Answered step by step

Verified Expert Solution

Question

1 Approved Answer

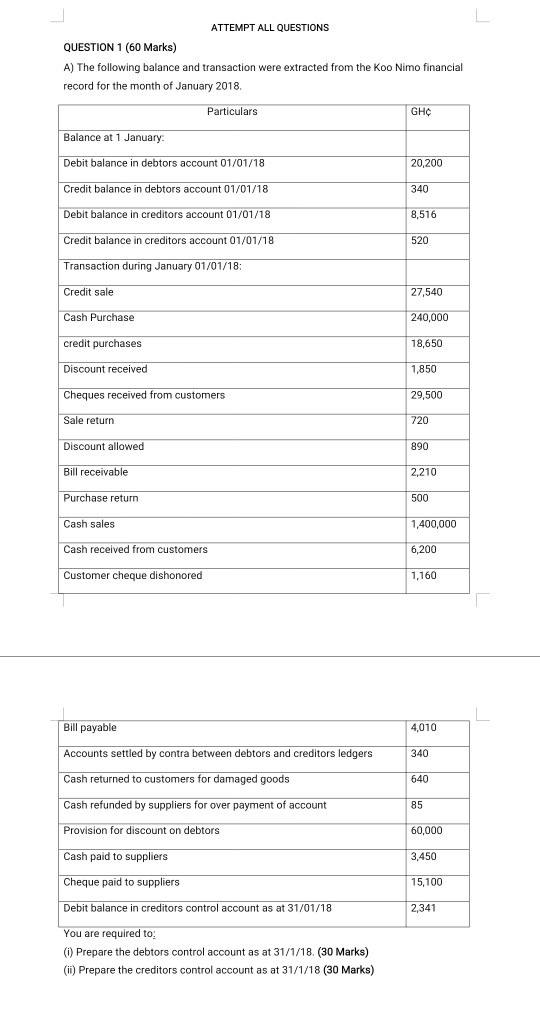

ATTEMPT ALL QUESTIONS QUESTION 1 (60 Marks) ( A) The following balance and transaction were extracted from the Koo Nimo financial record for the month

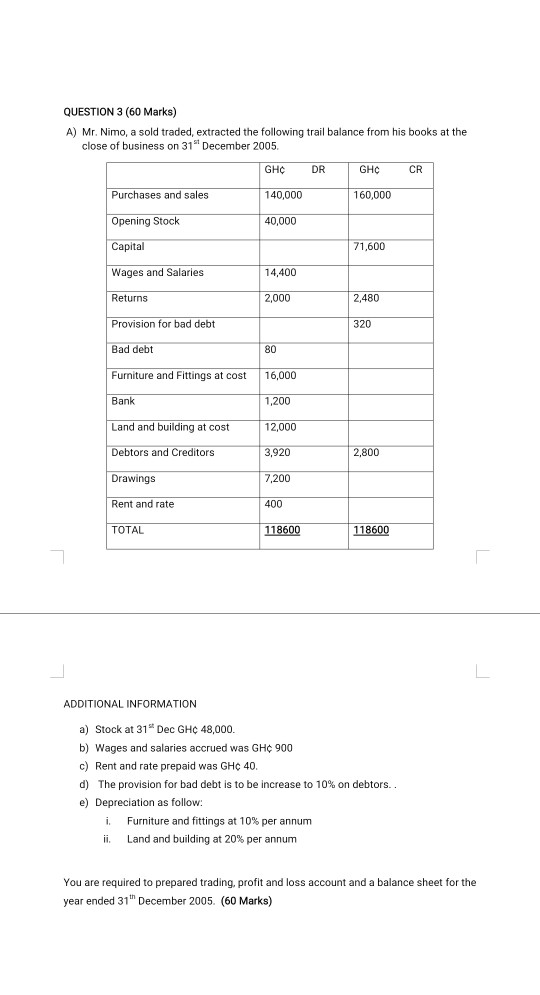

ATTEMPT ALL QUESTIONS QUESTION 1 (60 Marks) ( A) The following balance and transaction were extracted from the Koo Nimo financial record for the month of January 2018. Particulars GHC Balance at 1 January Debit balance in debtors account 01/01/18 20,200 Credit balance in debtors account 01/01/18 340 Debit balance in creditors account 01/01/18 8,516 Credit balance in creditors account 01/01/18 520 Transaction during January 01/01/18: Credit sale 27,540 Cash Purchase 240,000 credit purchases 18,650 Discount received 1,850 Cheques received from customers 29,500 Sale return 720 Discount allowed 890 Bill receivable 2,210 Purchase return 500 Cash sales 1,400,000 Cash received from customers 6,200 Customer cheque dishonored 1,160 Bill payable 4,010 Accounts settled by contra between debtors and creditors ledgers 340 Cash returned to customers for damaged goods 640 85 Cash refunded by suppliers for over payment of account Provision for discount on debtors 60,000 Cash paid to suppliers 3,450 Cheque paid to suppliers 15,100 Debit balance in creditors control account as at 31/01/18 2,341 You are required to: (0) Prepare the debtors control account as at 31/1/18. (30 Marks) (ii) Prepare the creditors control account as at 31/1/18 (30 Marks) QUESTION 3 (60 Marks) A) Mr. Nimo, a sold traded, extracted the following trail balance from his books at the close of business on 31" December 2005. GHC DR GHC CR Purchases and sales 140,000 160,000 Opening Stock 40,000 Capital 71,600 Wages and Salaries 14,400 Returns 2,000 2,480 Provision for bad debt 320 Bad debt 80 Furniture and Fittings at cost 16,000 Bank 1,200 Land and building at cost 12,000 Debtors and Creditors 3,920 2,800 Drawings 7,200 Rent and rate 400 TOTAL 118600 118600 ADDITIONAL INFORMATION a) Stock at 31 Dec GHC 48,000. b) Wages and salaries accrued was GHC 900 c) Rent and rate prepaid was GHC 40. d) The provision for bad debt is to be increase to 10% on debtors. e) Depreciation as follow: i Furniture and fittings at 10% per annum ii. Land and building at 20% per annum You are required to prepared trading profit and loss account and a balance sheet for the year ended 31 December 2005. (60 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started