Answered step by step

Verified Expert Solution

Question

1 Approved Answer

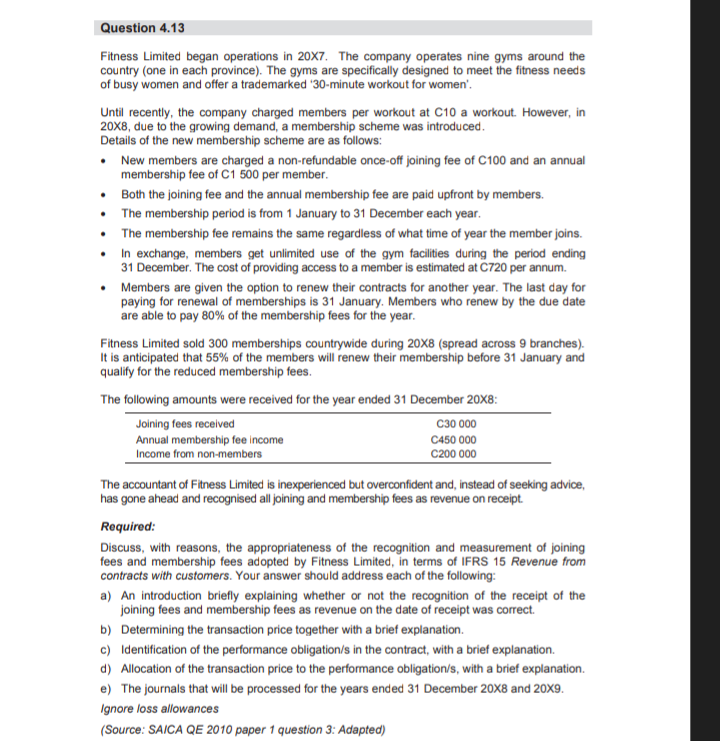

country (one in each province). The gyms are specifically designed to meet the fitness needs of busy women and offer a trademarked '30-minute workout for

country (one in each province). The gyms are specifically designed to meet the fitness needs of busy women and offer a trademarked '30-minute workout for women'. Until recently, the company charged members per workout at C10 a workout. However, in 20X8, due to the growing demand, a membership scheme was introduced. Details of the new membership scheme are as follows: - New members are charged a non-refundable once-off joining fee of C100 and an annual membership fee of C1 500 per member. - Both the joining fee and the annual membership fee are paid upfront by members. - The membership period is from 1 January to 31 December each year. - The membership fee remains the same regardless of what time of year the member joins. - In exchange, members get unlimited use of the gym facilities during the period ending 31 December. The cost of providing access to a member is estimated at C720 per annum. - Members are given the option to renew their contracts for another year. The last day for paying for renewal of memberships is 31 January. Members who renew by the due date are able to pay 80% of the membership fees for the year. Fitness Limited sold 300 memberships countrywide during 208 (spread across 9 branches). It is anticipated that 55% of the members will renew their membership before 31 January and qualify for the reduced membership fees. The following amounts were received for the year ended 31 December 208 : The accountant of Fitness Limited is inexperienced but overconfident and, instead of seeking advice, has gone ahead and recognised all joining and membership fees as revenue on receipt. Required: Discuss, with reasons, the appropriateness of the recognition and measurement of joining fees and membership fees adopted by Fitness Limited, in terms of IFRS 15 Revenue from contracts with customers. Your answer should address each of the following: a) An introduction briefly explaining whether or not the recognition of the receipt the joining fees and membership fees as revenue on the date of receipt was correct. b) Determining the transaction price together with a brief explanation. c) Identification of the performance obligation/s in the contract, with a brief explanation. d) Allocation of the transaction price to the performance obligation/s, with a brief explanation. e) The journals that will be processed for the years ended 31 December 208 and 209. Ignore loss allowances (Source: SAICA QE 2010 paper 1 question 3: Adapted)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started