Answered step by step

Verified Expert Solution

Question

1 Approved Answer

been allocated to the divisions on the basis of sales. a. What is the company's overall break-even in sales dollars? Show your work! (Please note

been allocated to the divisions on the basis of sales.

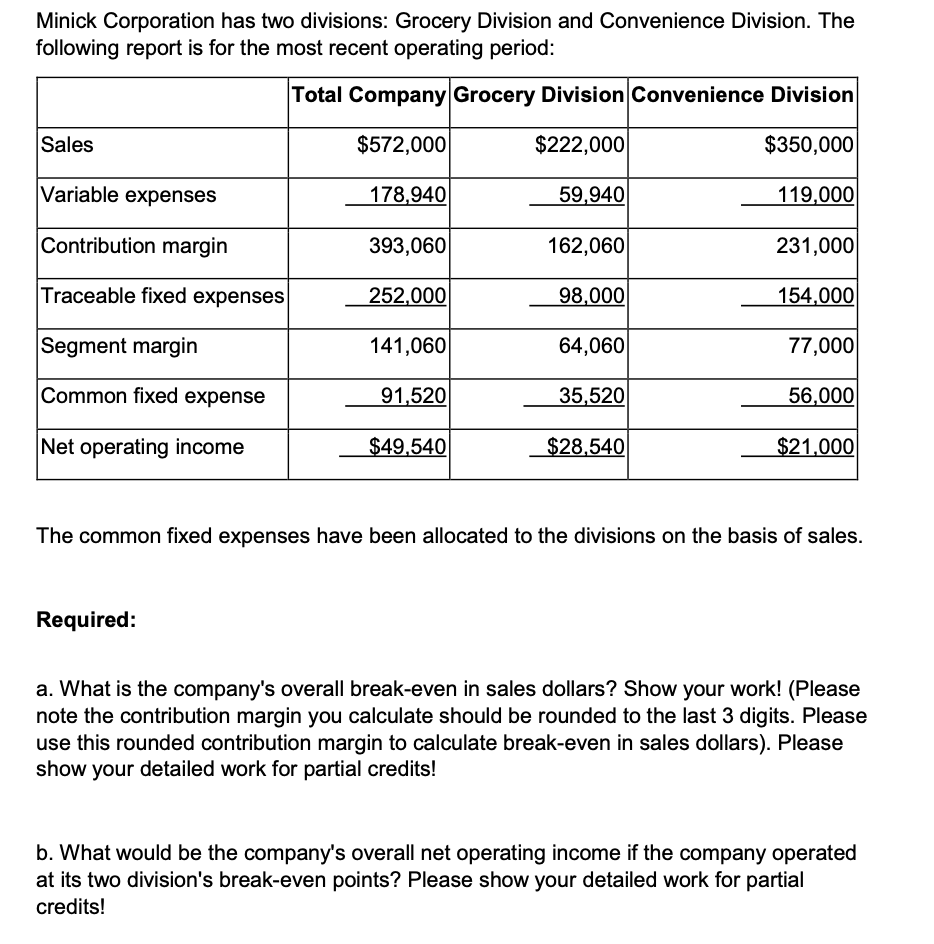

a. What is the company's overall break-even in sales dollars? Show your work! (Please note the contribution margin you calculate should be rounded to the last 3 digits. Please use this rounded contribution margin to calculate break-even in sales dollars). Please show your detailed work for partial credits!

b. What would be the company's overall net operating income if the company operated at its two division's break-even points? Please show your detailed work for partial credits!

Minick Corporation has two divisions: Grocery Division and Convenience Division. The following report is for the most recent operating period: Total Company Grocery Division Convenience Division Sales $572,000 $222,000 $350,000 Variable expenses 178,940 59,940 119,000 Contribution margin 393,060 162,060 231,000 Traceable fixed expenses 252,000 98,000 154,000 Segment margin 141,060 64,060 77,000 Common fixed expense 91,520 35,520 56,000 Net operating income $49,540 $28,540 $21,000 The common fixed expenses have been allocated to the divisions on the basis of sales. Required: a. What is the company's overall break-even in sales dollars? Show your work! (Please note the contribution margin you calculate should be rounded to the last 3 digits. Please use this rounded contribution margin to calculate break-even in sales dollars). Please show your detailed work for partial credits! b. What would be the company's overall net operating income if the company operated at its two division's break-even points? Please show your detailed work for partial creditsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started