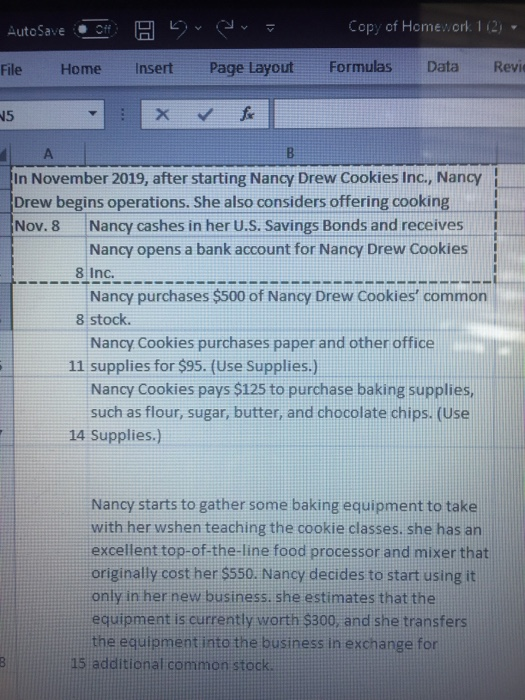

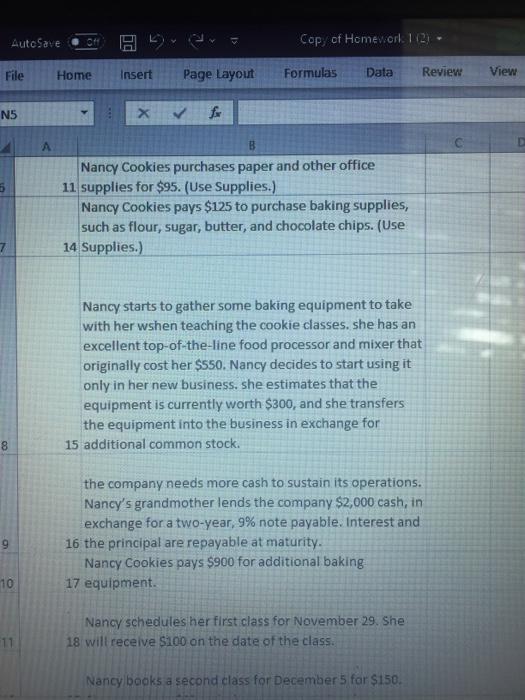

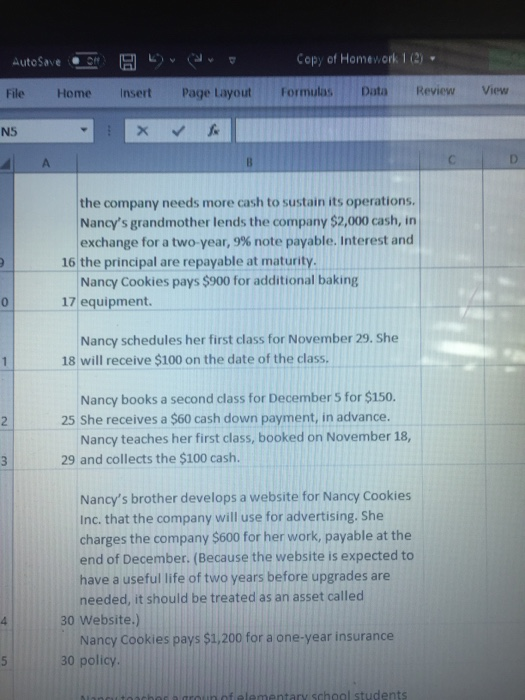

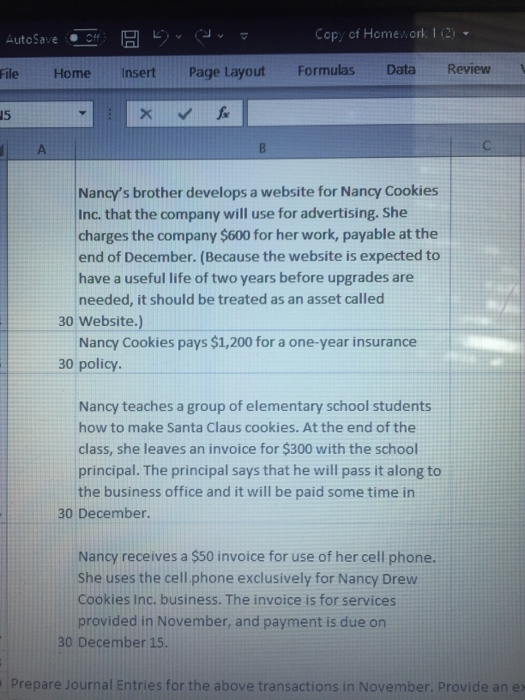

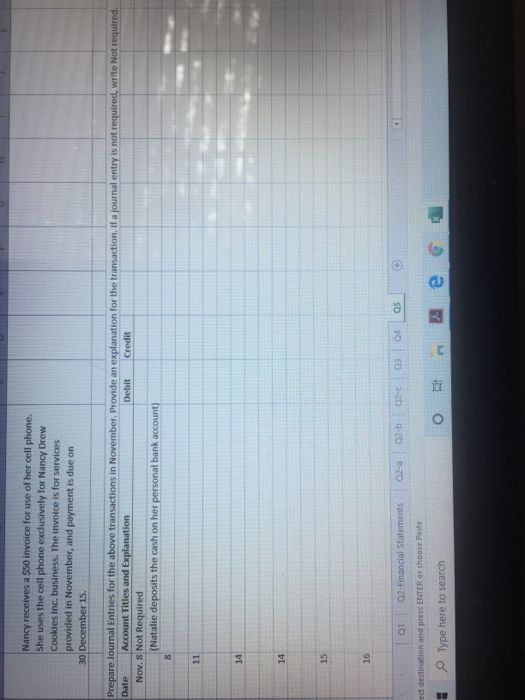

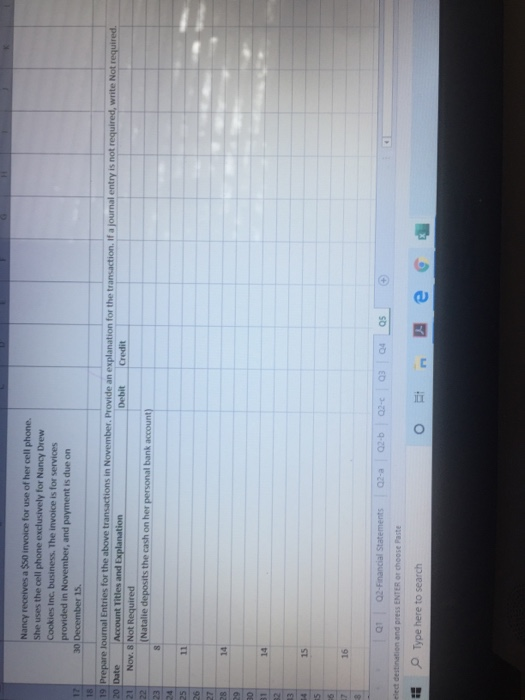

AutoSave CH Hvi Copy of Homework 1 (2) File Home Insert Page Layout Formulas Data Revic W5 for B A In November 2019, after starting Nancy Drew Cookies Inc., Nancy Drew begins operations. She also considers offering cooking Nov. 8 Nancy cashes in her U.S. Savings Bonds and receives Nancy opens a bank account for Nancy Drew Cookies 8 Inc. Nancy purchases $500 of Nancy Drew Cookies' common 8 stock. Nancy Cookies purchases paper and other office 11 supplies for $95. (Use Supplies.) Nancy Cookies pays $125 to purchase baking supplies, such as flour, sugar, butter, and chocolate chips. (Use 14 Supplies.) Nancy starts to gather some baking equipment to take with her wshen teaching the cookie classes, she has an excellent top-of-the-line food processor and mixer that originally cost her $550. Nancy decides to start using it only in her new business, she estimates that the equipment is currently worth $300, and she transfers the equipment into the business in exchange for 15 additional common stock. B AutoSave Copy of Homework 112) File Home Insert Page Layout Formulas Data Review View N5 v for B Nancy Cookies purchases paper and other office 11 supplies for $95. (Use Supplies.) Nancy Cookies pays $125 to purchase baking supplies, such as flour, sugar, butter, and chocolate chips. (Use 14 Supplies.) Nancy starts to gather some baking equipment to take with her wshen teaching the cookie classes, she has an excellent top-of-the-line food processor and mixer that originally cost her $550. Nancy decides to start using it only in her new business. she estimates that the equipment is currently worth $300, and she transfers the equipment into the business in exchange for 15 additional common stock. 8 the company needs more cash to sustain its operations. Nancy's grandmother lends the company $2,000 cash, in exchange for a two-year, 9% note payable. Interest and 16 the principal are repayable at maturity. Nancy Cookies pays $900 for additional baking 17 equipment 9 10 Nancy schedules her first class for November 29. She 18 will receive $100 on the date of the class. 11 Nancy books a second class for December 5 for $150. AutoSave Copy of Homework 1 (2) File Home Insert Page Layout Formulas Data Review View NS X B D the company needs more cash to sustain its operations. Nancy's grandmother lends the company $2,000 cash, in exchange for a two-year, 9% note payable. Interest and 16 the principal are repayable at maturity. Nancy Cookies pays $900 for additional baking 17 equipment Nancy schedules her first class for November 29. She 18 will receive $100 on the date of the class. 