Answered step by step

Verified Expert Solution

Question

1 Approved Answer

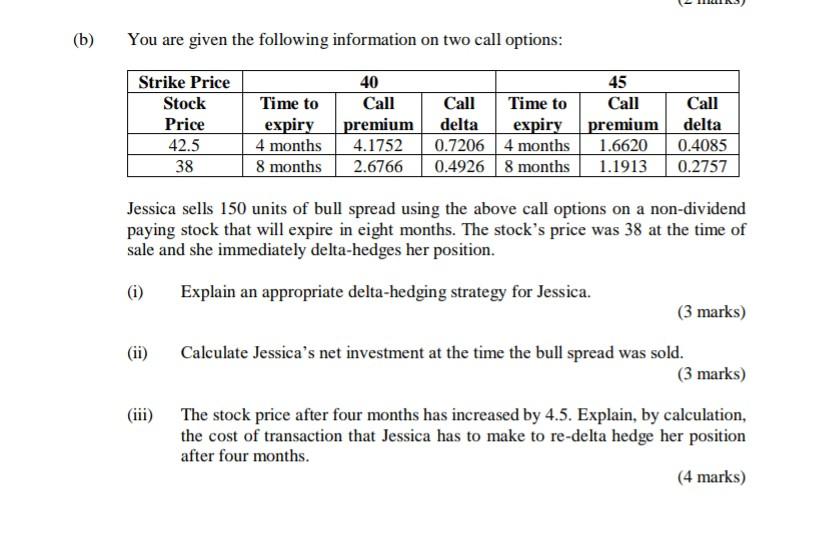

(b) You are given the following information on two call options: Strike Price Stock Price 42.5 38 Time to expiry 4 months 8 months 40

(b) You are given the following information on two call options: Strike Price Stock Price 42.5 38 Time to expiry 4 months 8 months 40 Call premium 4.1752 2.6766 45 Call Time to Call delta expiry premium 0.7206 4 months 1.6620 0.4926 8 months 1.1913 Call delta 0.4085 0.2757 Jessica sells 150 units of bull spread using the above call options on a non-dividend paying stock that will expire in eight months. The stock's price was 38 at the time of sale and she immediately delta-hedges her position. (i) Explain an appropriate delta-hedging strategy for Jessica. (3 marks) (ii) Calculate Jessica's net investment at the time the bull spread was sold. (3 marks) (iii) The stock price after four months has increased by 4.5. Explain, by calculation, the cost of transaction that Jessica has to make to re-delta hedge her position after four months. (4 marks) (b) You are given the following information on two call options: Strike Price Stock Price 42.5 38 Time to expiry 4 months 8 months 40 Call premium 4.1752 2.6766 45 Call Time to Call delta expiry premium 0.7206 4 months 1.6620 0.4926 8 months 1.1913 Call delta 0.4085 0.2757 Jessica sells 150 units of bull spread using the above call options on a non-dividend paying stock that will expire in eight months. The stock's price was 38 at the time of sale and she immediately delta-hedges her position. (i) Explain an appropriate delta-hedging strategy for Jessica. (3 marks) (ii) Calculate Jessica's net investment at the time the bull spread was sold. (3 marks) (iii) The stock price after four months has increased by 4.5. Explain, by calculation, the cost of transaction that Jessica has to make to re-delta hedge her position after four months. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started