Answered step by step

Verified Expert Solution

Question

1 Approved Answer

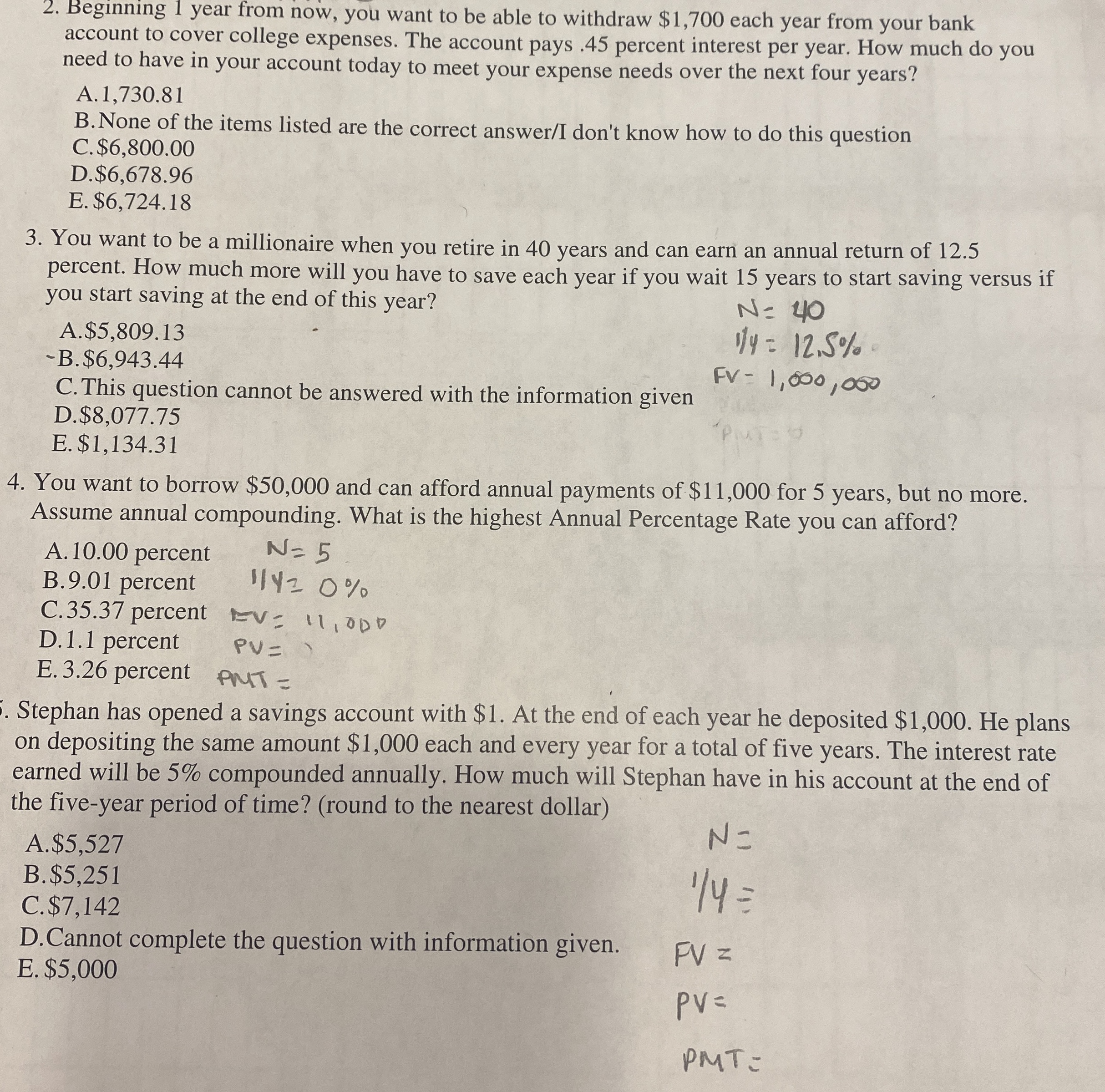

Beginning 1 year from now, you want to be able to withdraw $ 1 , 7 0 0 each year from your bank account to

Beginning year from now, you want to be able to withdraw $ each year from your bank

account to cover college expenses. The account pays percent interest per year. How much do you

need to have in your account today to meet your expense needs over the next four years?

A

B None of the items listed are the correct answerI don't know how to do this question

C $

D $

E $

You want to be a millionaire when you retire in years and can earn an annual return of

percent. How much more will you have to save each year if you wait years to start saving versus if

you start saving at the end of this year?

A $

B $

C This question cannot be answered with the information given

D $

E $

You want to borrow $ and can afford annual payments of $ for years, but no more.

Assume annual compounding. What is the highest Annual Percentage Rate you can afford?

A percent

B percent

C percent

D percent

E percent

Stephan has opened a savings account with $ At the end of each year he deposited $ He plans

on depositing the same amount $ each and every year for a total of five years. The interest rate

earned will be compounded annually. How much will Stephan have in his account at the end of

the fiveyear period of time? round to the nearest dollar

A $

B $

C $

D Cannot complete the question with information given.

E $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started