Question

b) c) Brian is considering starting his own small business this year in California. As a result, he is putting together a budget for acquiring

b)

c)

c)

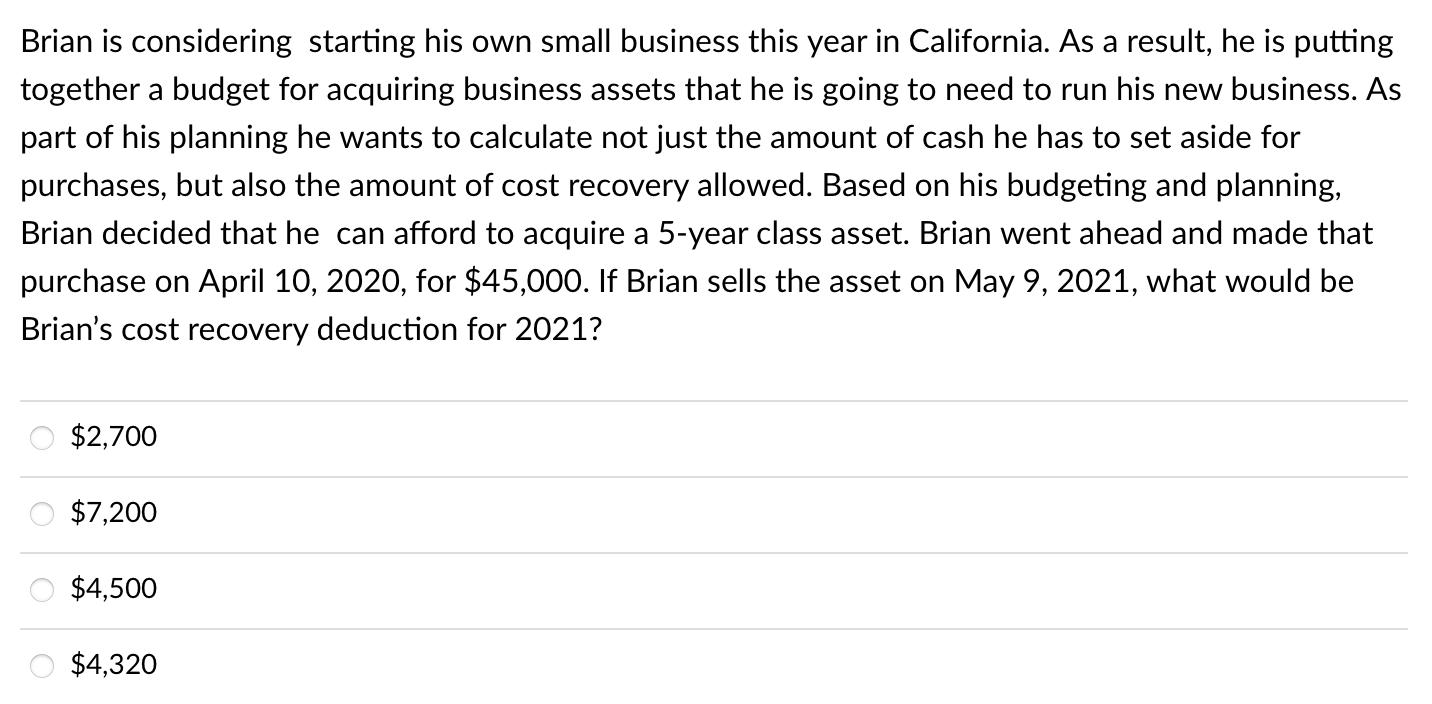

Brian is considering starting his own small business this year in California. As a result, he is putting together a budget for acquiring business assets that he is going to need to run his new business. As part of his planning he wants to calculate not just the amount of cash he has to set aside for purchases, but also the amount of cost recovery allowed. Based on his budgeting and planning, Brian decided that he can afford to acquire a 5-year class asset. Brian went ahead and made that purchase on April 10, 2020, for $45,000. If Brian sells the asset on May 9, 2021, what would be Brian's cost recovery deduction for 2021? $2,700 8 8 8 $7,200 $4,500 $4,320

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Que...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Kin Lo, George Fisher

3rd Edition Vol. 1

133865940, 133865943, 978-7300071374

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App