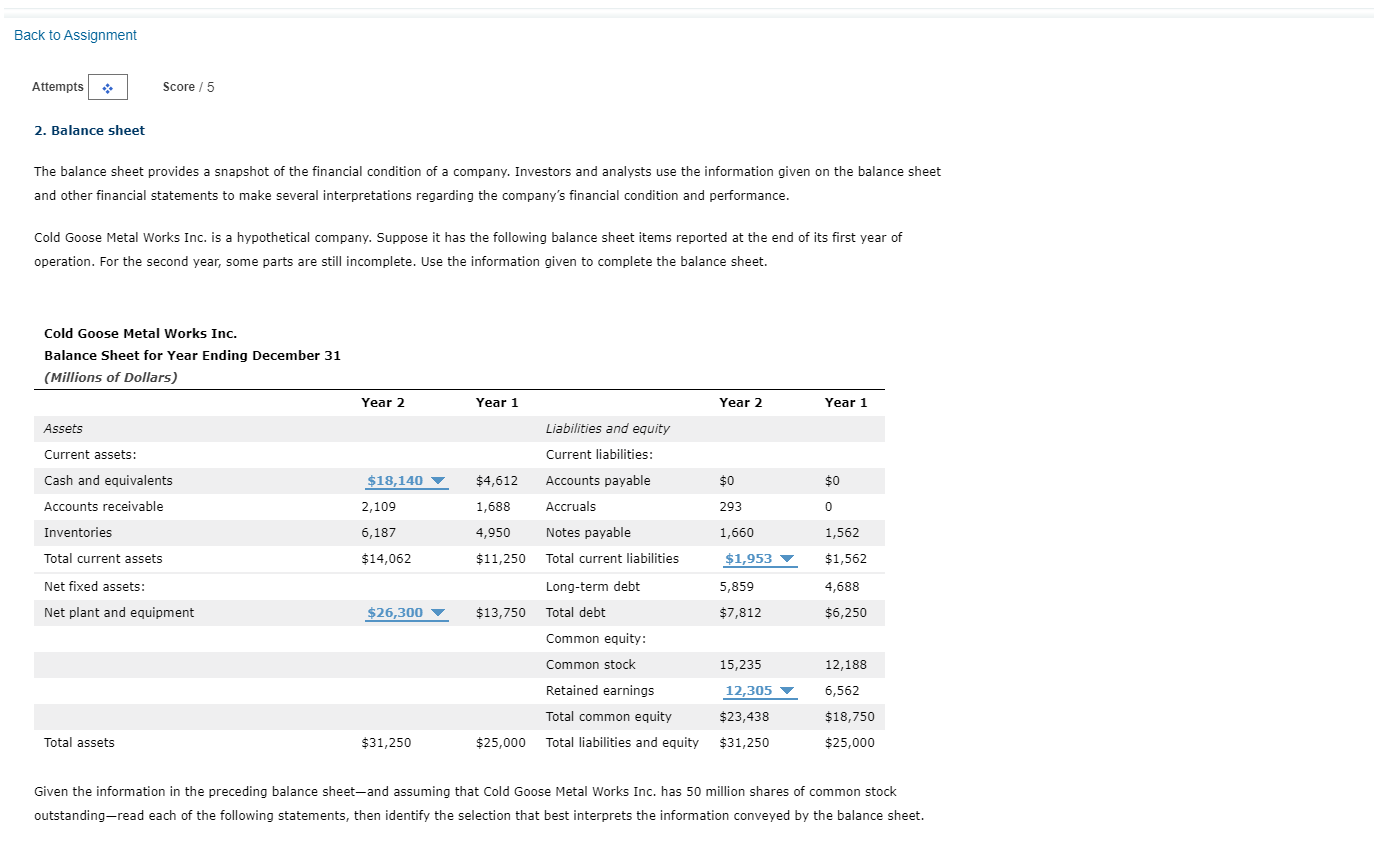

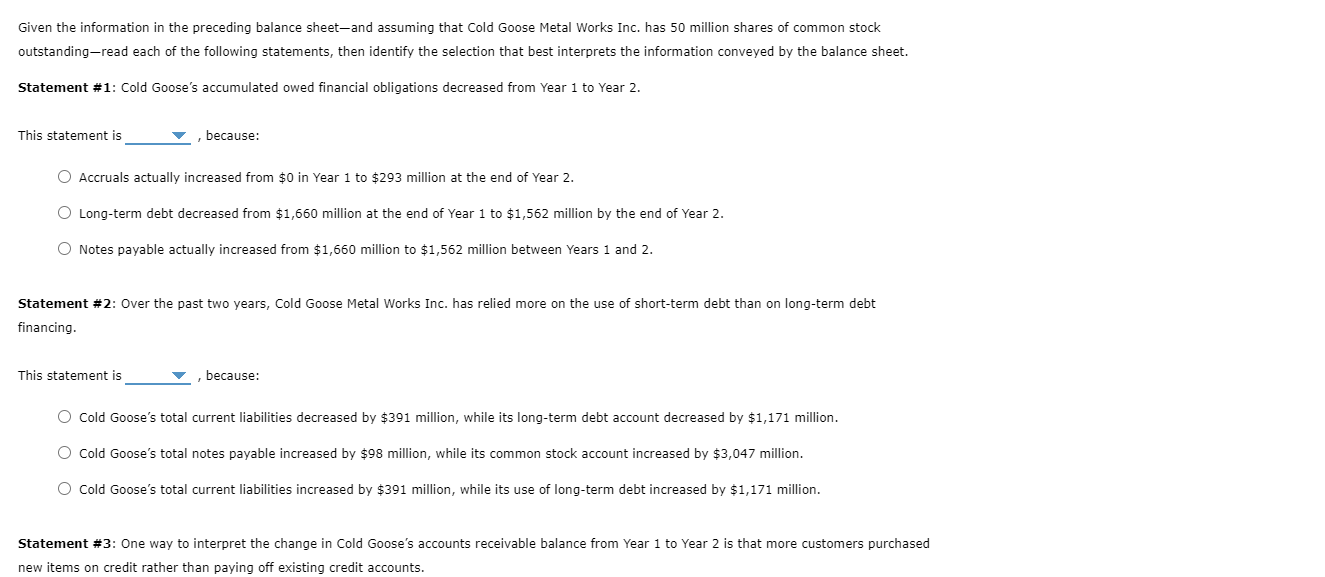

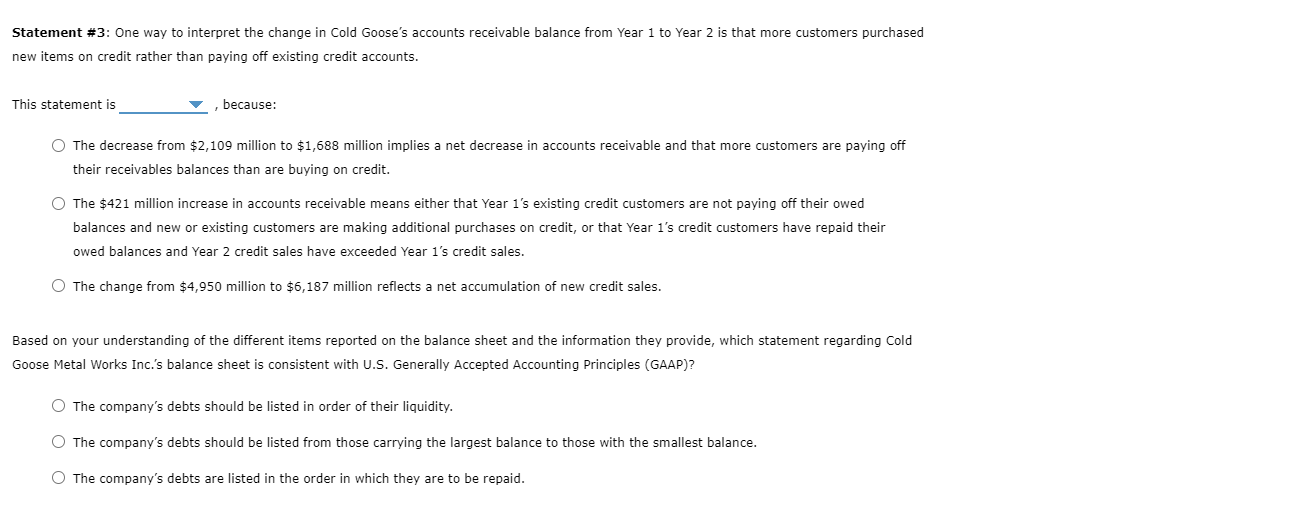

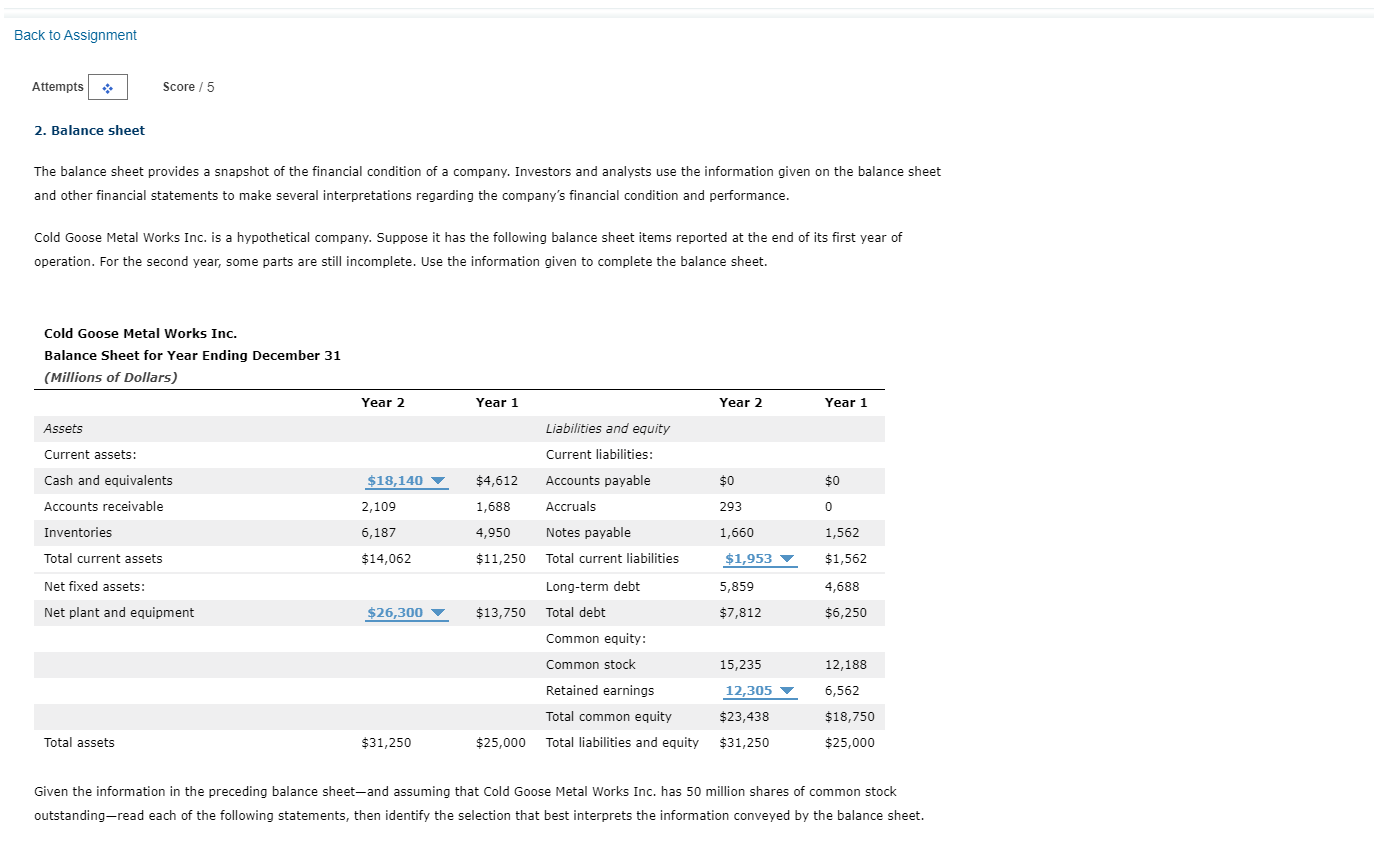

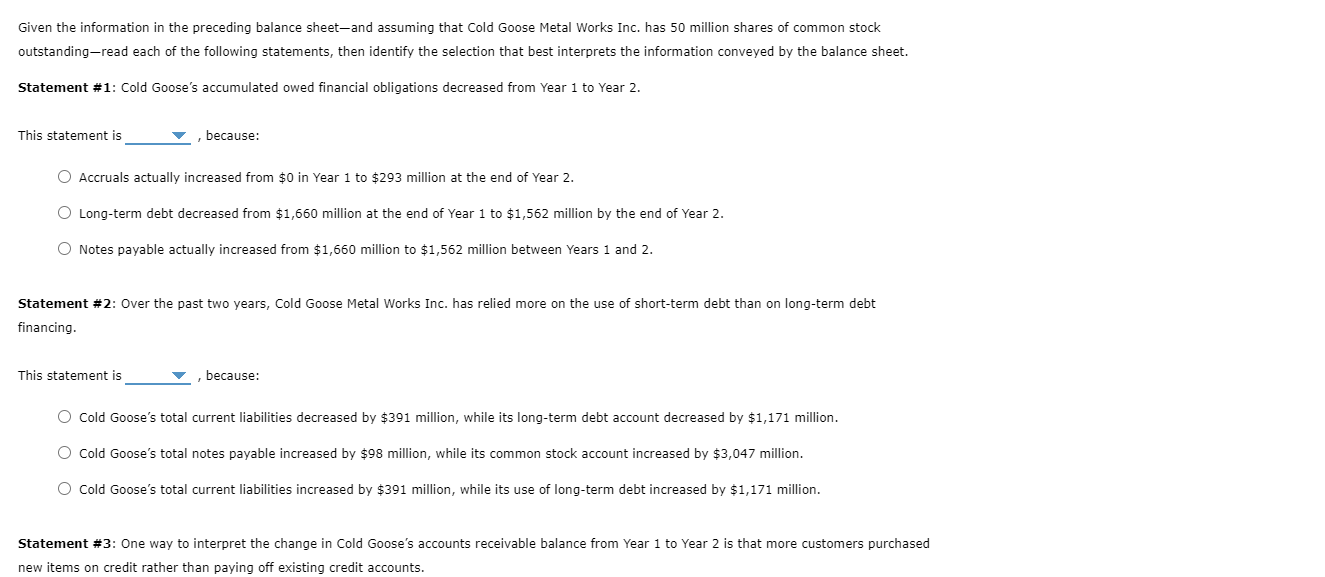

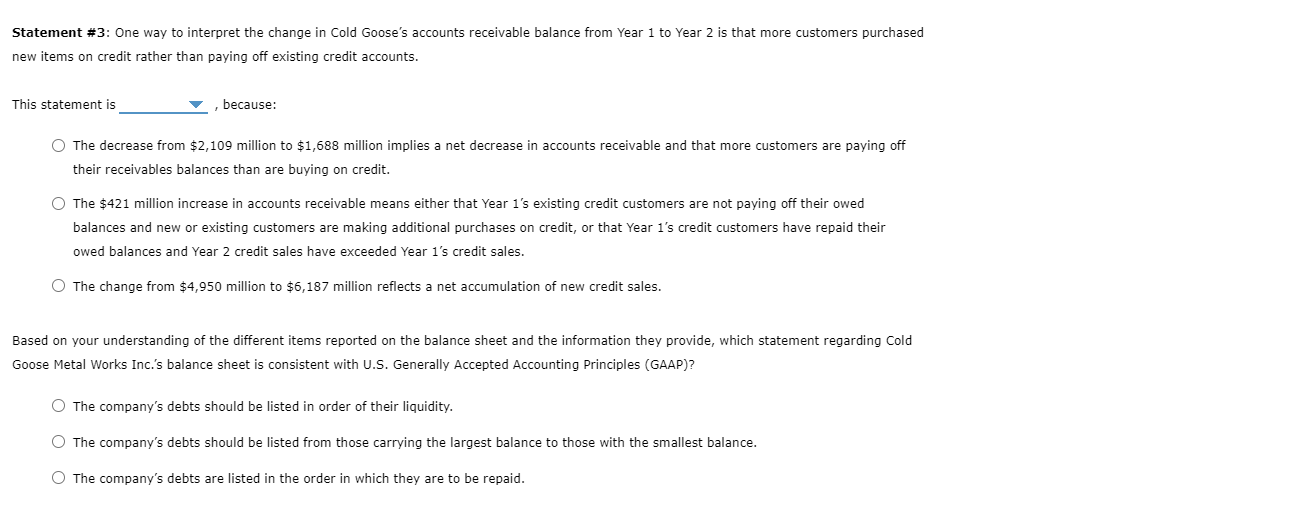

Back to Assignment Attempts Score/5 5 2. Balance sheet The balance sheet provides a snapshot of the financial condition of a company. Investors and analysts use the information given on the balance sheet and other financial statements to make several interpretations regarding the company's financial condition and performance. Cold Goose Metal Works Inc. is a hypothetical company. Suppose it has the following balance sheet items reported at the end of its first year of operation. For the second year, some parts are still incomplete. Use the information given to complete the balance sheet. Cold Goose Metal Works Inc. Balance Sheet for Year Ending December 31 (Millions of Dollars) Year 