attempt all

attempt all

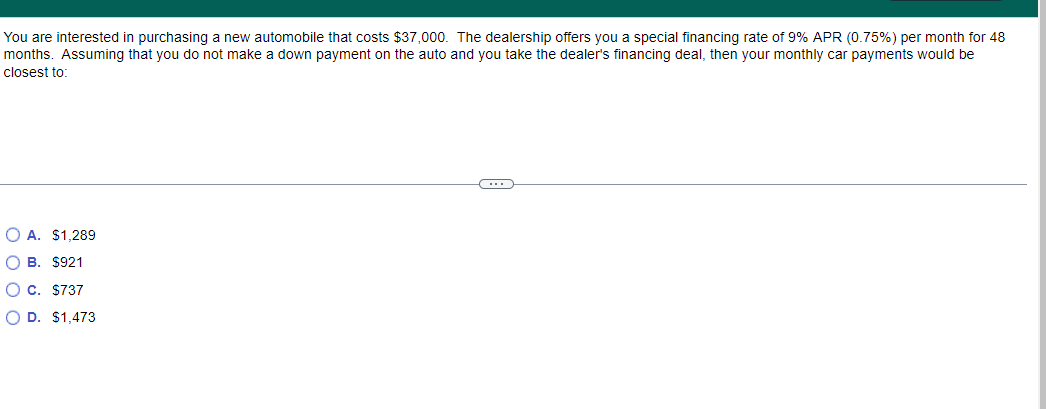

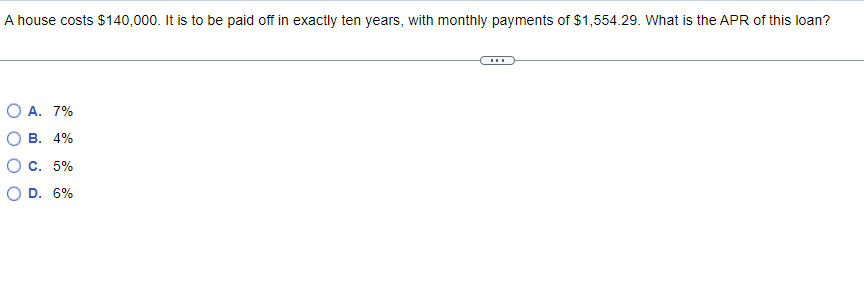

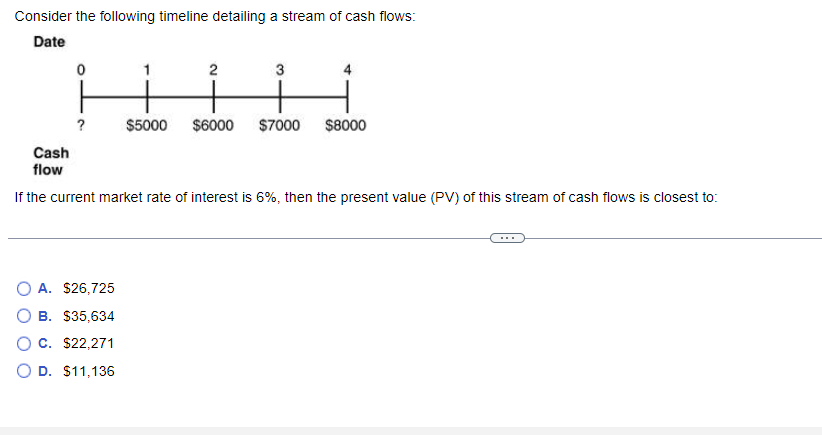

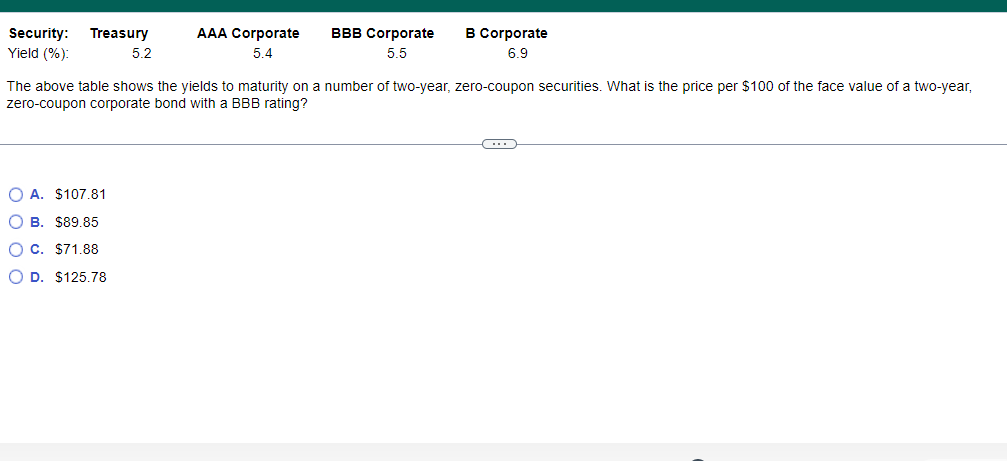

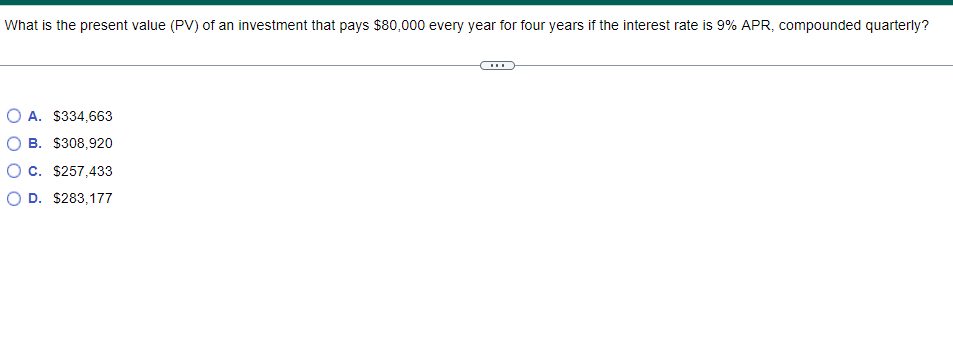

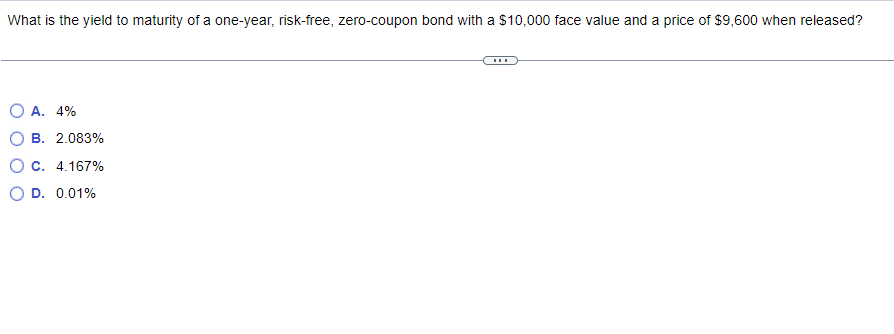

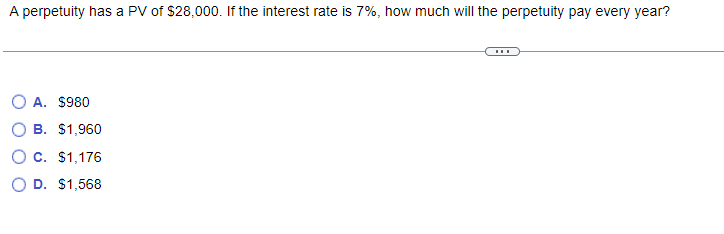

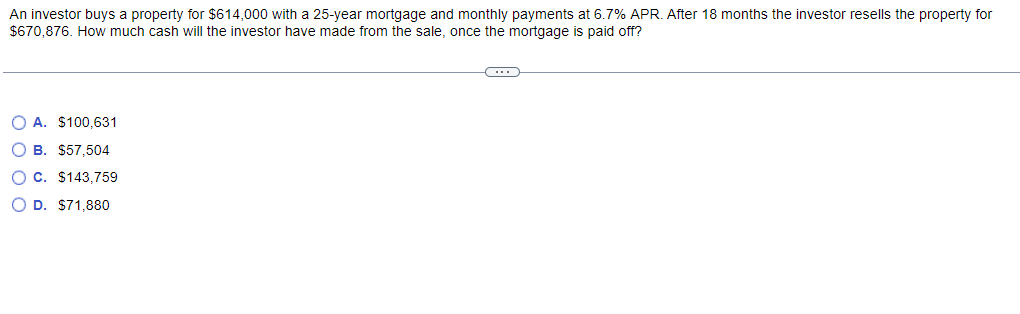

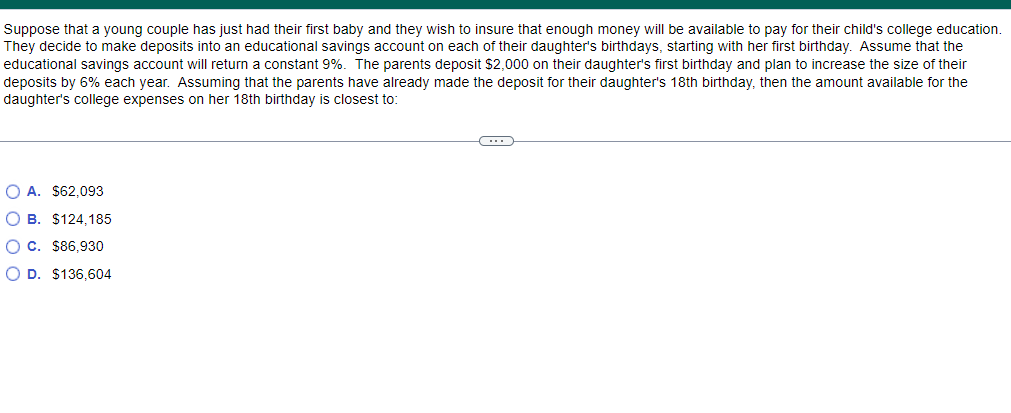

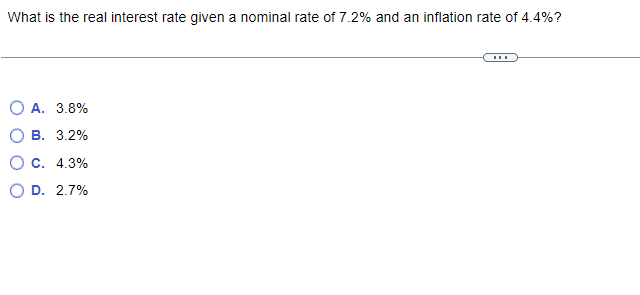

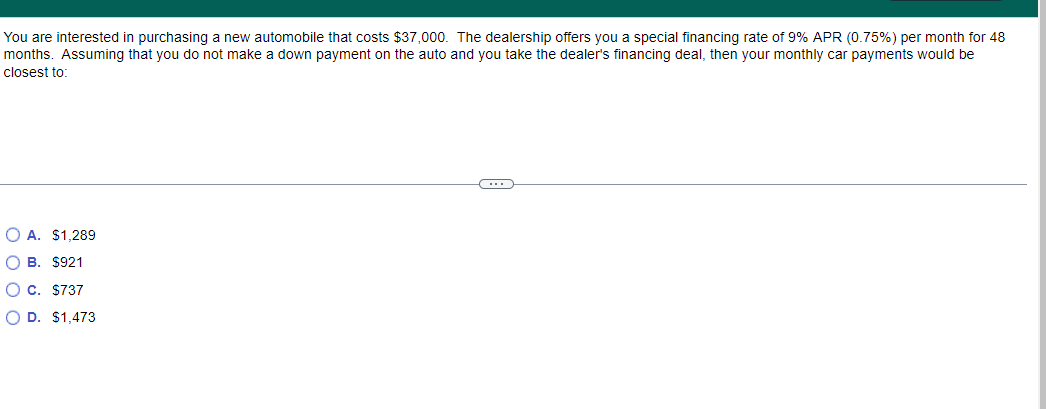

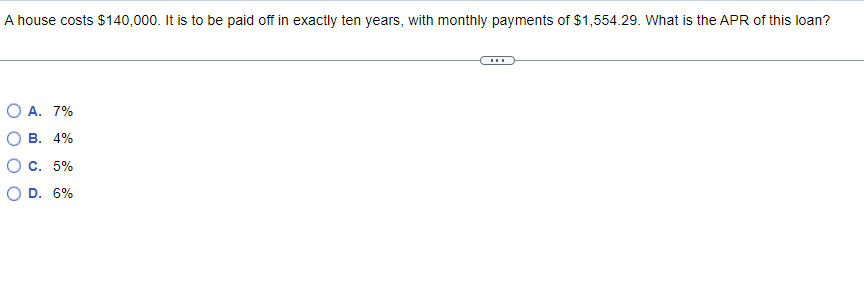

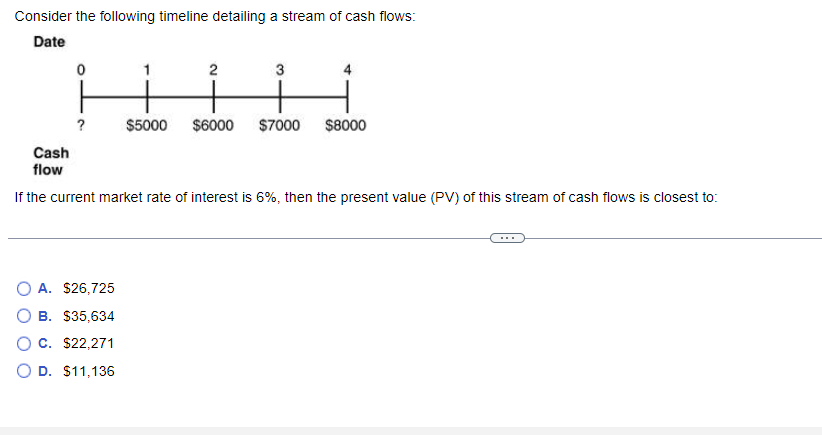