2 Nancy books a second class for December 5 for $150. 25 She receives a $60 cash down payment, in advance. Nancy teaches her first class, booked on November 18, 29 and collects the $100 cash. 3 Nancy's brother develops a website for Nancy Cookies Inc. that the company will use for advertising. She charges the company $600 for her work, payable at the end of December. (Because the website is expected to have a useful life of two years before upgrades are needed, it should be treated as an asset called 30 Website.) Nancy Cookies pays $1,200 for a one-year insurance 30 policy 5 school students AutoSave 5) Cabo Copy of Homework 1 File Home Insert Page Layout Formulas Data Review 15 X Nancy's brother develops a website for Nancy Cookies Inc. that the company will use for advertising. She charges the company $600 for her work, payable at the end of December. (Because the website is expected to have a useful life of two years before upgrades are needed, it should be treated as an asset called 30 Website.) Nancy Cookies pays $1,200 for a one-year insurance 30 policy Nancy teaches a group of elementary school students how to make Santa Claus cookies. At the end of the class, she leaves an invoice for $300 with the school principal. The principal says that he will pass it along to the business office and it will be paid some time in 30 December Nancy receives a $50 invoice for use of her cell phone. She uses the cell phone exclusively for Nancy Drew Cookies Inc. business. The invoice is for services provided in November, and payment is due on 30 December 15. Prepare Journal Entries for the above transactions in November. Provide an e Nancy receives a $50 invoice for use of her cell phone. She uses the cell phone exclusively for Nancy Drew Cookies Inc, business. The invoice is for services provided in November, and payment is due on 30 December 15. Prepare Journal Entries for the above transactions in November. Provide an explanation for the transaction. If a journal entry is not required, write Not required. Date Account Titles and Explanation Debit Credit Nov. 8 Not Required (Natalie deposits the cash on her personal bank account) 8 14 14 15 16 02-a 02-b 02-0 Q3 04 os Q1 Q2-Financial Statements et destination and press ENTER or choose Paste Type here to search OR e Nancy receives a $50 invoice for use of her cell phone. She uses the cell phone exclusively for Nancy Drew Cookies Inc, business. The invoice is for services provided in November, and payment is due on 1 30 December 15. 18 19 Prepare lournal Entries for the above transactions in November. Provide an explanation for the transaction. If a journal entry is not required, write Not required. 