Answered step by step

Verified Expert Solution

Question

1 Approved Answer

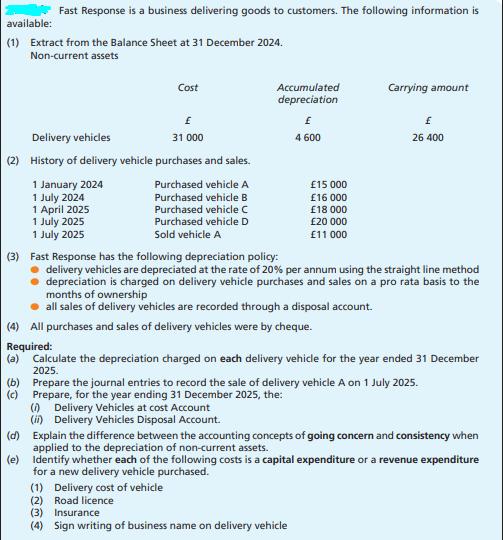

available: (1) Extract from the Balance Sheet at 31 December 2024. Non-current assets Fast Response is a business delivering goods to customers. The following

available: (1) Extract from the Balance Sheet at 31 December 2024. Non-current assets Fast Response is a business delivering goods to customers. The following information is Delivery vehicles (2) History of delivery vehicle purchases and sales. (b) (c) 1 January 2024 1 July 2024 1 April 2025 1 July 2025 1 July 2025 (d) (e) Cost (1) (ii) 31 000 Purchased vehicle A Purchased vehicle B Purchased vehicle C Purchased vehicle D Sold vehicle A (3) Fast Response has the following depreciation policy: delivery vehicles are depreciated at the rate of 20% per annum using the straight line method depreciation is charged on delivery vehicle purchases and sales on a pro rata basis to the months of ownership all sales of delivery vehicles are recorded through a disposal account. Accumulated depreciation 4600 (4) All purchases and sales of delivery vehicles were by cheque. Required: (a) Calculate the depreciation charged on each delivery vehicle for the year ended 31 December 2025. Prepare the journal entries to record the sale of delivery vehicle A on 1 July 2025. Prepare, for the year ending 31 December 2025, the: Delivery Vehicles at cost Account Delivery Vehicles Disposal Account. (1) Delivery cost of vehicle (2) Road licence 15 000 16 000 18 000 20 000 11 000 Carrying amount 26 400 (3) Insurance (4) Sign writing of business name on delivery vehicle Explain the difference between the accounting concepts of going concern and consistency when applied to the depreciation of non-current assets. Identify whether each of the following costs is a capital expenditure or a revenue expenditure for a new delivery vehicle purchased.

Step by Step Solution

★★★★★

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a To work out the devaluation charged on every conveyance vehicle for the year finished 31 December 2025 we want to decide the quantity of months every vehicle was claimed during the year Vehicle A Bo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started