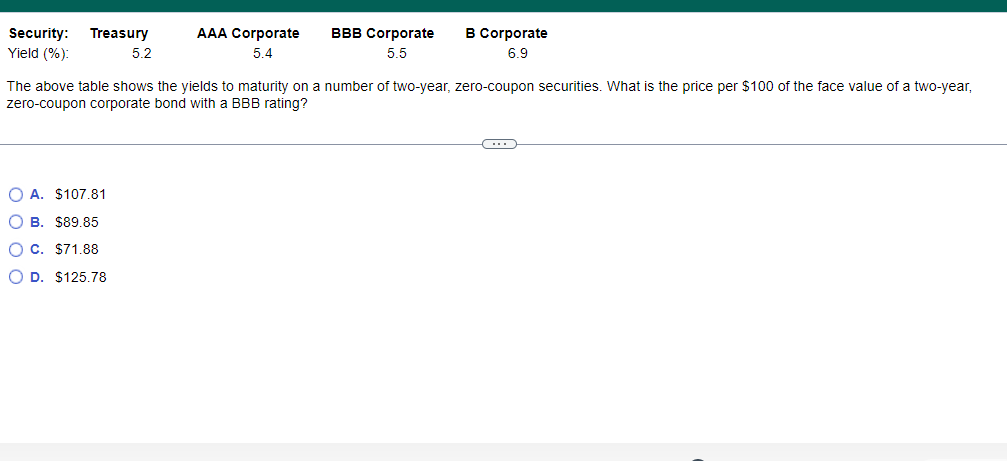

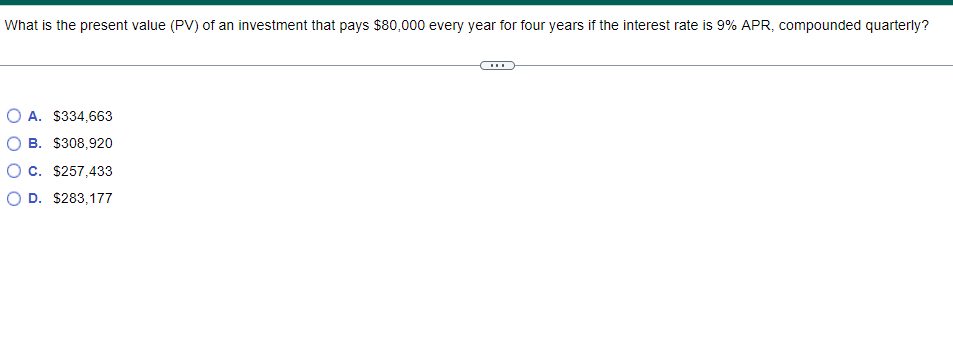

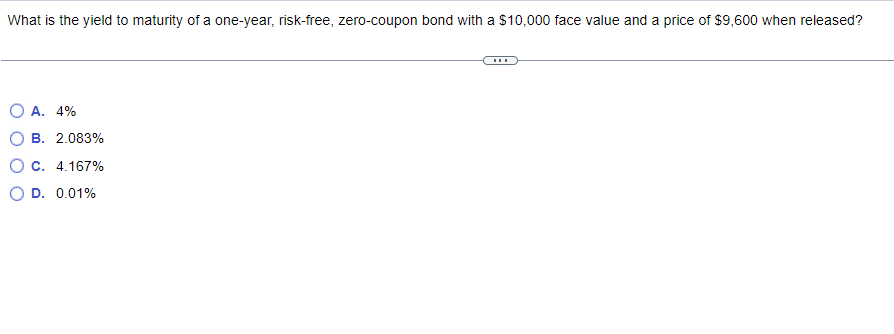

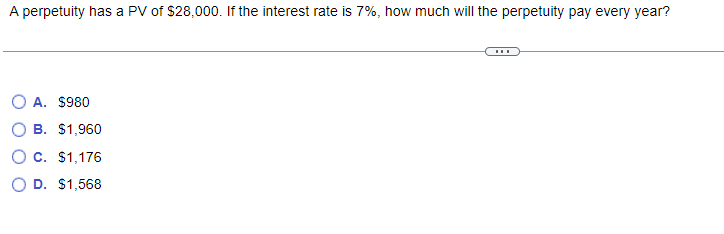

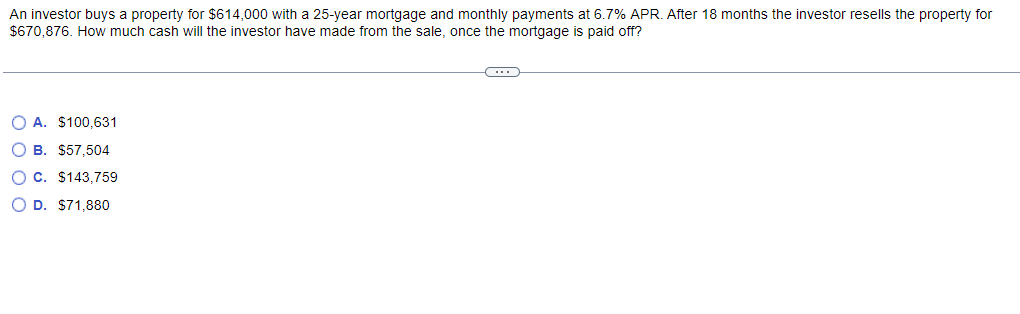

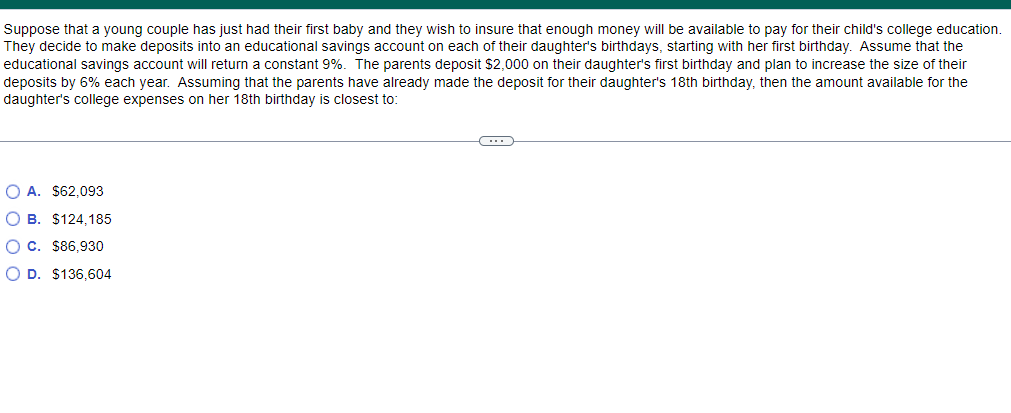

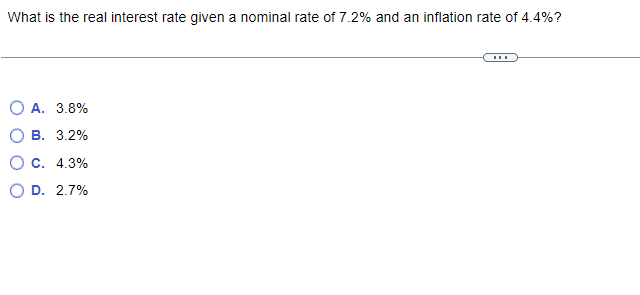

You are interested in purchasing a new automobile that costs $37,000. The dealership offers you a special financing rate of 9% APR (0.75%) per month for 48 months. Assuming that you do not make a down payment on the auto and you take the dealer's financing deal, then your monthly car payments would be closest to: