Audit Program Audit work steps / procedures are clearly stated and listed for each asset and liability, formatted in a table.

Assets:

-

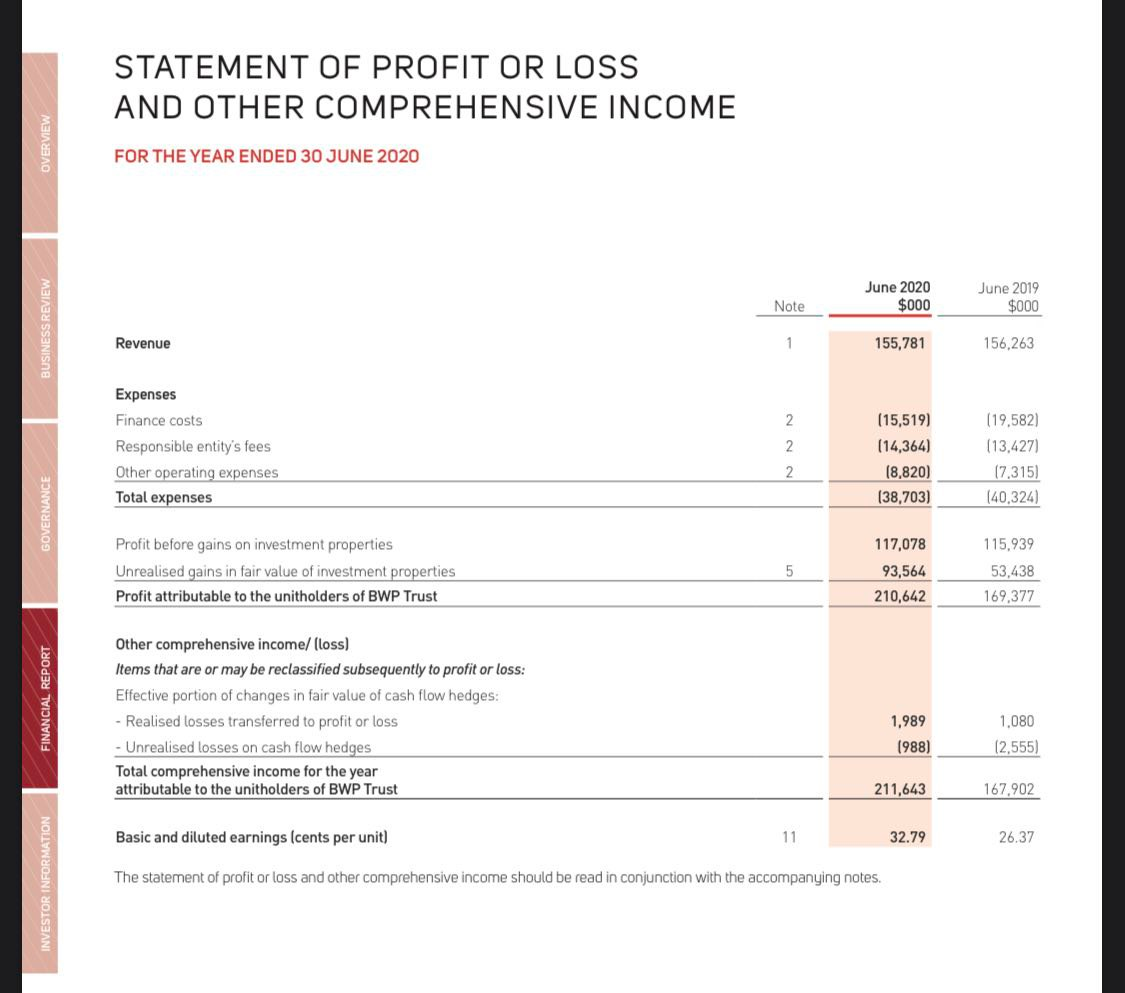

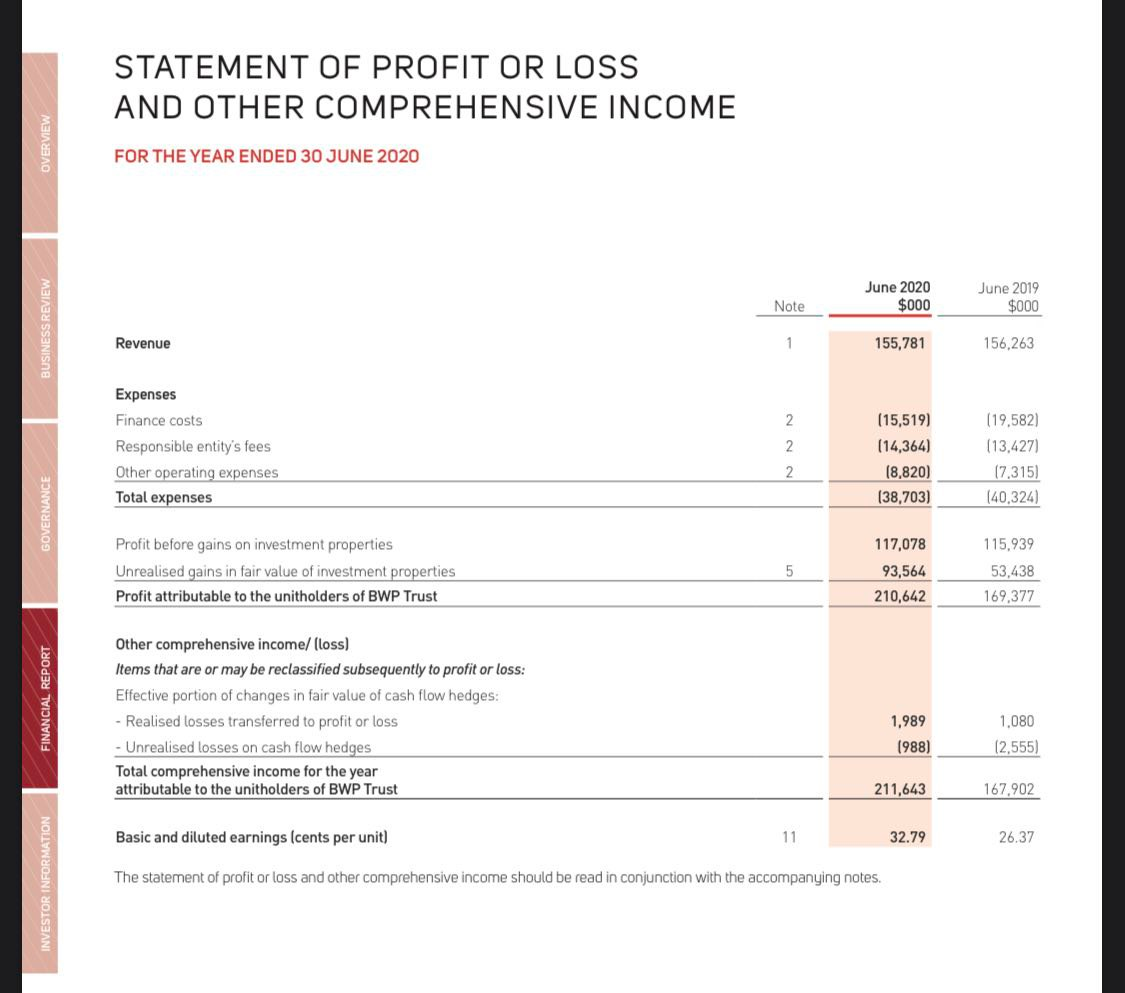

Total comprehensive income for the year (Profit before tax) $211,643,000 (pg28)

