Question

Below is an extract from NZ King Salmons 2019 annual report. Record the journal entries for the recognition of any changes in fair value gain

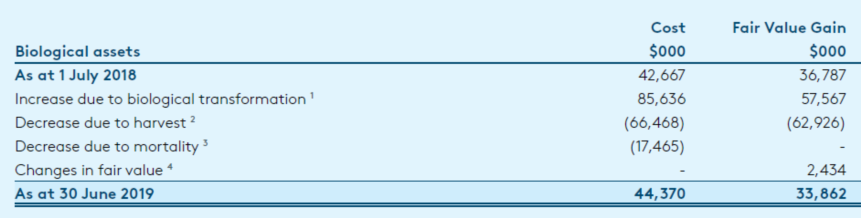

Below is an extract from NZ King Salmons 2019 annual report. Record the journal entries for the recognition of any changes in fair value gain from biological assets for the 2019 financial year. Mortality is expensed directly and does not affect fair value gains or losses.

1. Biological transformation fair value is impacted by volume increases and fish weight at reporting date relative to the target fish harvest weight of 4 kgs (proportional recognition).

2. Harvested fair value is included in cost of goods sold in the statement of comprehensive income and is calculated by multiplying the current years harvest (biomass) by the prior years estimated gross margin per kg (recognised at 100%).

3 .Mortality cost is expensed directly to the statement of comprehensive income in the period which it occurs and is not subject to a fair value uplift.

4 .Changes in fair value are impacted by movements in margin primarily being changes in sales price and costs to sell (fish cost, harvest, processing and freight to market).

Biological assets As at 1 July 2018 Increase due to biological transformation' Decrease due to harvest 2 Decrease due to mortality Changes in fair value * As at 30 June 2019 Cost $000 42,667 85,636 (66,468) (17,465) Fair Value Gain $000 36,787 57,567 (62,926) 2,434 33,862 44,370Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started