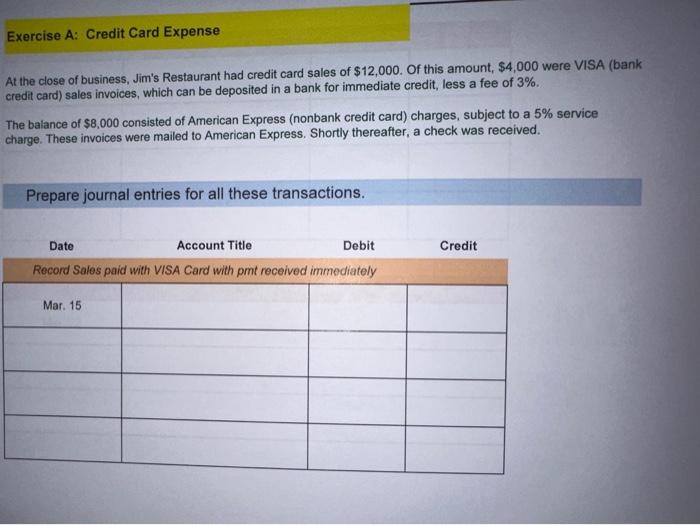

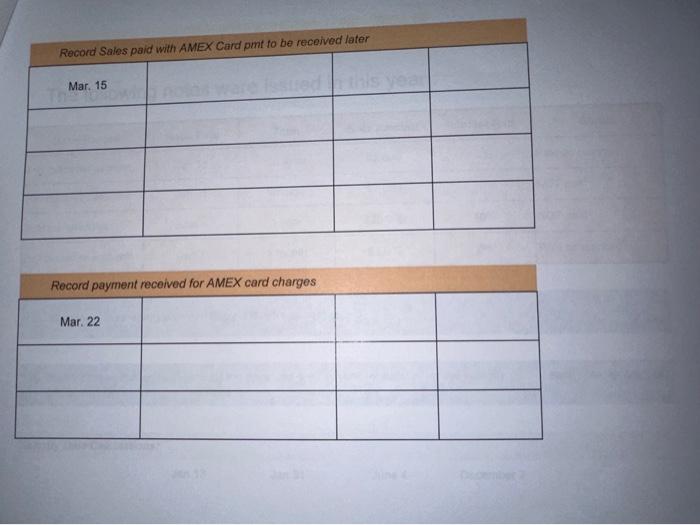

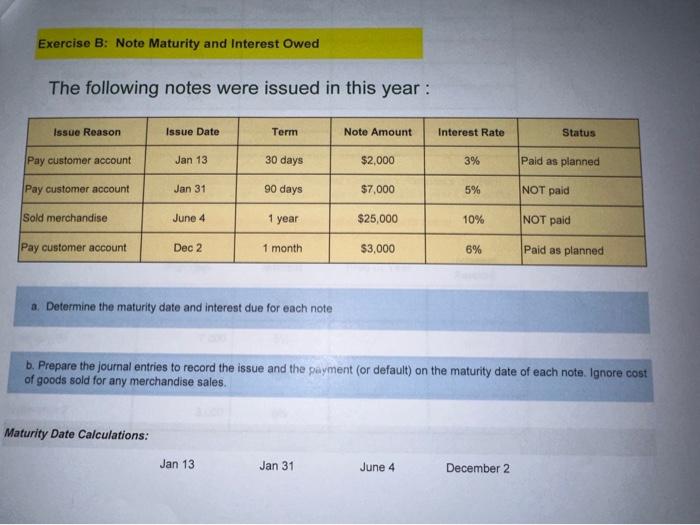

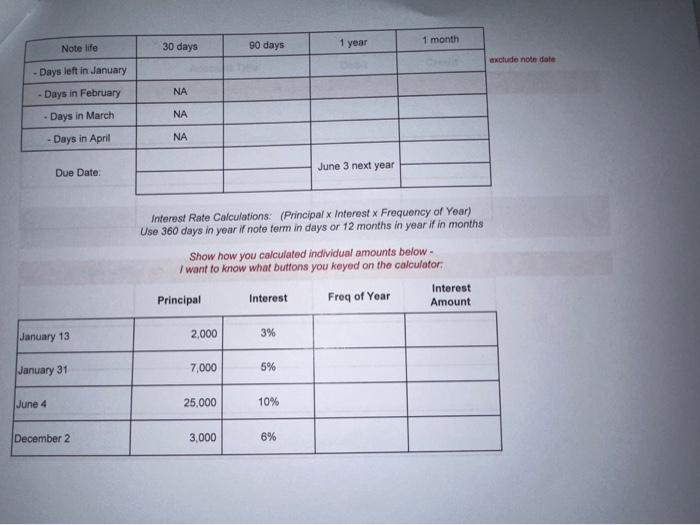

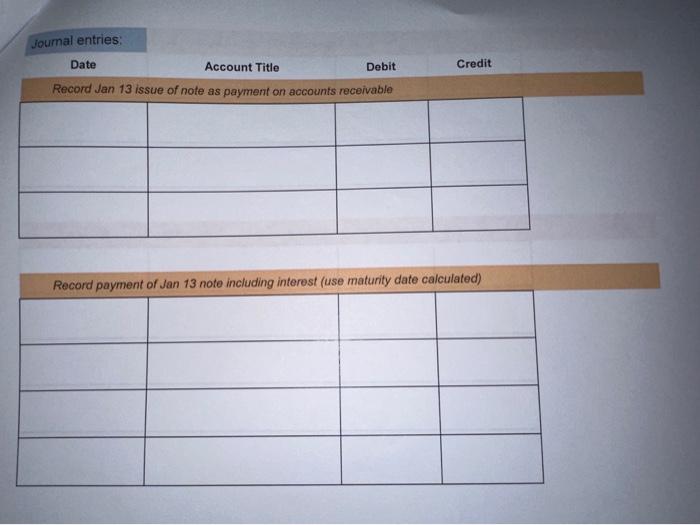

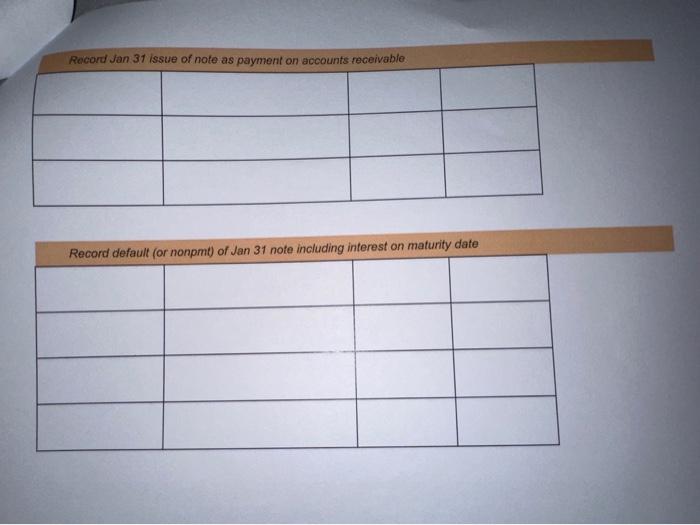

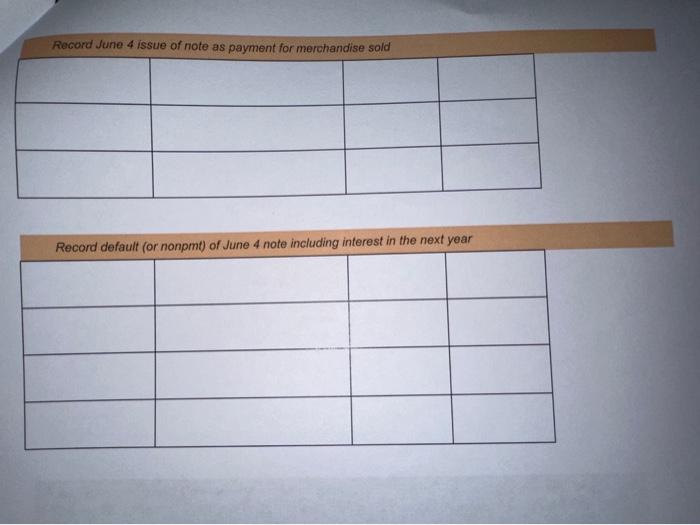

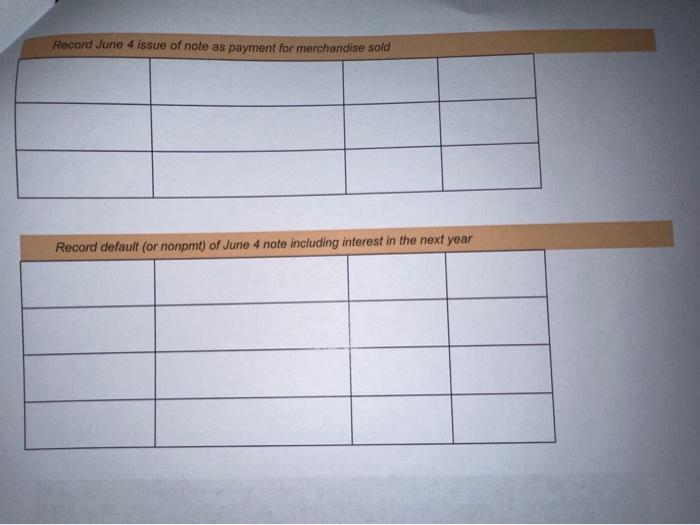

At the close of business, Jim's Restaurant had credit card sales of $12,000. Of this amount, $4,000 were VISA (bank credit card) sales invoices, which can be deposited in a bank for immediate credit, less a fee of 3%. The balance of $8,000 consisted of American Express (nonbank credit card) charges, subject to a 5% service charge. These invoices were mailed to American Express. Shortly thereafter, a check was received. Record Sales paid with AMEX Card pmt to be received later \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Record Sales paid with AMEX Card pont to be received later } \\ \hline Mar. 15 & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Record payment