Answered step by step

Verified Expert Solution

Question

1 Approved Answer

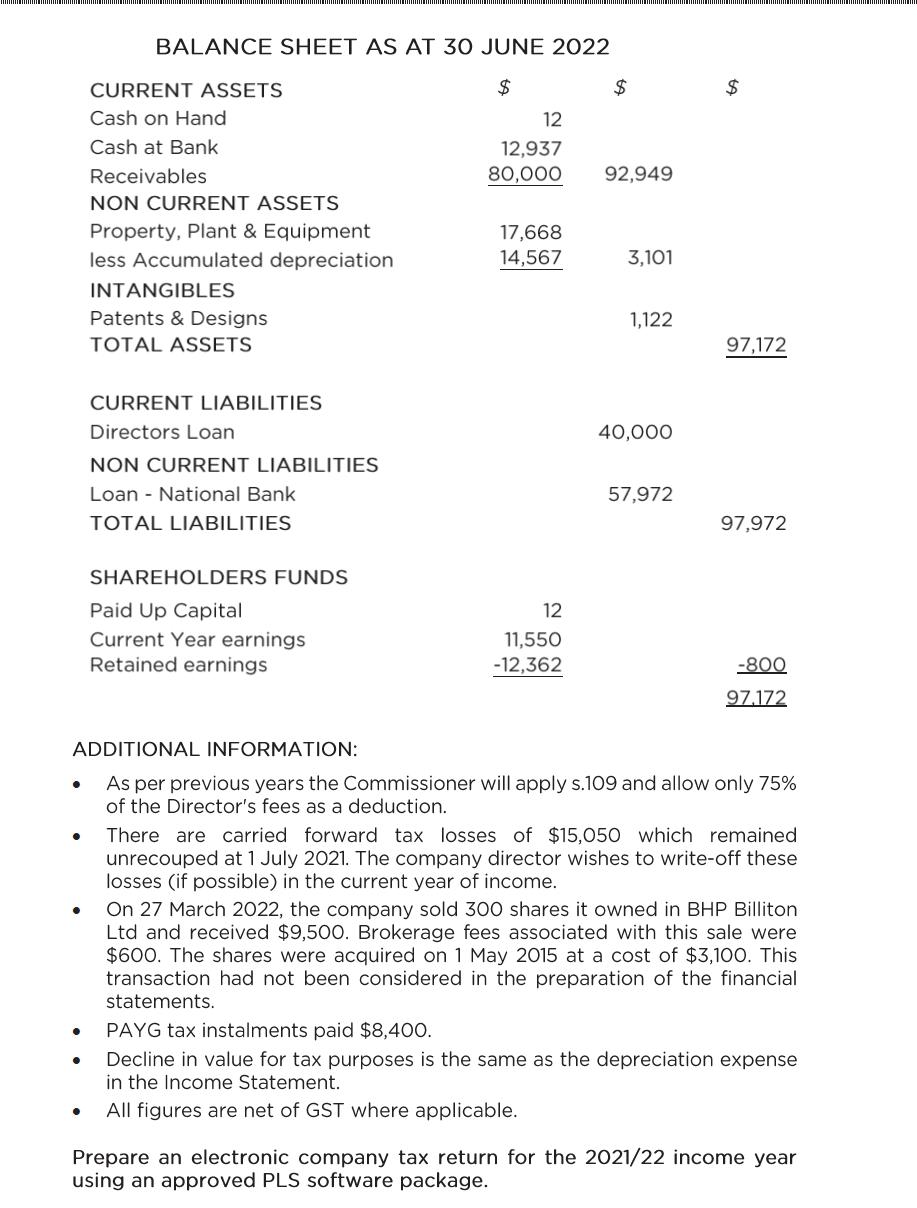

. BALANCE SHEET AS AT 30 JUNE 2022 $ CURRENT ASSETS Cash on Hand Cash at Bank Receivables NON CURRENT ASSETS Property, Plant &

. BALANCE SHEET AS AT 30 JUNE 2022 $ CURRENT ASSETS Cash on Hand Cash at Bank Receivables NON CURRENT ASSETS Property, Plant & Equipment less Accumulated depreciation INTANGIBLES Patents & Designs TOTAL ASSETS CURRENT LIABILITIES Directors Loan NON CURRENT LIABILITIES Loan National Bank TOTAL LIABILITIES SHAREHOLDERS FUNDS Paid Up Capital Current Year earnings Retained earnings 12 12,937 80,000 17,668 14,567 12 11,550 -12,362 $ 92,949 3,101 1,122 40,000 57,972 $ ADDITIONAL INFORMATION: As per previous years the Commissioner will apply s.109 and allow only 75% of the Director's fees as a deduction. 97,172 97,972 -800 97.172 There are carried forward tax losses of $15,050 which remained unrecouped at 1 July 2021. The company director wishes to write-off these losses (if possible) in the current year of income. PAYG tax instalments paid $8,400. Decline in value for tax purposes is the same as the depreciation expense in the Income Statement. All figures are net of GST where applicable. On 27 March 2022, the company sold 300 shares it owned in BHP Billiton Ltd and received $9,500. Brokerage fees associated with this sale were $600. The shares were acquired on 1 May 2015 at a cost of $3,100. This transaction had not been considered in the preparation of the financial statements. Prepare an electronic company tax return for the 2021/22 income year using an approved PLS software package.

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To prepare an electronic company tax return for the 202122 income year using an approved PLS softwar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started