A. $1,289 B. $921 C. $737 D. $1,473 A house costs $140,000. It is to be paid off in exactly ten years, with monthly payments of $1,554.29. What is the APR of this loan? A. 7% B. 4% C. 5% D. 6% Consider the following timeline detailing a stream of cash flows: Date If the current market rate of interest is 6%, then the present value (PV) of this stream of cash flows is closest to: A. $26,725 B. $35,634 C. $22,271 D. $11,136 The above table shows the yields to maturity on a number of two-year, zero-coupon securities. What is the price per $100 of the face value of a two-year, zero-coupon corporate bond with a BBB rating? A. $107.81 B. $89.85 C. $71.88 D. $125.78 What is the present value (PV) of an investment that pays $80,000 every year for four years if the interest rate is 9% APR, compounded quarterly? A. $334,663 B. $308,920 C. $257,433 D. $283,177 What is the yield to maturity of a one-year, risk-free, zero-coupon bond with a $10,000 face value and a price of $9,600 when released? A. 4% B. 2.083% C. 4.167% D. 0.01% A perpetuity has a PV of $28,000. If the interest rate is 7%, how much will the perpetuity pay every year? A. $980 B. $1,960 C. $1,176 D. $1,568 An investor buys a property for $614,000 with a 25 -year mortgage and monthly payments at 6.7% APR. After 18 months the investor resells the property for $670,876. How much cash will the investor have made from the sale, once the mortgage is paid off? A. $100,631 B. $57,504 C. $143,759 D. $71,880 Suppose that a young couple has just had their first baby and they wish to insure that enough money will be available to pay for their child's college education. They decide to make deposits into an educational savings account on each of their daughter's birthdays, starting with her first birthday. Assume that the educational savings account will return a constant 9%. The parents deposit $2,000 on their daughter's first birthday and plan to increase the size of their deposits by 6% each year. Assuming that the parents have already made the deposit for their daughter's 18 th birthday, then the amount available for the daughter's college expenses on her 18 th birthday is closest to: A. $62,093 B. $124,185 C. $86,930 D. $136,604 What is the real interest rate given a nominal rate of 7.2% and an inflation rate of 4.4%? A. 3.8% B. 3.2% C. 4.3% D. 2.7%

attempt all

attempt all