received for AMEX card charges \begin{tabular}{|l|l|l|l|} \hline Mar. 22 & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} The following notes were issued in this year: a. Determine the maturity date and interest due for each note b. Prepare the journal entries to record the issue and the payment (or default) on the maturity date of each note. Ignore cost of goods sold for any merchandise sales. Interest Rate Calculations: (Principal x Interest x Frequency of Year) Use 360 days in year if note term in days or 12 months in year if in months Show how you calculated individual amounts below I want to know what buttons you keyed on the calculator: Joumal entries: Date Account Title Debit Credit Record Jan 13 issue of note as payment on accounts receivable \begin{tabular}{|l|l|l|l|} \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Record payment of Jan 13 note including interest (use maturity date calculated) \begin{tabular}{|l|l|l|l|} \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Record Jan 31 issue of note as payment on accounts receivable \begin{tabular}{|l|l|l|l|} \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline Record default (or nonpmt) of Jan 31 note including interest on maturity date \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Record June 4 issue of note as payment for merchandise sold \begin{tabular}{|l|l|l|l|} \hline Record default (or nonpmt) of June 4 note including interest in the next year \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Record June 4 issue of note as payment for merchandise sold \begin{tabular}{|l|l|l|l|} \hline Record default (or nonpmt) of June 4 note including interest in the next year \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Record December 2 issue of note as payment on accounts receivable \begin{tabular}{|l|l|l|l|} \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline \multicolumn{2}{|l|}{ Record payment of Dec 2 note including interest at maturity } \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular}