Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ben White is 60 and is deaf. His wife, Rose White, is 66 . They provide 100% of the support for Rose's mother who does

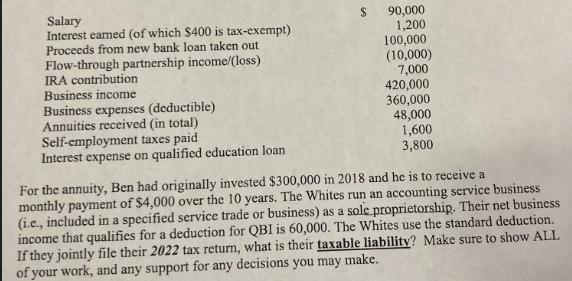

Ben White is 60 and is deaf. His wife, Rose White, is 66 . They provide 100% of the support for Rose's mother who does not live with them and has no income. The Whites present the following information:

Salary Interest earned (of which $400 is tax-exempt) Proceeds from new bank loan taken out Flow-through partnership income/(loss) IRA contribution Business income Business expenses (deductible) Annuities received (in total) Self-employment taxes paid Interest expense on qualified education loan 90,000 1,200 100,000 (10,000) 7,000 420,000 360,000 48,000 1,600 3,800 For the annuity, Ben had originally invested $300,000 in 2018 and he is to receive a monthly payment of $4,000 over the 10 years. The Whites run an accounting service business (i.e., included in a specified service trade or business) as a sole proprietorship. Their net business income that qualifies for a deduction for QBI is 60,000. The Whites use the standard deduction. If they jointly file their 2022 tax return, what is their taxable liability? Make sure to show ALL of your work, and any support for any decisions you may make.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the Whites taxable liability we need to first calculate their total income and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started