-

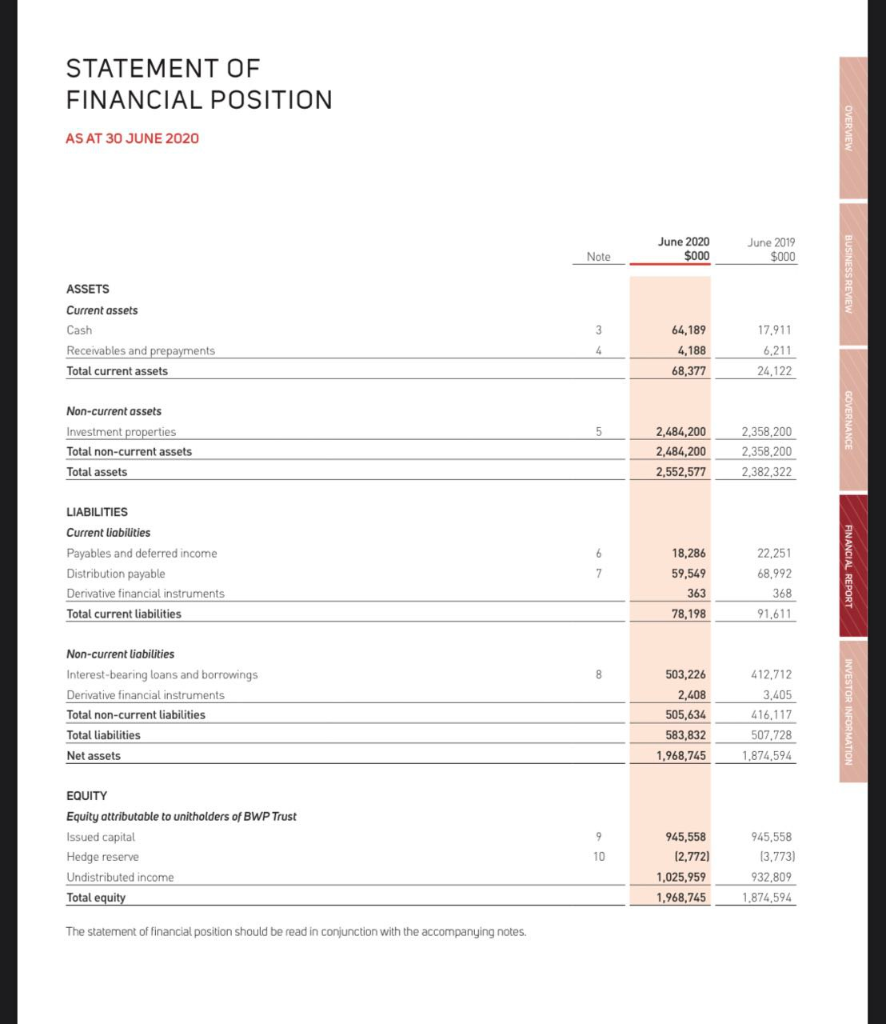

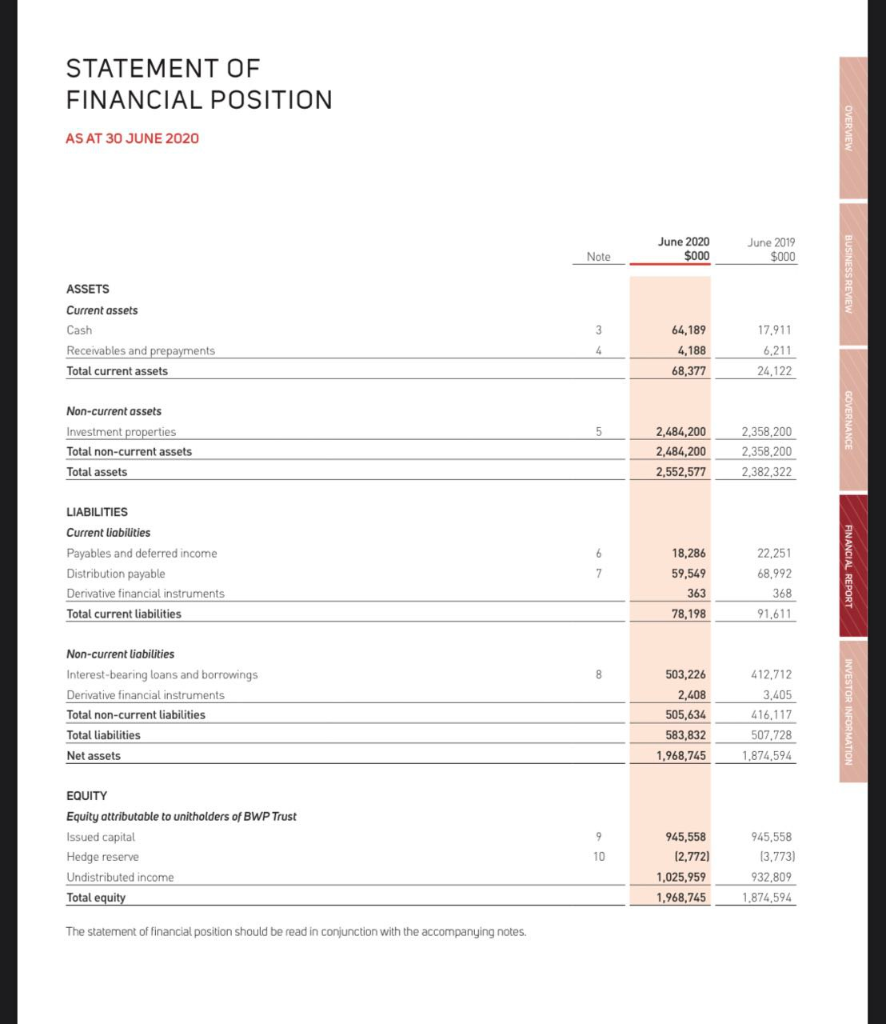

Investment properties $2,484,200,000 (pg 29)

-

Total Assets $2,552,577,000 (pg29)

-

Net Assets $1,968,745,000 (pg29)

-

Receivables and prepayments $68,377,000 (pg29)

Liabilities:

-

Derivative financial instruments $363,000 (pg29)

-

Interest-bearing loans and borrowings $503,226,000 (pg29)

-

Derivative financial instruments $2,408,000 (pg29)

