Answered step by step

Verified Expert Solution

Question

1 Approved Answer

B. On December 31, 2020, Valley Co. has a defined benefit obligation of $167,500 and pension plan assets with a fair value of $172,500. The

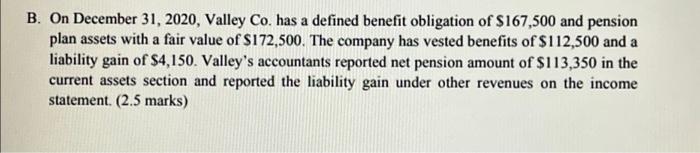

B. On December 31, 2020, Valley Co. has a defined benefit obligation of $167,500 and pension plan assets with a fair value of $172,500. The company has vested benefits of $112,500 and a liability gain of $4,150. Valley's accountants reported net pension amount of $113,350 in the current assets section and reported the liability gain under other revenues on the income statement. (2.5 marks)

COMMENT on the given numbers and the accounting reporting and classification whether it is correct or not. If it is wrong, Provide Calculations of the correct answer and EXPLAIN the correct reporting and classifications.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started