Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Audit Procedures for Client Acceptance and Retention: Client acceptance and retention procedures are fundamental in ensuring that auditing firms establish and maintain professional relationships with

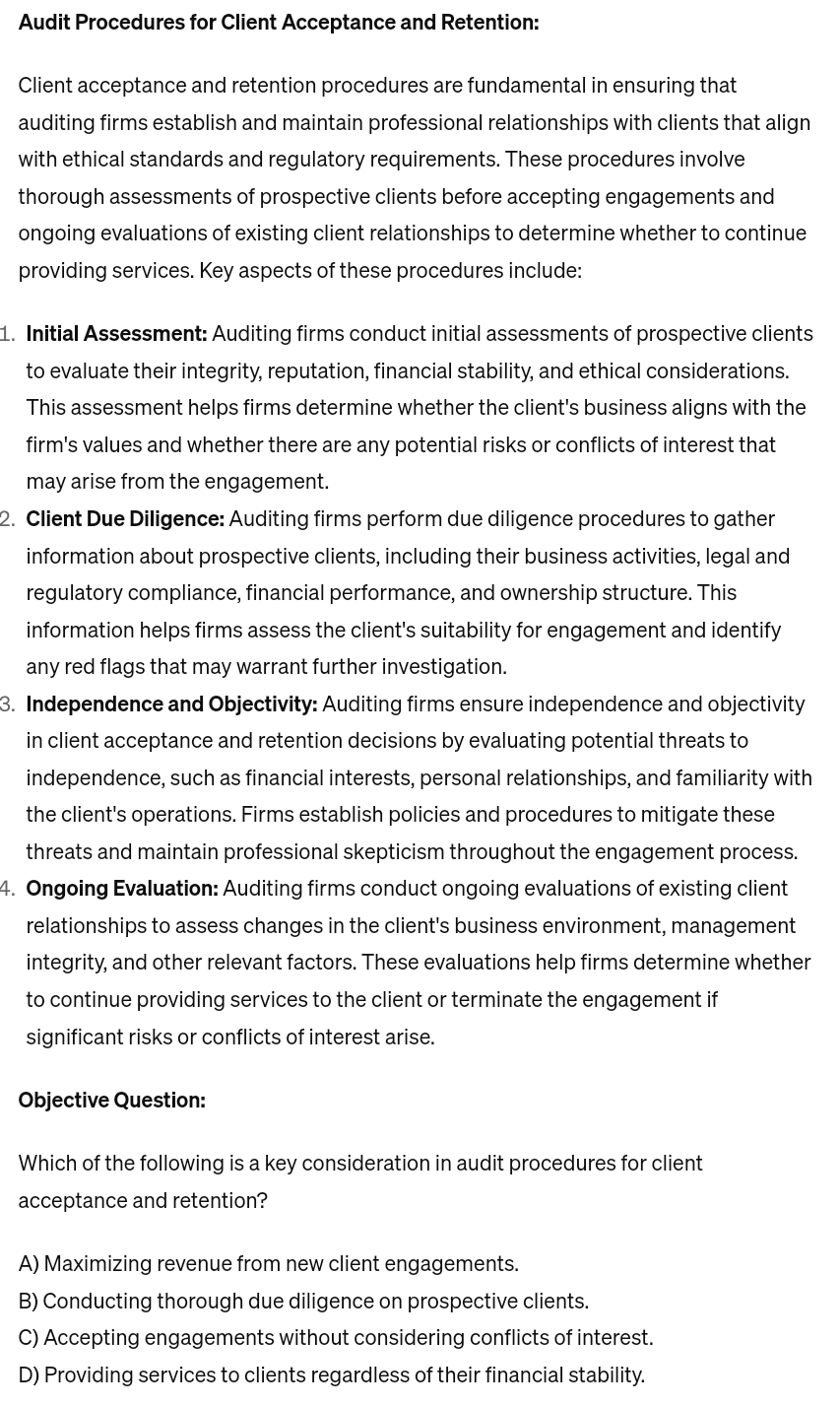

Audit Procedures for Client Acceptance and Retention:

Client acceptance and retention procedures are fundamental in ensuring that auditing firms establish and maintain professional relationships with clients that align with ethical standards and regulatory requirements. These procedures involve thorough assessments of prospective clients before accepting engagements and ongoing evaluations of existing client relationships to determine whether to continue providing services. Key aspects of these procedures include:

Initial Assessment: Auditing firms conduct initial assessments of prospective clients to evaluate their integrity, reputation, financial stability, and ethical considerations. This assessment helps firms determine whether the client's business aligns with the firm's values and whether there are any potential risks or conflicts of interest that may arise from the engagement.

Client Due Diligence: Auditing firms perform due diligence procedures to gather information about prospective clients, including their business activities, legal and regulatory compliance, financial performance, and ownership structure. This information helps firms assess the client's suitability for engagement and identify any red flags that may warrant further investigation.

Independence and Objectivity: Auditing firms ensure independence and objectivity in client acceptance and retention decisions by evaluating potential threats to independence, such as financial interests, personal relationships, and familiarity with the client's operations. Firms establish policies and procedures to mitigate these threats and maintain professional skepticism throughout the engagement process.

Ongoing Evaluation: Auditing firms conduct ongoing evaluations of existing client relationships to assess changes in the client's business environment, management integrity, and other relevant factors. These evaluations help firms determine whether to continue providing services to the client or terminate the engagement if significant risks or conflicts of interest arise.

Objective Question:

Which of the following is a key consideration in audit procedures for client acceptance and retention?

A Maximizing revenue from new client engagements.

B Conducting thorough due diligence on prospective clients.

C Accepting engagements without considering conflicts of interest.

D Providing services to clients regardless of their financial stability.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started