Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bakari Sdn Bhd (BSB) manufactures blenders for household use. Currently BSB is developing departmental overhead rates for its two production departments, Assembly and Finishing, based

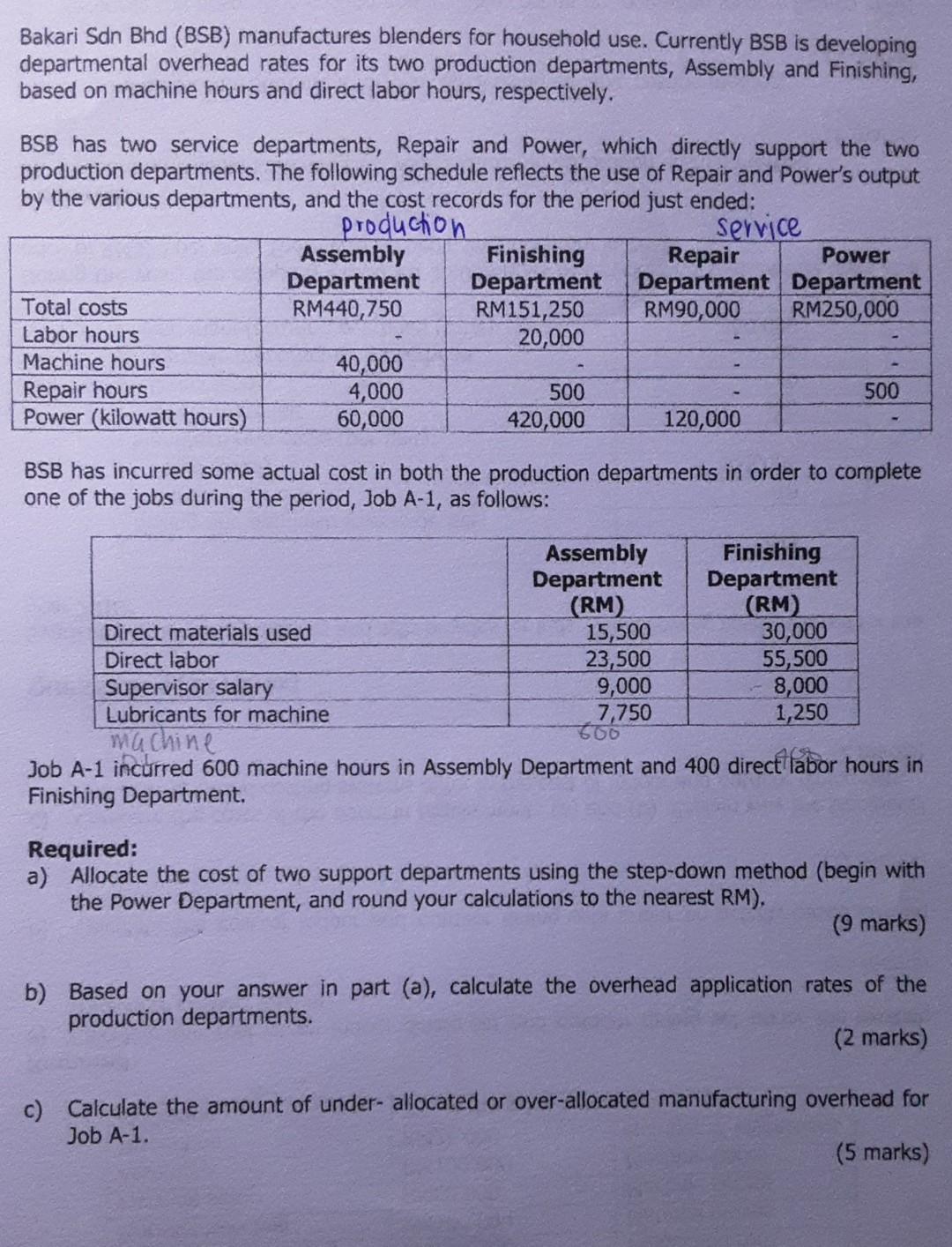

Bakari Sdn Bhd (BSB) manufactures blenders for household use. Currently BSB is developing departmental overhead rates for its two production departments, Assembly and Finishing, based on machine hours and direct labor hours, respectively. BSB has two service departments, Repair and Power, which directly support the two production departments. The following schedule reflects the use of Repair and Power's output by the various departments, and the cost records for the period just ended: production service Assembly Finishing Repair Power Department Department Department Department Total costs RM440,750 RM151,250 RM90,000 RM250,000 Labor hours 20,000 Machine hours 40,000 Repair hours 4,000 500 500 Power (kilowatt hours) 60,000 420,000 120,000 BSB has incurred some actual cost in both the production departments in order to complete one of the jobs during the period, Job A-1, as follows: Assembly Finishing Department Department (RM) (RM) Direct materials used 15,500 30,000 Direct labor 23,500 55,500 Supervisor salary 9,000 8,000 Lubricants for machine 7,750 1,250 machine 600 Job A-1 incurred 600 machine hours in Assembly Department and 400 direct labor hours in Finishing Department. Required: a) Allocate the cost of two support departments using the step-down method (begin with the Power Department, and round your calculations to the nearest RM). (9 marks) b) Based on your answer in part (a), calculate the overhead application rates of the production departments. (2 marks) c) Calculate the amount of under-allocated or over-allocated manufacturing overhead for Job A-1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started