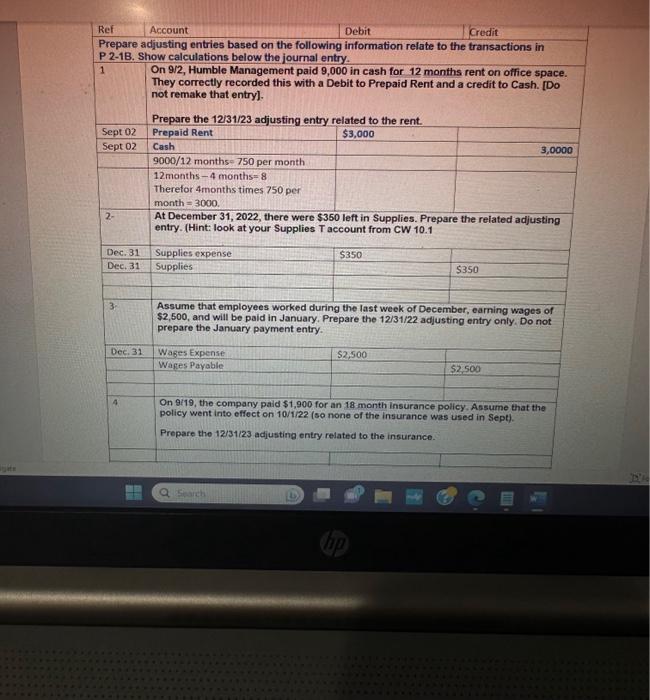

\begin{tabular}{|c|c|c|c|} \hline Ref & Account & Debit & Credit \\ \hline \multicolumn{4}{|c|}{PrepareadjustingentriesbasedonthefollowinginformationrelatetothetransactionsinP21B.Showcalculationsbelowthejournalentry.} \\ \hline 1 & \multicolumn{3}{|c|}{On9/2,HumbleManagementpaid9,000incashfor12monthsrentonoffice5pace.TheycorrectlyrecordedthiswithaDebittoPrepaidRentandacredittoCash.[Donotremakethatentry].Preparethe12/31/23adjustingentryrelatedtotherent.} \\ \hline Sept 02 & Prepaid Rent & $3,000 & \\ \hline \multirow[t]{3}{*}{ Sept 02} & Cash & & 3,0000 \\ \hline & 9000/12 months 750 per month & & \\ \hline & 12months4months=8Therefor4monthstimes750permonth=3000. & & \\ \hline 2. & \multicolumn{3}{|c|}{AtDecember31,2022,therewere$350leftinSupplies.Preparetherelatedadjustingentry.(Hint:lookatyourSuppliesTaccountfromCW10.1} \\ \hline Dec. 31 & Supplies expense & $350 & \\ \hline Dec, 31 & Supplies & & $350 \\ \hline & & & \\ \hline 3. & \multicolumn{3}{|c|}{AssumethatemployeesworkedduringthelastweekofDecember,earningwagesof$2,500,andwillbepaidinJanuary.Preparethe12/31/22adjustingentryonly.DonotpreparetheJanuarypaymententry.} \\ \hline \multirow[t]{2}{*}{ Dec. 31} & Wages Expense & $2,500 & \\ \hline & Wages Payable & & 52.500 \\ \hline & & & \\ \hline 4. & \multicolumn{3}{|c|}{On9/19,thecompanypaid$1,900foran18monthinsurancepolicy.Assumethatthepolicywentintoeffecton10/1/22(sononeoftheinsurancewasusedinSept).Preparethe12/31/23adjustingentryrelatedtotheinsurance.} \\ \hline & & & \\ \hline \end{tabular} 1 On 9/2, Humble Management paid 9,000 in cash for 12 months rent on office space. They correctly recorded this with a Debit to Prepaid Rent and a credit to Cash. [Do not remake that entry]. Prepare the 12/31/23 adjusting entry related to the rent. 2. At December 31,2022 , there were $350 left in Supplies. Prepare the related adjusting entry. (Hint: look at your Supplies T account from CW 10.1 3. Assume that employees worked during the last week of December, earning wages of $2,500, and will be paid in January. Prepare the 12/31/22 adjusting entry only. Do not prepare the January payment entry. 4 On 9/19, the company paid $1,900 for an 18 month insurance policy. Assume that the policy went into effect on 10/1/22 (so none of the insurance was used in Sept). Prepare the 12/31/23 adjusting entry related to the insurance. \begin{tabular}{|c|c|c|c|} \hline Ref & Account & Debit & Credit \\ \hline \multicolumn{4}{|c|}{PrepareadjustingentriesbasedonthefollowinginformationrelatetothetransactionsinP21B.Showcalculationsbelowthejournalentry.} \\ \hline 1 & \multicolumn{3}{|c|}{On9/2,HumbleManagementpaid9,000incashfor12monthsrentonoffice5pace.TheycorrectlyrecordedthiswithaDebittoPrepaidRentandacredittoCash.[Donotremakethatentry].Preparethe12/31/23adjustingentryrelatedtotherent.} \\ \hline Sept 02 & Prepaid Rent & $3,000 & \\ \hline \multirow[t]{3}{*}{ Sept 02} & Cash & & 3,0000 \\ \hline & 9000/12 months 750 per month & & \\ \hline & 12months4months=8Therefor4monthstimes750permonth=3000. & & \\ \hline 2. & \multicolumn{3}{|c|}{AtDecember31,2022,therewere$350leftinSupplies.Preparetherelatedadjustingentry.(Hint:lookatyourSuppliesTaccountfromCW10.1} \\ \hline Dec. 31 & Supplies expense & $350 & \\ \hline Dec, 31 & Supplies & & $350 \\ \hline & & & \\ \hline 3. & \multicolumn{3}{|c|}{AssumethatemployeesworkedduringthelastweekofDecember,earningwagesof$2,500,andwillbepaidinJanuary.Preparethe12/31/22adjustingentryonly.DonotpreparetheJanuarypaymententry.} \\ \hline \multirow[t]{2}{*}{ Dec. 31} & Wages Expense & $2,500 & \\ \hline & Wages Payable & & 52.500 \\ \hline & & & \\ \hline 4. & \multicolumn{3}{|c|}{On9/19,thecompanypaid$1,900foran18monthinsurancepolicy.Assumethatthepolicywentintoeffecton10/1/22(sononeoftheinsurancewasusedinSept).Preparethe12/31/23adjustingentryrelatedtotheinsurance.} \\ \hline & & & \\ \hline \end{tabular} 1 On 9/2, Humble Management paid 9,000 in cash for 12 months rent on office space. They correctly recorded this with a Debit to Prepaid Rent and a credit to Cash. [Do not remake that entry]. Prepare the 12/31/23 adjusting entry related to the rent. 2. At December 31,2022 , there were $350 left in Supplies. Prepare the related adjusting entry. (Hint: look at your Supplies T account from CW 10.1 3. Assume that employees worked during the last week of December, earning wages of $2,500, and will be paid in January. Prepare the 12/31/22 adjusting entry only. Do not prepare the January payment entry. 4 On 9/19, the company paid $1,900 for an 18 month insurance policy. Assume that the policy went into effect on 10/1/22 (so none of the insurance was used in Sept). Prepare the 12/31/23 adjusting entry related to the insurance