2 Year 1 Year 2 2 Year 1 1 Assets Liabilities and equity Current assets: Current liabilities: Cash and equivalents $18,140 $4,612 Accounts payable $0 0 $0 Accounts receivable 2,109 1,688 Accruals 293 0 Inventories 6,187 1,660 1,562 4,950 Notes payable $11,250 Total current liabilities Total current assets $14,062 $1,953 $1,562 Long-term debt 5,859 4,688 Net fixed assets: Net plant and equipment $26,300 $6,250 12,188 $13,750 Total debt $7,812 Common equity: Common stock 15,235 Retained earnings 12,305 Total common equity $23,438 $25,000 Total liabilities and equity $31,250 6,562 $18,750 Total assets $31,250 $25,000 Given the information in the preceding balance sheet-and assuming that Cold Goose Metal Works Inc. has 50 million shares of common stock outstanding-read each of the following statements, then identify the selection that best interprets the information conveyed by the balance sheet. Given the information in the preceding balance sheet-and assuming that Cold Goose Metal Works Inc. has 50 million shares of common stock outstanding-read each of the following statements, then identify the selection that best interprets the information conveyed by the balance sheet. Statement #1: Cold Goose's accumulated owed financial obligations decreased from Year 1 to Year 2. This statement is because: Accruals actually increased from $0 in Year 1 to $293 million at the end of Year 2. Long-term debt decreased from $1,660 million at the end of Year 1 to $1,562 million by the end of Year 2. Notes payable actually increased from $1,660 million to $1,562 million between Years 1 and 2. Statement #2: Over the past two years, Cold Goose Metal Works Inc. has relied more on the use of short-term debt than on long-term debt financing. This statement is because: Cold Goose's total current liabilities decreased by $391 million, while its long-term debt account decreased by $1,171 million. Cold Goose's total notes payable increased by $98 million, while its common stock account increased by $3,047 million. O Cold Goose's total current liabilities increased by $391 million, while its use of long-term debt increased by $1,171 million. Statement #3: One way to interpret the change in Cold Goose's accounts receivable balance from Year 1 to Year 2 is that more customers purchased new items on credit rather than paying off existing credit accounts. Statement #3: One way to interpret the change in Cold Goose's accounts receivable balance from Year 1 to Year 2 is that more customers purchased new items on credit rather than paying off existing credit accounts. This statement is because: The decrease from $2,109 million to $1,688 million implies a net decrease in accounts receivable and that more customers are paying off their receivables balances than are buying on credit. O The $421 million increase in accounts receivable means either that Year 1's existing credit customers are not paying off their owed balances and new or existing customers are making additional purchases on credit, or that Year 1's credit customers have repaid their owed balances and Year 2 credit sales have exceeded Year 1's credit sales. The change from $4,950 million to $6,187 million reflects a net accumulation of new credit sales. Based on your understanding of the different items reported on the balance sheet and the information they provide, which statement regarding Cold Goose Metal Works Inc.'s balance sheet is consistent with U.S. Generally Accepted Accounting Principles (GAAP)? The company's debts should be listed in order of their liquidity. The company's debts should be listed from those carrying the largest balance to those with the smallest balance. The company's debts are listed in the order in which they are to be repaid