Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on Fig (2), name the two drivers of the market share of Islamic banking assets and elaborate on their effects and their driving role

- Based on Fig (2), name the two drivers of the market share of Islamic banking assets and elaborate on their effects and their driving role in the economic growth.

(20 marks)

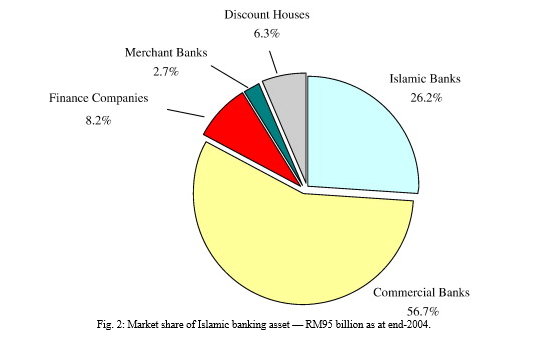

Fig. 2 plots the market share of Islamic banking assets by various financial institutions as at end-2004. Despite having only a small percentage of their asset portfolio in Islamic banking. commercial banks actually held the largest market share (56.7%) of the total Islamic banking assets. Islamic banks' market share, in contrast, is at 26.2%, while finance companies, merchant banks, and discount houses' market share is at 8.2%, 2.7%, and 6.3%, respectively. Thus, a large proportion of the Islamic banking assets (73.8%) are held by institutions that provide Islamic banking services through the Interest-free Banking Scheme. Available data from December 2002 to December 2004 also show that Islamic banking assets held by institutions under the Interest-free Banking Scheme grew at an average rate 20.8% per annum, while assets held by the pure Islamic banks grew at 11.1% per annum. A probable reason why institutions under the Interest-free Banking Scheme experienced higher growth in Islamic banking assets is because, in comparison to the pure Islamic banks, such institutions are more established, have greater distribution network, and enjoy greater economies of scale and scope. Discount Houses 6.3% Merchant Banks 2.7% Islamic Banks 26.2% Finance Companies 8.2% Commercial Banks 56.7% Fig. 2: Market share of Islamic banking asset - RM95 billion as at end-2004. Fig. 2 plots the market share of Islamic banking assets by various financial institutions as at end-2004. Despite having only a small percentage of their asset portfolio in Islamic banking. commercial banks actually held the largest market share (56.7%) of the total Islamic banking assets. Islamic banks' market share, in contrast, is at 26.2%, while finance companies, merchant banks, and discount houses' market share is at 8.2%, 2.7%, and 6.3%, respectively. Thus, a large proportion of the Islamic banking assets (73.8%) are held by institutions that provide Islamic banking services through the Interest-free Banking Scheme. Available data from December 2002 to December 2004 also show that Islamic banking assets held by institutions under the Interest-free Banking Scheme grew at an average rate 20.8% per annum, while assets held by the pure Islamic banks grew at 11.1% per annum. A probable reason why institutions under the Interest-free Banking Scheme experienced higher growth in Islamic banking assets is because, in comparison to the pure Islamic banks, such institutions are more established, have greater distribution network, and enjoy greater economies of scale and scope. Discount Houses 6.3% Merchant Banks 2.7% Islamic Banks 26.2% Finance Companies 8.2% Commercial Banks 56.7% Fig. 2: Market share of Islamic banking asset - RM95 billion as at end-2004

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started