Answered step by step

Verified Expert Solution

Question

1 Approved Answer

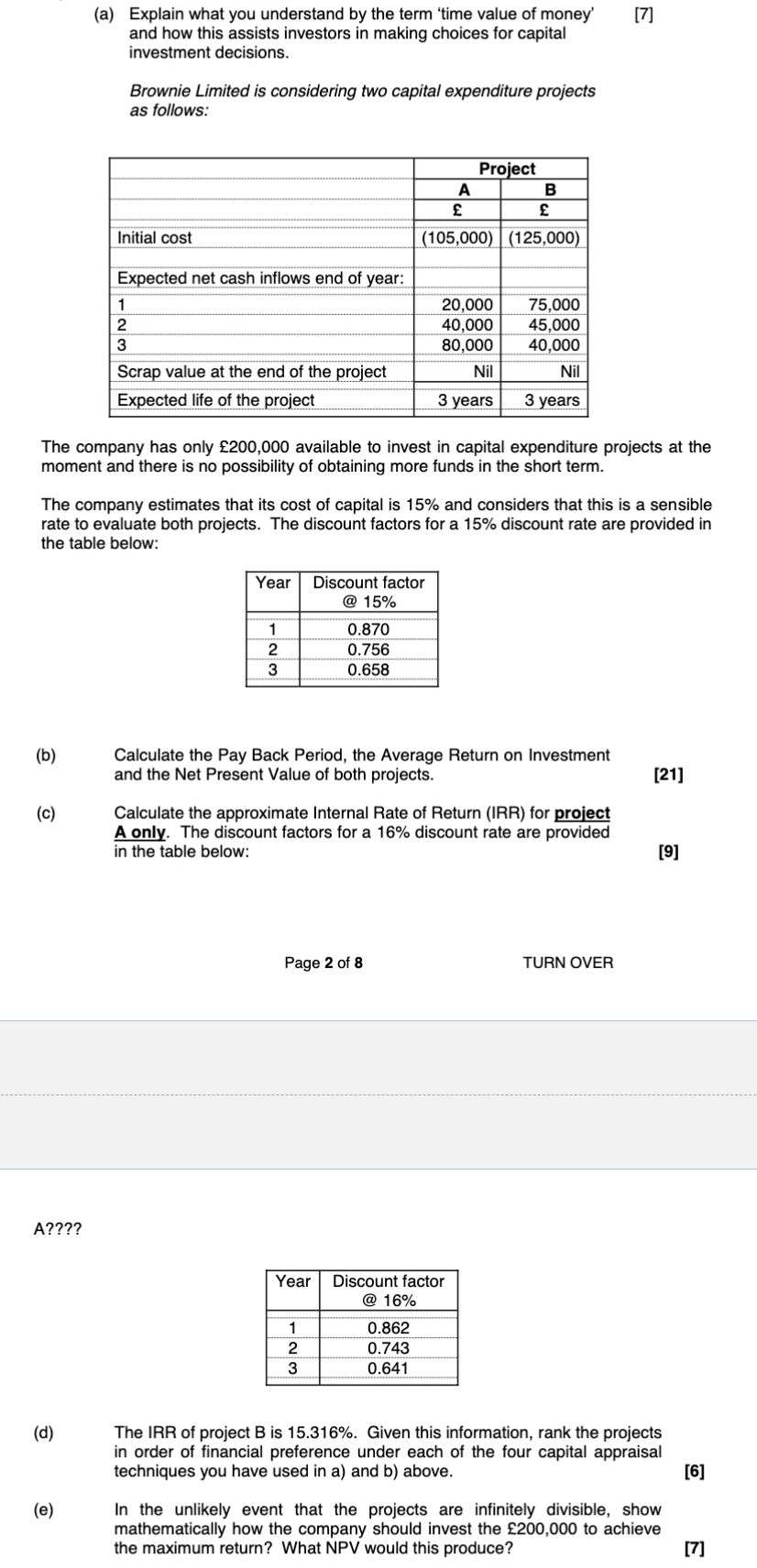

(b) (c) A???? (a) Explain what you understand by the term 'time value of money' and how this assists investors in making choices for

(b) (c) A???? (a) Explain what you understand by the term 'time value of money' and how this assists investors in making choices for capital investment decisions. (d) Brownie Limited is considering two capital expenditure projects as follows: (e) Initial cost Expected net cash inflows end of year: 1 2 3 Scrap value at the end of the project Expected life of the project The company has only 200,000 available to invest in capital expenditure projects at the moment and there is no possibility of obtaining more funds in the short term. The company estimates that its cost of capital is 15% and considers that this is a sensible rate to evaluate both projects. The discount factors for a 15% discount rate are provided in the table below: Year Discount factor @ 15% 1 2 3 0.870 0.756 0.658 A Page 2 of 8 Project (105,000) (125,000) 1 2 3 20,000 40,000 80,000 Nil 3 years B Year Discount factor @ 16% 0.862 0.743 0.641 Calculate the Pay Back Period, the Average Return on Investment and the Net Present Value of both projects. 75,000 45,000 40,000 Nil 3 years Calculate the approximate Internal Rate of Return (IRR) for project A only. The discount factors for a 16% discount rate are provided in the table below: [7] TURN OVER [21] [9] The IRR of project B is 15.316%. Given this information, rank the projects in order of financial preference under each of the four capital appraisal techniques you have used in a) and b) above. In the unlikely event that the projects are infinitely divisible, show mathematically how the company should invest the 200,000 to achieve the maximum return? What NPV would this produce? [6] [7]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The term time value of money refers to the concept that money available today is worth more than the same amount of money in the future It recognizes that the value of money changes over time due to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started