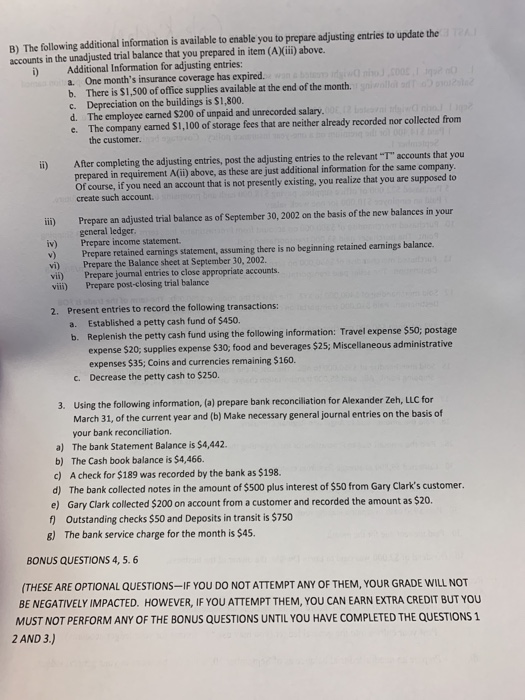

B) The following additional information is available to enable you to prepare adjusting entries to update the accounts in the unadjusted trial balance that you prepared in item (AXii) above. i) Additional Information for adjusting entries: a. One month's insurance coverage has expired. b. There is $1,500 of office supplies available at the end of the month. c. Depreciation on the buildings is $1,800. d. The employee earned S200 of umpaid and unrecorded salary e. The company earned $1,100 of storage fees that are neither already recorded nor collected from e elecns the customer After completing the adjusting entries, post the adjusting entries to the relevant-T" accounts that prepared in requirement A(ii) above, as these are just additional information for the same Of course, if you need an account that is not presently existing, you realize that you are supposed to ii) company create such account. ii) Prepare an adjusted trial balance as of September 30, 2002 on the basis of the new balances in your general ledger iv) Prepare income statement. v) Prepare retained earnings statement, assuming there is no beginning retained earnings balance vi) Prepare the Balance sheet at September 30, 2002. vii) Prepare journal entries to close appropriate accounts vii) Prepare post-closing trial balanoe 2. Present entries to record the following transactions: a. Established a petty cash fund of $450 b. Replenish the petty cash fund using the following information: Travel expense $50; postage expense $20, supplies expense $30, food and beverages $25; Miscellaneous administrative expenses $35; Coins and currencies remaining $160 Decrease the petty cash to $250. c. 3. Using the following information, (a) prepare bank reconcilation for Alexander Zeh, LLC for March 31, of the current year and (b) Make necessary general journal entries on the basis of your bank reconciliation. a) The bank Statement Balance is $4,442 b) The Cash book balance is $4,466 c) A check for $189 was recorded by the bank as $198. d) The bank collected notes in the amount of $500 plus interest of $50 from Gary Clark's customer. e) Gary Clark collected $200 on account from a customer and recorded the amount as $20. f) Outstanding checks $50 and Deposits in transit is $750 g) The bank service charge for the month is $45. BONUS QUESTIONS 4, 5.6 (THESE ARE OPTIONAL QUESTIONS-IF YOU DO NOT ATTEMPT ANY OF THEM, YOUR GRADE WILL NOT BE NEGATIVELY IMPACTED. HOWEVER, IF YOU ATTEMPT THEM, YOU CAN EARN EXTRA CREDIT BUT YOU MUST NOT PERFORM ANY OF THE BONUS QUESTIONS UNTIL YOU HAVE COMPLETED THE QUESTIONS 1 2 AND 3.)