-

Payable and deferred income $18,286,000(pg29)

-

Total liabilities $583,832,000 (pg29)

STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME OVERVIEW FOR THE YEAR ENDED 30 JUNE 2020 June 2020 $000 June 2019 $000 Note BUSINESS REVIEW Revenue 1 155,781 156,263 2 Expenses Finance costs Responsible entity's fees Other operating expenses Total expenses 2 2 (15,519) (14,364) (8,820) (38,703) (19,582) (13.427) (7,315) 140.324) GOVERNANCE Profit before gains on investment properties Unrealised gains in fair value of investment properties Profit attributable to the unitholders of BWP Trust 5 117,078 93,564 210,642 115,939 53,438 169.377 FINANCIAL REPORT Other comprehensive income/(loss) Items that are or may be reclassified subsequently to profit or loss: Effective portion of changes in fair value of cash flow hedges: - Realised losses transferred to profit or loss Unrealised losses on cash flow hedges Total comprehensive income for the year attributable to the unitholders of BWP Trust 1,989 (988 1,080 (2,555) 211,643 167,902 Basic and diluted earnings (cents per unit) 11 32.79 26.37 INVESTOR INFORMATION The statement of profit or loss and other comprehensive income should be read in conjunction with the accompanying notes STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE 2020 OVERVIEW June 2020 $000 June 2019 $000 Note ASSETS Current assets Cash Receivables and prepayments Total current assets 3 4 64,189 4,188 68,377 17.911 6,211 24,122 5 Non-current assets Investment properties Total non-current assets Total assets 2,484,200 2,484,200 2,552,577 2,358,200 2,358,200 2,382,322 LIABILITIES Current liabilities Payables and deferred income Distribution payable Derivative financial instruments Total current liabilities 6 FINANCIAL 7 18,286 59,549 363 22,251 68.992 368 78,198 91,611 8 Non-current liabilities Interest-bearing loans and borrowings Derivative financial instruments Total non-current liabilities Total liabilities 503,226 2,408 505,634 583,832 1,968,745 412,712 3,405 416,117 507,728 1,874,594 Net assets 9 EQUITY Equity attributable to unitholders of BWP Trust Issued capital Hedge reserve Undistributed income Total equity 10 945,558 12,7721 1,025,959 1,968,745 945,558 13,773) 932,809 1.874,594 The statement of financial position should be read in conjunction with the accompanying notes. STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME OVERVIEW FOR THE YEAR ENDED 30 JUNE 2020 June 2020 $000 June 2019 $000 Note BUSINESS REVIEW Revenue 1 155,781 156,263 2 Expenses Finance costs Responsible entity's fees Other operating expenses Total expenses 2 2 (15,519) (14,364) (8,820) (38,703) (19,582) (13.427) (7,315) 140.324) GOVERNANCE Profit before gains on investment properties Unrealised gains in fair value of investment properties Profit attributable to the unitholders of BWP Trust 5 117,078 93,564 210,642 115,939 53,438 169.377 FINANCIAL REPORT Other comprehensive income/(loss) Items that are or may be reclassified subsequently to profit or loss: Effective portion of changes in fair value of cash flow hedges: - Realised losses transferred to profit or loss Unrealised losses on cash flow hedges Total comprehensive income for the year attributable to the unitholders of BWP Trust 1,989 (988 1,080 (2,555) 211,643 167,902 Basic and diluted earnings (cents per unit) 11 32.79 26.37 INVESTOR INFORMATION The statement of profit or loss and other comprehensive income should be read in conjunction with the accompanying notes STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE 2020 OVERVIEW June 2020 $000 June 2019 $000 Note ASSETS Current assets Cash Receivables and prepayments Total current assets 3 4 64,189 4,188 68,377 17.911 6,211 24,122 5 Non-current assets Investment properties Total non-current assets Total assets 2,484,200 2,484,200 2,552,577 2,358,200 2,358,200 2,382,322 LIABILITIES Current liabilities Payables and deferred income Distribution payable Derivative financial instruments Total current liabilities 6 FINANCIAL 7 18,286 59,549 363 22,251 68.992 368 78,198 91,611 8 Non-current liabilities Interest-bearing loans and borrowings Derivative financial instruments Total non-current liabilities Total liabilities 503,226 2,408 505,634 583,832 1,968,745 412,712 3,405 416,117 507,728 1,874,594 Net assets 9 EQUITY Equity attributable to unitholders of BWP Trust Issued capital Hedge reserve Undistributed income Total equity 10 945,558 12,7721 1,025,959 1,968,745 945,558 13,773) 932,809 1.874,594 The statement of financial position should be read in conjunction with the accompanying notes