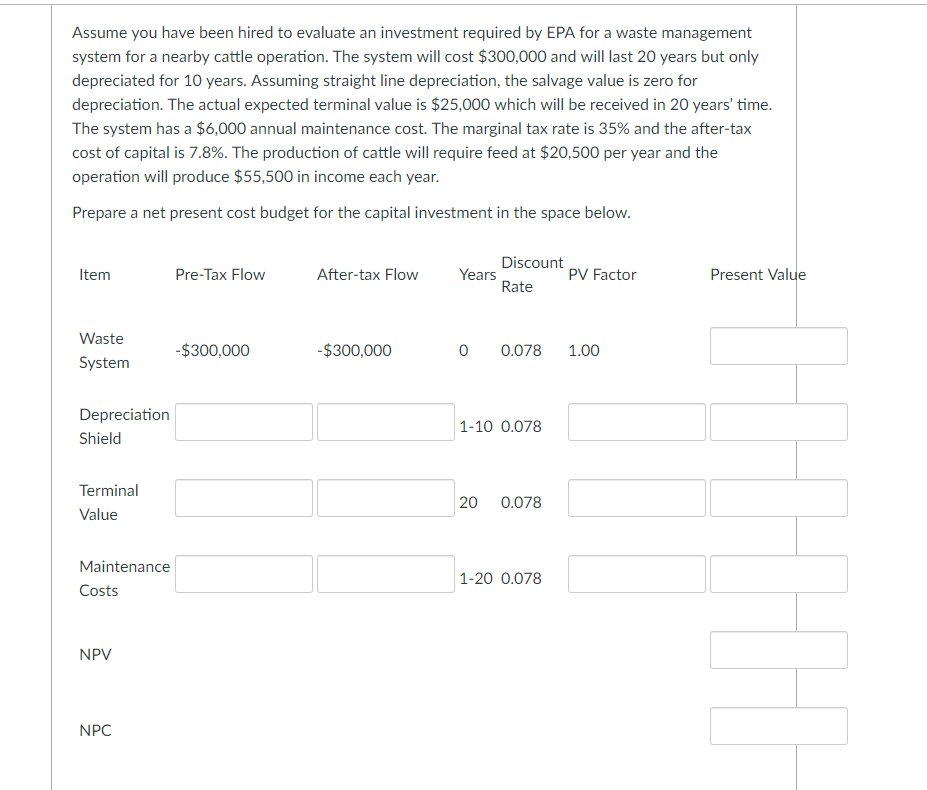

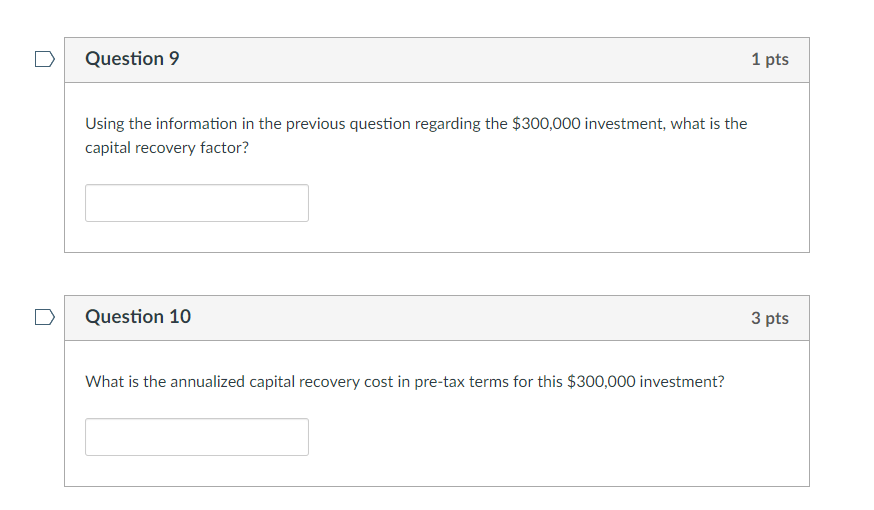

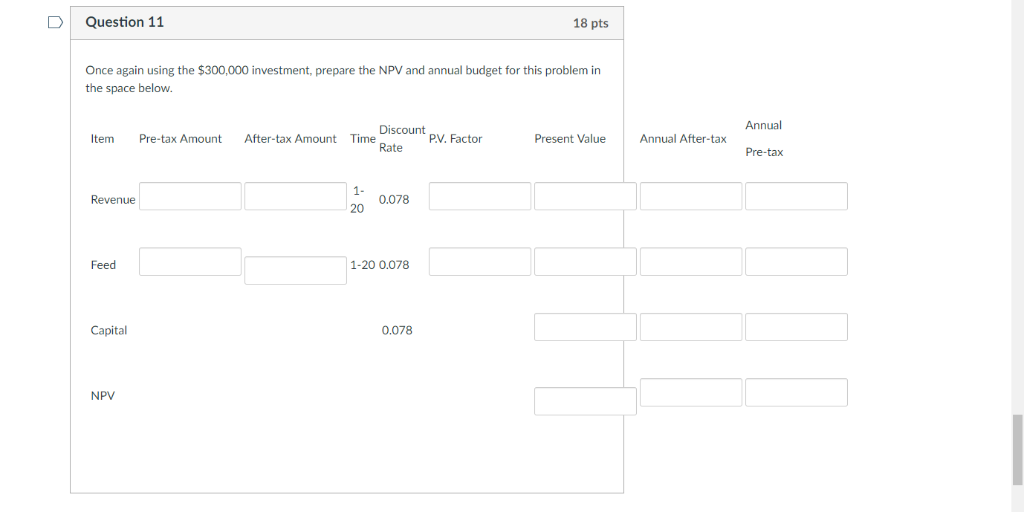

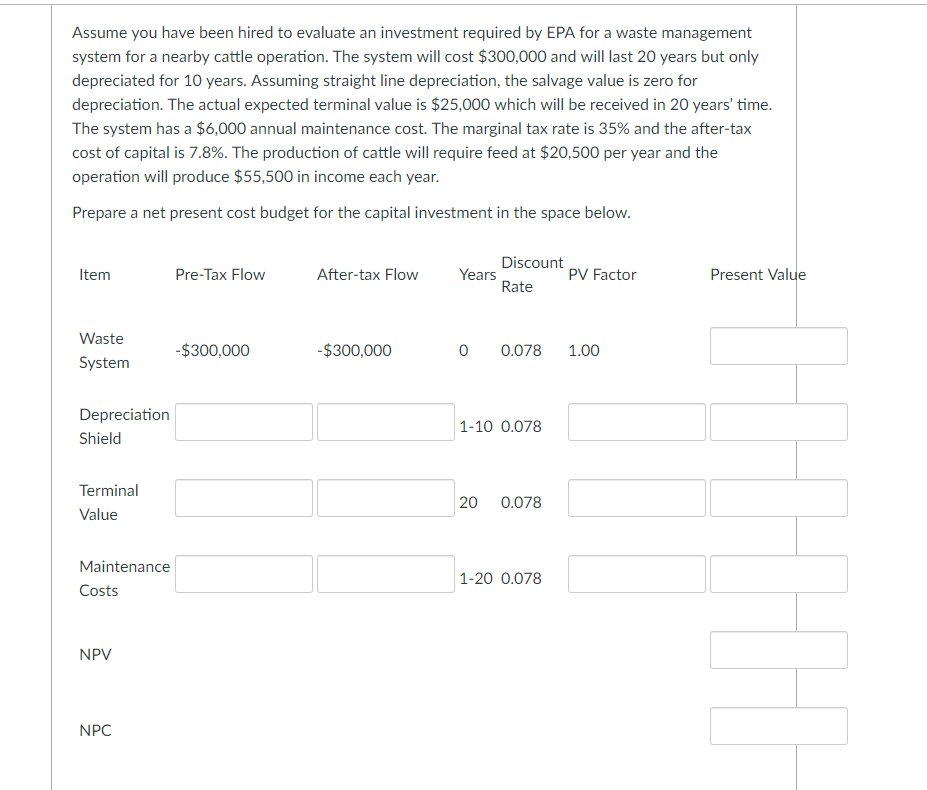

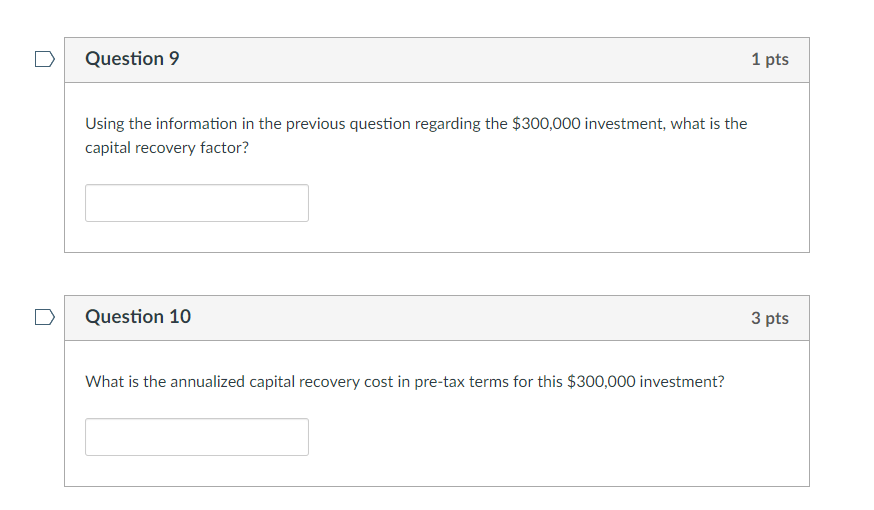

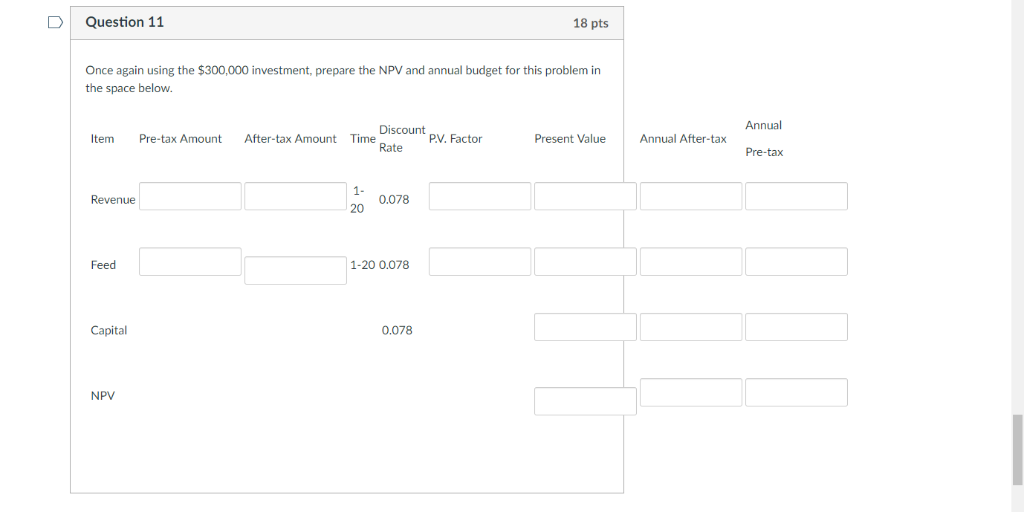

Assume you have been hired to evaluate an investment required by EPA for a waste management system for a nearby cattle operation. The system will cost $300,000 and will last 20 years but only depreciated for 10 years. Assuming straight line depreciation, the salvage value is zero for depreciation. The actual expected terminal value is $25,000 which will be received in 20 years' time The system has a $6,000 annual maintenance cost. The marginal tax rate is 35% and the after-tax cost of capital is 7.8%. The production of cattle will require feed at $20,500 per year and the operation will produce $55,500 in income each year. Prepare a net present cost budget for the capital investment in the space below Discount Rate Item Pre-Tax Flow After-tax Flow Years PV Factor Present Value Waste $300,000 $300,000 0 0.078 1.00 System Depreciation Shield 1-10 0.078 Terminal Value 20 0.078 Maintenance Costs 1-20 0.078 NPV NPC Question 9 1 pts Using the information in the previous question regarding the $300,000 investment, what is the capital recovery factor? Question 10 3 pts What is the annualized capital recovery cost in pre-tax terms for this $300,000 investment? D Question 11 18 pts Once again using the $300,000 investment, prepare the NPV and annual budget for this problem in the space below. Annual Discount Rate Item Pre-tax Amount After-tax Amount Time P.V. Factor Present Value Annual After-tax Pre-tax 0.078 20 Feed 1-20 0.078 Capital 0.078 NPV Assume you have been hired to evaluate an investment required by EPA for a waste management system for a nearby cattle operation. The system will cost $300,000 and will last 20 years but only depreciated for 10 years. Assuming straight line depreciation, the salvage value is zero for depreciation. The actual expected terminal value is $25,000 which will be received in 20 years' time The system has a $6,000 annual maintenance cost. The marginal tax rate is 35% and the after-tax cost of capital is 7.8%. The production of cattle will require feed at $20,500 per year and the operation will produce $55,500 in income each year. Prepare a net present cost budget for the capital investment in the space below Discount Rate Item Pre-Tax Flow After-tax Flow Years PV Factor Present Value Waste $300,000 $300,000 0 0.078 1.00 System Depreciation Shield 1-10 0.078 Terminal Value 20 0.078 Maintenance Costs 1-20 0.078 NPV NPC Question 9 1 pts Using the information in the previous question regarding the $300,000 investment, what is the capital recovery factor? Question 10 3 pts What is the annualized capital recovery cost in pre-tax terms for this $300,000 investment? D Question 11 18 pts Once again using the $300,000 investment, prepare the NPV and annual budget for this problem in the space below. Annual Discount Rate Item Pre-tax Amount After-tax Amount Time P.V. Factor Present Value Annual After-tax Pre-tax 0.078 20 Feed 1-20 0.078 Capital 0.078 NPV