20 Date Account Titles and Explanation Debit Credit 21 Nov. 8 Not Required 22 (Natalie deposits the cash on her personal bank account) 23 8 24 25 26 14 28 19 30 11 52 14 3 15 5 6 16 3 02-Financial Statements 02-a 02-b 03 Q4 05 elect destination and press ENTER or choose Paste Type here to search 0 e . AutoSave CH Hvi Copy of Homework 1 (2) File Home Insert Page Layout Formulas Data Revic W5 for B A In November 2019, after starting Nancy Drew Cookies Inc., Nancy Drew begins operations. She also considers offering cooking Nov. 8 Nancy cashes in her U.S. Savings Bonds and receives Nancy opens a bank account for Nancy Drew Cookies 8 Inc. Nancy purchases $500 of Nancy Drew Cookies' common 8 stock. Nancy Cookies purchases paper and other office 11 supplies for $95. (Use Supplies.) Nancy Cookies pays $125 to purchase baking supplies, such as flour, sugar, butter, and chocolate chips. (Use 14 Supplies.) Nancy starts to gather some baking equipment to take with her wshen teaching the cookie classes, she has an excellent top-of-the-line food processor and mixer that originally cost her $550. Nancy decides to start using it only in her new business, she estimates that the equipment is currently worth $300, and she transfers the equipment into the business in exchange for 15 additional common stock. B AutoSave Copy of Homework 112) File Home Insert Page Layout Formulas Data Review View N5 v for B Nancy Cookies purchases paper and other office 11 supplies for $95. (Use Supplies.) Nancy Cookies pays $125 to purchase baking supplies, such as flour, sugar, butter, and chocolate chips. (Use 14 Supplies.) Nancy starts to gather some baking equipment to take with her wshen teaching the cookie classes, she has an excellent top-of-the-line food processor and mixer that originally cost her $550. Nancy decides to start using it only in her new business. she estimates that the equipment is currently worth $300, and she transfers the equipment into the business in exchange for 15 additional common stock. 8 the company needs more cash to sustain its operations. Nancy's grandmother lends the company $2,000 cash, in exchange for a two-year, 9% note payable. Interest and 16 the principal are repayable at maturity. Nancy Cookies pays $900 for additional baking 17 equipment 9 10 Nancy schedules her first class for November 29. She 18 will receive $100 on the date of the class. 11 Nancy books a second class for December 5 for $150. AutoSave Copy of Homework 1 (2) File Home Insert Page Layout Formulas Data Review View NS X B D the company needs more cash to sustain its operations. Nancy's grandmother lends the company $2,000 cash, in exchange for a two-year, 9% note payable. Interest and 16 the principal are repayable at maturity. Nancy Cookies pays $900 for additional baking 17 equipment Nancy schedules her first class for November 29. She 18 will receive $100 on the date of the class. 2 Nancy books a second class for December 5 for $150. 