Question

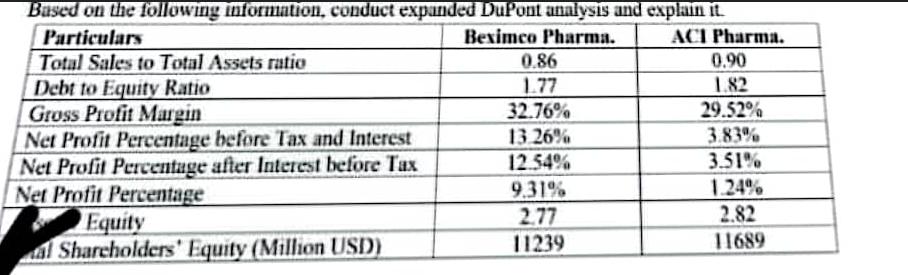

Based on the following information, conduct expanded DuPont analysis and explain it. Particulars Beximco Pharma. ACI Pharma. Total Sales to Total Assets ratio Debt

Based on the following information, conduct expanded DuPont analysis and explain it. Particulars Beximco Pharma. ACI Pharma. Total Sales to Total Assets ratio Debt to Equity Ratio Gross Profit Margin Net Profit Percentage before Tax and Interest Net Profit Percentage after Interest before Tax Net Profit Percentage Equity al Shareholders' Equity (Million USD) 0.86 1.77 32.76% 13.26% 12.54% 9.31% 2.77 11239 0.90 1.82 29.52% 3.83% 3.51% 1.24% 2.82 11689

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

DuPont analysis is a financial performance measurement tool that breaks down the return on equity ROE into different components helping to identify th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Theory And Practice

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason

3rd Canadian Edition

017658305X, 978-0176583057

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App