Answered step by step

Verified Expert Solution

Question

1 Approved Answer

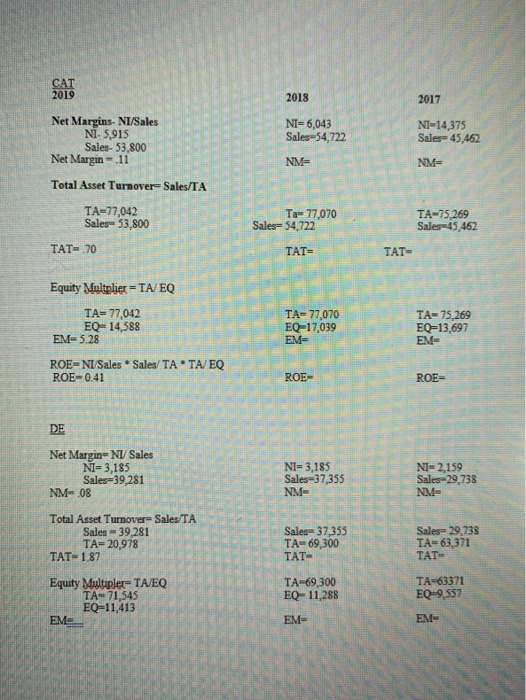

based on the work that i did. how would i compare the 2 companies (CAT AND DE) to their own annual histories as well as

based on the work that i did. how would i compare the 2 companies (CAT AND DE) to their own annual histories as well as each other? over the 3 years of finacials i have calcualted.

based on the work that i did. how would i compare the 2 companies (CAT AND DE) to their own annual histories as well as each other? over the 3 years of finacials i have calcualted. also how would i tell what within their income/balance sheets, is driving the growth or deterioration if the coment ratios and ROE over time?

im really stuck on how to verberally explain these. also is the formula for ROE correct ?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started