25 She receives a $60 cash down payment, in advance. Nancy teaches her first class, booked on November 18, 29 and collects the $100 cash. 3 Nancy's brother develops a website for Nancy Cookies Inc. that the company will use for advertising. She charges the company $600 for her work, payable at the end of December. (Because the website is expected to have a useful life of two years before upgrades are needed, it should be treated as an asset called 30 Website.) Nancy Cookies pays $1,200 for a one-year insurance 30 policy 5 school students AutoSave 5) Cabo Copy of Homework 1 File Home Insert Page Layout Formulas Data Review 15 X Nancy's brother develops a website for Nancy Cookies Inc. that the company will use for advertising. She charges the company $600 for her work, payable at the end of December. (Because the website is expected to have a useful life of two years before upgrades are needed, it should be treated as an asset called 30 Website.) Nancy Cookies pays $1,200 for a one-year insurance 30 policy Nancy teaches a group of elementary school students how to make Santa Claus cookies. At the end of the class, she leaves an invoice for $300 with the school principal. The principal says that he will pass it along to the business office and it will be paid some time in 30 December Nancy receives a $50 invoice for use of her cell phone. She uses the cell phone exclusively for Nancy Drew Cookies Inc. business. The invoice is for services provided in November, and payment is due on 30 December 15. Prepare Journal Entries for the above transactions in November. Provide an e Nancy receives a $50 invoice for use of her cell phone. She uses the cell phone exclusively for Nancy Drew Cookies Inc, business. The invoice is for services provided in November, and payment is due on 30 December 15. Prepare Journal Entries for the above transactions in November. Provide an explanation for the transaction. If a journal entry is not required, write Not required. Date Account Titles and Explanation Debit Credit Nov. 8 Not Required (Natalie deposits the cash on her personal bank account) 8 14 14 15 16 02-a 02-b 02-0 Q3 04 os Q1 Q2-Financial Statements et destination and press ENTER or choose Paste Type here to search OR e Nancy receives a $50 invoice for use of her cell phone. She uses the cell phone exclusively for Nancy Drew Cookies Inc, business. The invoice is for services provided in November, and payment is due on 1 30 December 15. 18 19 Prepare lournal Entries for the above transactions in November. Provide an explanation for the transaction. If a journal entry is not required, write Not required. 20 Date Account Titles and Explanation Debit Credit 21 Nov. 8 Not Required 22 (Natalie deposits the cash on her personal bank account) 23 8 24 25 26 14 28 19 30 11 52 14 3 15 5 6 16 3 02-Financial Statements 02-a 02-b 03 Q4 05 elect destination and press ENTER or choose Paste Type here to search 0 e