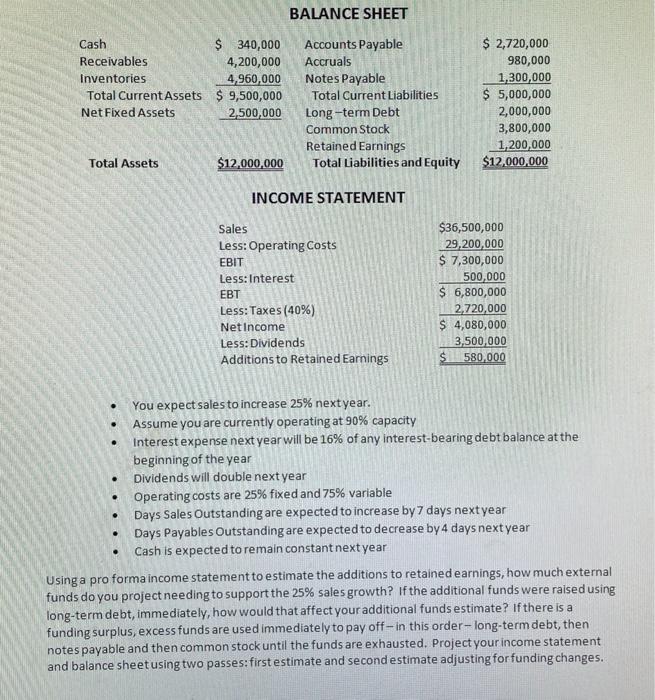

BALANCE SHEET Cash $ 340,000 Receivables 4,200,000 Inventories 4,960,000 Total Current Assets $9,500,000 Net Fixed Assets 2,500,000 Accounts Payable Accruals Notes Payable Total Current Liabilities Long-term Debt Common Stock Retained Earnings Total Liabilities and Equity $ 2,720,000 980,000 1,300,000 $ 5,000,000 2,000,000 3,800,000 1,200,000 $12,000,000 Total Assets $12,000,000 INCOME STATEMENT Sales Less: Operating costs EBIT Less: Interest EBT Less: Taxes (40%) Net Income Less: Dividends Additions to Retained Earnings $36,500,000 29,200,000 $ 7,300,000 500,000 $ 6,800,000 2,720,000 $ 4,080,000 3,500,000 580,000 . . . . You expect sales to increase 25% next year. Assume you are currently operating at 90% capacity Interest expense next year will be 16% of any interest-bearing debt balance at the beginning of the year Dividends will double next year Operating costs are 25% fixed and 75% variable Days Sales Outstanding are expected to increase by 7 days next year Days Payables Outstanding are expected to decrease by 4 days next year Cash is expected to remain constant next year Using a pro forma income statement to estimate the additions to retained earnings, how much external funds do you project needing to support the 25% sales growth? If the additional funds were raised using long-term debt, immediately, how would that affect your additional funds estimate? If there is a funding surplus, excess funds are used immediately to pay off-in this order-long-term debt, then notes payable and then common stock until the funds are exhausted. Project your income statement and balance sheet using two passes: first estimate and second estimate adjusting for funding changes. . BALANCE SHEET Cash $ 340,000 Receivables 4,200,000 Inventories 4,960,000 Total Current Assets $9,500,000 Net Fixed Assets 2,500,000 Accounts Payable Accruals Notes Payable Total Current Liabilities Long-term Debt Common Stock Retained Earnings Total Liabilities and Equity $ 2,720,000 980,000 1,300,000 $ 5,000,000 2,000,000 3,800,000 1,200,000 $12,000,000 Total Assets $12,000,000 INCOME STATEMENT Sales Less: Operating costs EBIT Less: Interest EBT Less: Taxes (40%) Net Income Less: Dividends Additions to Retained Earnings $36,500,000 29,200,000 $ 7,300,000 500,000 $ 6,800,000 2,720,000 $ 4,080,000 3,500,000 580,000 . . . . You expect sales to increase 25% next year. Assume you are currently operating at 90% capacity Interest expense next year will be 16% of any interest-bearing debt balance at the beginning of the year Dividends will double next year Operating costs are 25% fixed and 75% variable Days Sales Outstanding are expected to increase by 7 days next year Days Payables Outstanding are expected to decrease by 4 days next year Cash is expected to remain constant next year Using a pro forma income statement to estimate the additions to retained earnings, how much external funds do you project needing to support the 25% sales growth? If the additional funds were raised using long-term debt, immediately, how would that affect your additional funds estimate? If there is a funding surplus, excess funds are used immediately to pay off-in this order-long-term debt, then notes payable and then common stock until the funds are exhausted. Project your income statement and balance sheet using two passes: first estimate and second estimate adjusting for funding changes