Question

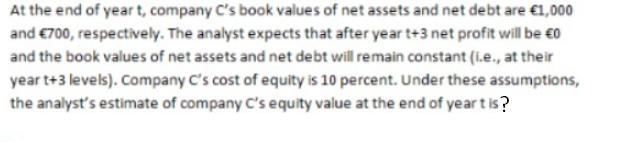

At the end of year t, company C's book values of net assets and net debt are 1,000 and 700, respectively. The analyst expects

At the end of year t, company C's book values of net assets and net debt are 1,000 and 700, respectively. The analyst expects that after year t+3 net profit will be 0 and the book values of net assets and net debt will remain constant (i.e., at their year t+3 levels). Company C's cost of equity is 10 percent. Under these assumptions, the analyst's estimate of company C's equity value at the end of yeart is?

Step by Step Solution

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

To estimate company Cs equity value at the end of year t we can use the Gordon Growth ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Organic Chemistry

Authors: Paula Yurkanis Bruice

4th edition

131407481, 978-0131407480

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App