Question

BACKGROUND: When James Beech, a skilled carpenter, was made redundant he set-up KitTab Limited to produce a self-assembly dining table, the Constable. A few years

BACKGROUND:

When James Beech, a skilled carpenter, was made redundant he set-up KitTab Limited to produce a self-assembly dining table, the Constable. A few years later he introduced the Monet, also a self-assembly kit, and for several years KitTab achieved steady growth in turnover and profits selling the two tables to DIY stores. Increased competition in the selfassembly furniture market forced James to design the Dali, a more complex, adjustable table but still in kit form. The Dali has proved a success, its sales increasing as the demand for the Constable and the Monet declined. Moreover the Dali continues to sell surprisingly well despite a recent price increase. Ongoing demand for the Constable and the Monet appears to be dependent on maintaining old prices and as overall profitability is falling James is considering phasing out these and concentrating on the Dali and other new tables of more unusual design. James is, however, worried that his present product costing system is flawed and he has called you in as a consultant to advise him.

DETAIL:

You establish that James runs an organised workshop using a batch production system, making each table type in alternate batches. To minimise the number of set ups of his machines he produces in batches larger than the sales order quantities and holds the excess in stock for the next order. Each table uses different types of wood and fittings.

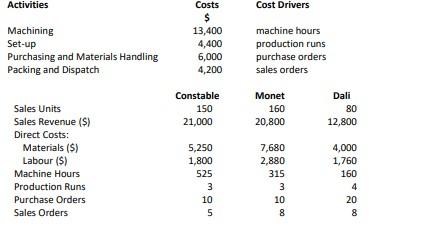

All production overhead is currently absorbed on a machine hour basis but you ascertain that KitTabs processes involve four main activities. The budgeted costs and revenues, and cost driver information for a typical month are as follows:

REQUIRED

Your report to James Beech covering the following:

f) An explanation of any evidence you find to support his suspicions that the present product costing system is flawed.

g) A calculation of total profits, analysed by product, using the present (machine hour absorption) costing system. Highlight return on sales (profit margin) in total and by product.

h) A similar analysis using appropriate activity based costing methodology and burden rates. Highlight the amended return on sales (profit margin) of each product.

i) Your explanation for the differences in product profit margins observed.

j) Your recommendations to KitTab, including your advice on the future product and production strategies that KitTab should adopt as a consequence of the ABC analysis

Activities Cost Drivers Machining Set-up Purchasing and Materials Handling Packing and Dispatch Costs $ 13,400 4,400 6,000 4,200 machine hours production runs purchase orders sales orders Constable 150 Monet 160 20,800 Dali 80 12,800 21,000 Sales Units Sales Revenue ($) Direct Costs: Materials ($) Labour ($) Machine Hours Production Runs Purchase Orders Sales Orders 5,250 1,800 525 3 3 10 5 7,680 2,880 315 3 10 4,000 1,760 160 4 20 8 DOStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started