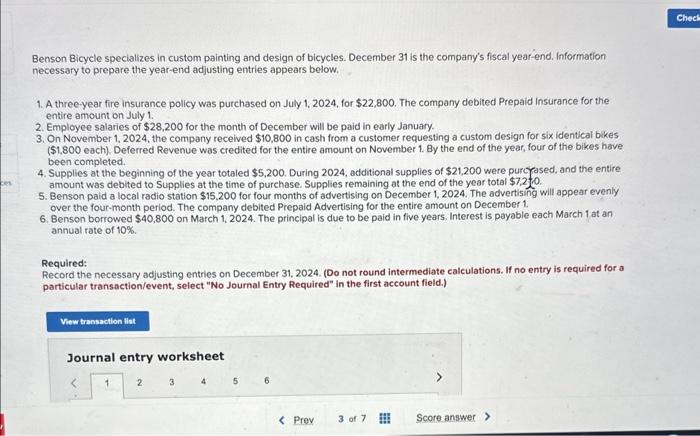

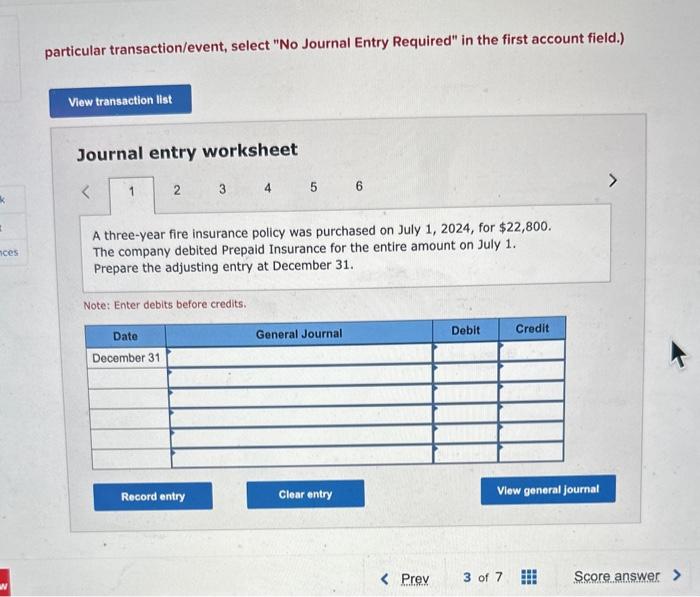

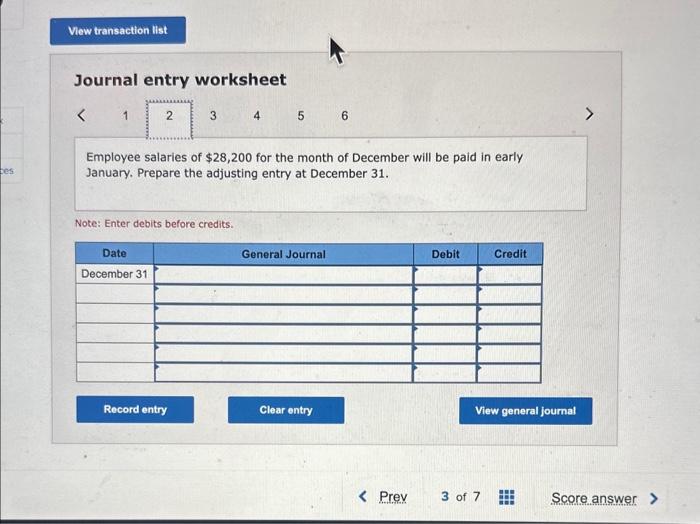

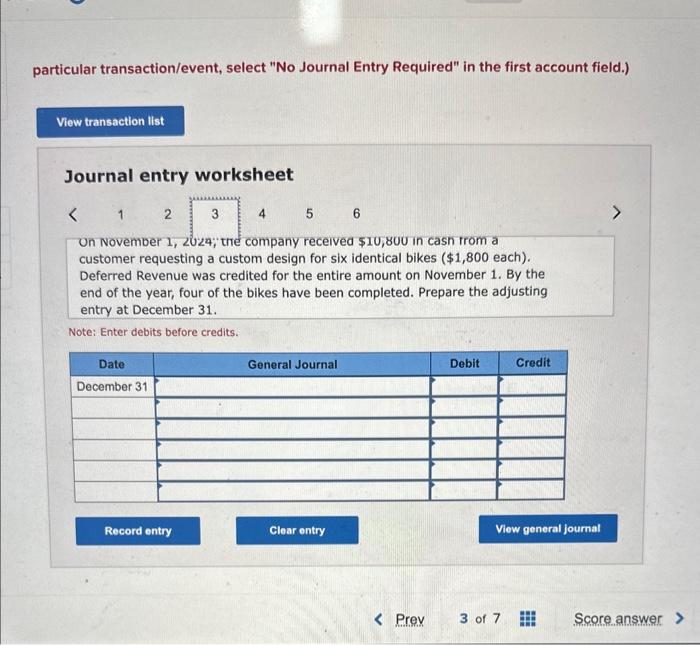

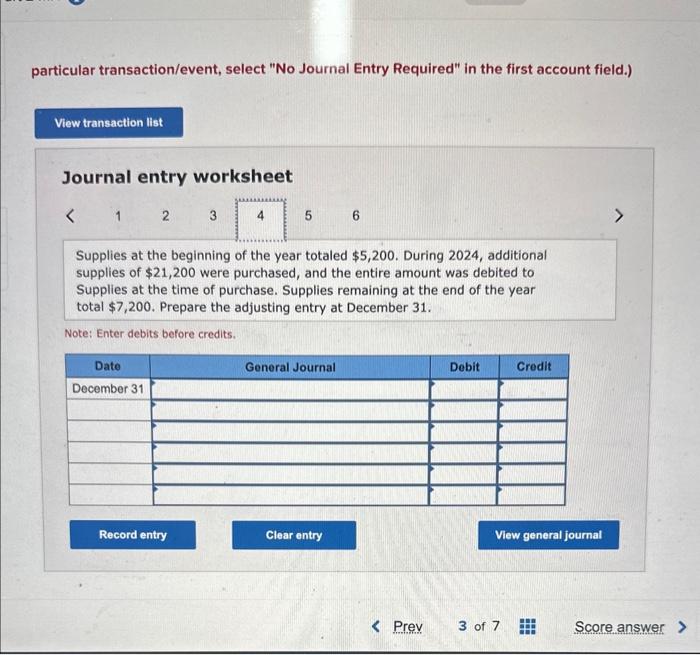

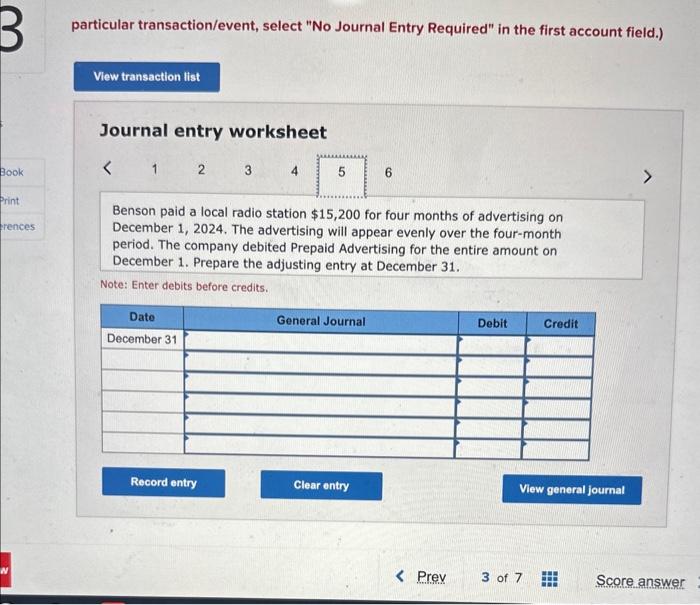

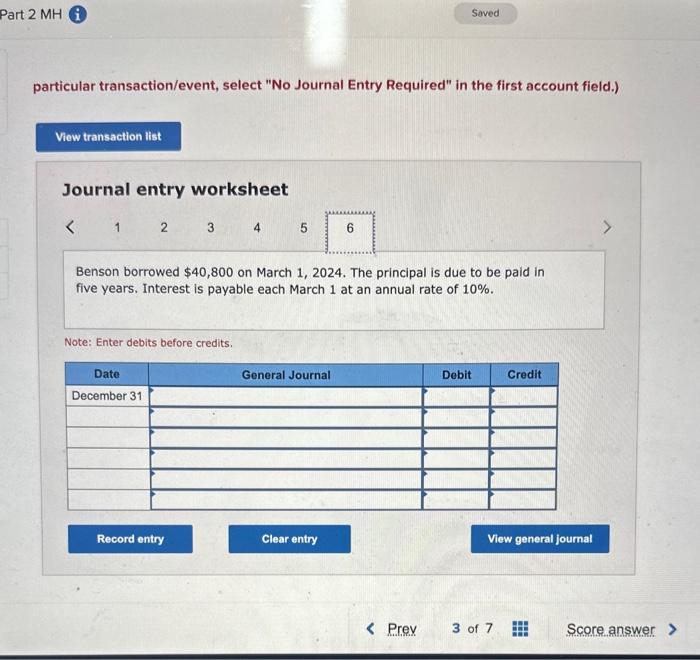

Benson Bicycle specializes in custom painting and design of bicycles. December 31 is the company's fiscal year-end. Information necessary to prepare the year-end adjusting entries appears below. 1. A three-year fire insurance policy was purchased on July 1,2024 , for $22,800. The company debited Prepaid Insurance for the entire amount on July 1. 2. Employee salaries of $28,200 for the month of December will be paid in early January. 3. On November 1, 2024, the company received $10,800 in cash from a customer requesting a custom design for six identical bikes (\$1,800 each). Deferred Revenue was credited for the entire amount on November 1 . By the end of the year, four of the bikes have been completed. 4. Supplies at the beginning of the year totaled $5,200. During 2024, additional supplies of $21,200 were purcyased, and the entire amount was debited to Supplies at the time of purchase. Supplies remaining at the end of the year total $7,2, 5. Benson paid a local radio station $15,200 for four months of advertising on December 1,2024 . The advertising will appear evenly over the four-month period. The company debited Prepaid Advertising for the entire amount on December 1 . 6. Benson borrowed $40,800 on March 1, 2024. The principal is due to be paid in flve years. Interest is payable each March 1 at an annual rate of 10%. Required: Record the necessary adjusting entries on December 31, 2024. (Do not round intermediate caleulations. If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 56 A three-year fire insurance policy was purchased on July 1,2024 , for $22,800. The company debited Prepaid Insurance for the entire amount on July 1. Prepare the adjusting entry at December 31 . Note: Enter debits before credits. Journal entry worksheet Employee salaries of $28,200 for the month of December will be paid in early January. Prepare the adjusting entry at December 31. Note: Enter debits before credits. particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet