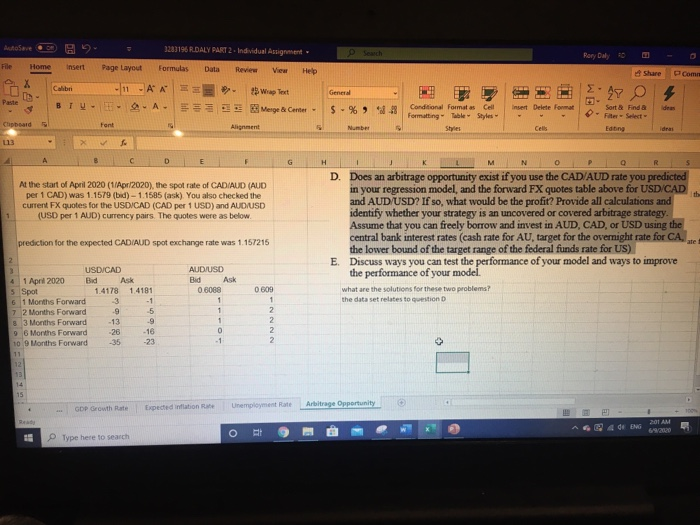

Autolave 3200196 R.DALY PART 2 - Individual Assignment Rory Daly Shure Com ten File Home Insert Page Layout Formulas Data Review View Help X 11 AM Wap Test Paste BTU - IA- SEE Merge & Center - Chipboard Font Alignment General 47 0 4 $ - % 94.18 Insert Delete format des Conditional Formats Cell Formatting Table Styles Styles Sort & Find a Filter - Select Edoing Number Cells dra > fo 4 C D G H 1 M N 0 R At the start of April 2020 (1/Apr/2020), the spot rate of CAD AUD (AUD per 1 CAD) was 1.1579 (bid) - 1.1585 (ask). You also checked the current FX quotes for the USD/CAD (CAD per 1 USD) and AUDUSD (USD per 1 AUD) currency pairs. The quotes were as below. D. Does an arbitrage opportunity exist if you use the CAD AUD rate you predicted in your regression model, and the forward FX quotes table above for USD/CAD and AUD/USD? If so, what would be the profit? Provide all calculations and identify whether your strategy is an uncovered or covered arbitrage strategy. Assume that you can freely borrow and invest in AUD, CAD, or USD using the central bank interest rates (cash rate for AU, target for the overnight rate for CA, the lower bound of the target range of the federal funds rate for US) E Discuss ways you can test the performance of your model and ways to improve the performance of your model. what are the solutions for these two problems? the data set relates to question prediction for the expected CADIAUD spot exchange rate was 1.157215 ate 2 3 USD/CAD 4 1 April 2020 Bid Ask 5 Spot 1.4178 1 4181 1 Months Forward -3 -1 7 2 Months Forward 9 -5 8 3 Months Forward -13 -9 9 6 Months Forward -26 -16 10 9 Months Forward -35 -23 11 AUD/USD Bid Ask 0.6068 1 1 1 0 -1 0600 1 2 2 2 2 14 15 GDP Growth Rate Expected inflation Unemployment Rate Arbitrage Opportunity 201 AM CA de ENG o FR Type here to search Autolave 3200196 R.DALY PART 2 - Individual Assignment Rory Daly Shure Com ten File Home Insert Page Layout Formulas Data Review View Help X 11 AM Wap Test Paste BTU - IA- SEE Merge & Center - Chipboard Font Alignment General 47 0 4 $ - % 94.18 Insert Delete format des Conditional Formats Cell Formatting Table Styles Styles Sort & Find a Filter - Select Edoing Number Cells dra > fo 4 C D G H 1 M N 0 R At the start of April 2020 (1/Apr/2020), the spot rate of CAD AUD (AUD per 1 CAD) was 1.1579 (bid) - 1.1585 (ask). You also checked the current FX quotes for the USD/CAD (CAD per 1 USD) and AUDUSD (USD per 1 AUD) currency pairs. The quotes were as below. D. Does an arbitrage opportunity exist if you use the CAD AUD rate you predicted in your regression model, and the forward FX quotes table above for USD/CAD and AUD/USD? If so, what would be the profit? Provide all calculations and identify whether your strategy is an uncovered or covered arbitrage strategy. Assume that you can freely borrow and invest in AUD, CAD, or USD using the central bank interest rates (cash rate for AU, target for the overnight rate for CA, the lower bound of the target range of the federal funds rate for US) E Discuss ways you can test the performance of your model and ways to improve the performance of your model. what are the solutions for these two problems? the data set relates to question prediction for the expected CADIAUD spot exchange rate was 1.157215 ate 2 3 USD/CAD 4 1 April 2020 Bid Ask 5 Spot 1.4178 1 4181 1 Months Forward -3 -1 7 2 Months Forward 9 -5 8 3 Months Forward -13 -9 9 6 Months Forward -26 -16 10 9 Months Forward -35 -23 11 AUD/USD Bid Ask 0.6068 1 1 1 0 -1 0600 1 2 2 2 2 14 15 GDP Growth Rate Expected inflation Unemployment Rate Arbitrage Opportunity 201 AM CA de ENG o FR Type here to search