Answered step by step

Verified Expert Solution

Question

1 Approved Answer

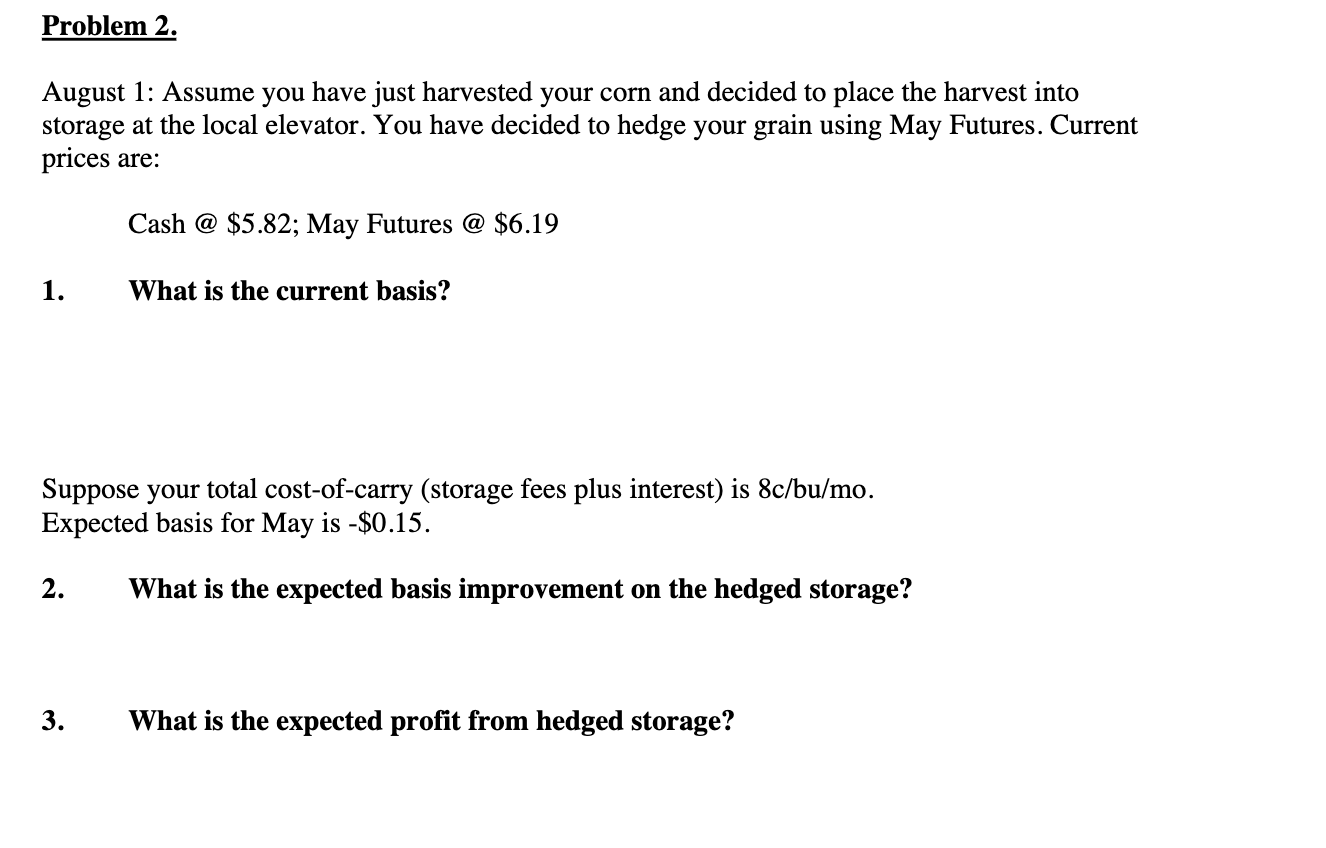

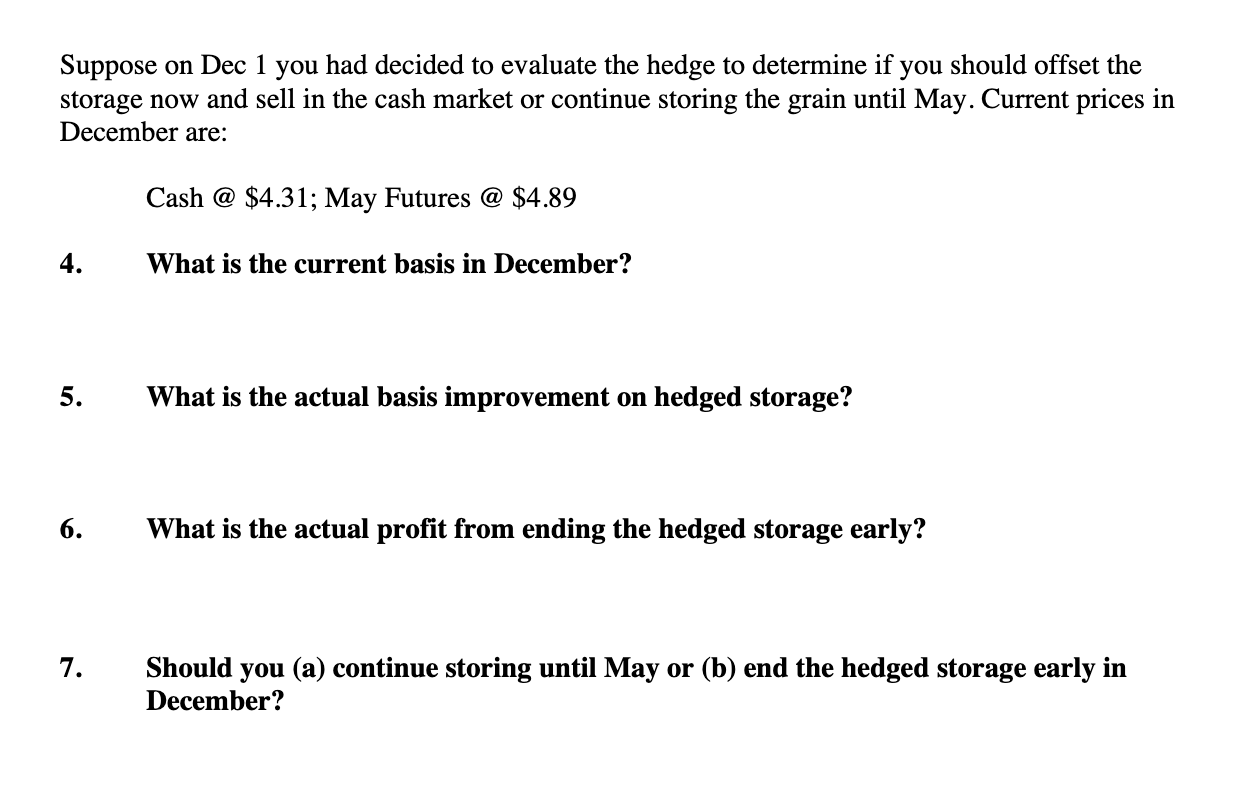

August 1: Assume you have just harvested your corn and decided to place the harvest into storage at the local elevator. You have decided to

August 1: Assume you have just harvested your corn and decided to place the harvest into storage at the local elevator. You have decided to hedge your grain using May Futures. Current prices are: Cash @ \$5.82; May Futures @ \$6.19 1. What is the current basis? Suppose your total cost-of-carry (storage fees plus interest) is 8c/bu/mo. Expected basis for May is $0.15. 2. What is the expected basis improvement on the hedged storage? 3. What is the expected profit from hedged storage? Suppose on Dec 1 you had decided to evaluate the hedge to determine if you should offset the storage now and sell in the cash market or continue storing the grain until May. Current prices in December are: Cash @ \$4.31; May Futures @ \$4.89 4. What is the current basis in December? 5. What is the actual basis improvement on hedged storage? 6. What is the actual profit from ending the hedged storage early? 7. Should you (a) continue storing until May or (b) end the hedged storage early in December

August 1: Assume you have just harvested your corn and decided to place the harvest into storage at the local elevator. You have decided to hedge your grain using May Futures. Current prices are: Cash @ \$5.82; May Futures @ \$6.19 1. What is the current basis? Suppose your total cost-of-carry (storage fees plus interest) is 8c/bu/mo. Expected basis for May is $0.15. 2. What is the expected basis improvement on the hedged storage? 3. What is the expected profit from hedged storage? Suppose on Dec 1 you had decided to evaluate the hedge to determine if you should offset the storage now and sell in the cash market or continue storing the grain until May. Current prices in December are: Cash @ \$4.31; May Futures @ \$4.89 4. What is the current basis in December? 5. What is the actual basis improvement on hedged storage? 6. What is the actual profit from ending the hedged storage early? 7. Should you (a) continue storing until May or (b) end the hedged storage early in December Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started