Question

Berkeley Co. Berkeley Co. (the Company) is a private company that operates luxury hotel properties. As of December 31, 2010, Berkeley Co. had $432 million

Berkeley Co.

Berkeley Co. (the Company) is a private company that operates luxury hotel properties. As of December 31, 2010, Berkeley Co. had $432 million in uncollateralized term loans (the Original Debt) outstanding with two lenders, Bank A ($129.6 million) and Bank B ($302.4 million). Note that these are not participating loans. Further, issuance costs associated with the Original Debt in the amount of $3 million remained unamortized as of December 31, 2010 ($900,000 and $2.1 million for the loans held by Bank A and Bank B, respectively).

As a result of lower than expected travel during the holiday season, the Company projected a short-term cash flow shortage and would not be able to meet the short-term requirements of the Original Debt. In addition, the Company defaulted on a separate debt instrument with Bank C, which resulted in a cross default on the Original Debt held by Bank A and Bank B. On January 1, 2011,Berkeley Co. restructured and amended the Original Debt (the Restructuring) with Bank A and Bank B. As part of the terms of amending the Original Debt:

The Company sold its 50 percent investment in Resort P in exchange for $250 million, which was used to pay down the loan balance that existed before the amendment. This reduced the Original Debt balance from $432 million to $182 million.

The Company agreed to new interest terms, which included raising the interest rate from 5 percent to 6 percent. The modified interest rate is not considered a below market rate for a debt offering with similar risk.

The Original Debt required annual payments consisting of principal and interest of $16.8 million and $39.2 million to Bank A and Bank B, respectively.

The post-modification debt (the Modified Debt) does not require periodic payments of principal and interest;rather, all principal and interest are due at the maturity date.

The maturity date of the Modified Debt is December 31, 2020, which is the same date as the final payment date of the Original Debt.

Contemporaneously with the modification of the Original Debt terms (explained above), Bank B extended the Company a new $15 million term loan (the New Term Loan), which is due December 31, 2020 (the same due date as the Modified Debt). The New Term Loan has the same interest rate and same payment schedule as the Modified Debt (see above). The New Term Loan was extended to the Company and the proceeds were to be used (1) to pay fees to Bank A and expenses incurred with third parties (accounting legal advisors) in connection with the Restructuring, (2) to pay for a partial principal pay- down of the Original Debt held by Bank A ($5 million), and (3) after payment of the amounts in (1) and (2) for working capital and other general corporate purposes permitted pursuant to the Modified Debt.

The Company made a cash payment of $1 million to Bank A, and in exchange, Bank A waived the default provisions associated with the cross default of the Original Debt. The Company issued equity instruments to Bank B with a fair value of $30 million. In exchange for the equity, Bank B agreed to (1) waive any default penalties associated with the cross default of the Original Debt, (2) enter into the Modified Debt agreement, and

(3) extend the New Term Loan. The issuance of equity did not reduce the principal or interest due under the Original Debt agreement. Rather, the Company issued the equity to Bank B as additional compensation for the overall Restructuring.

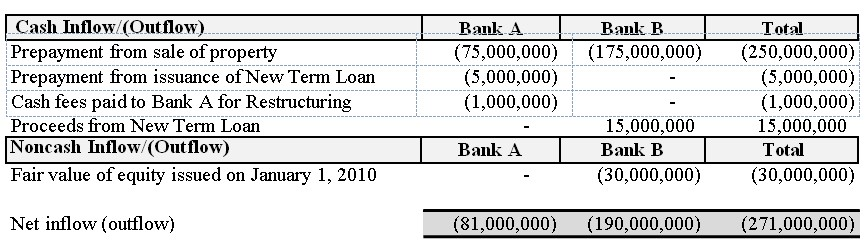

The table below summarizes the total consideration exchanged between the debtor and creditors as part of the

Restructuring on January 1, 2011:

Finally, in exchange for services provided in executing the Restructuring, the Company paid accounting and legal advisors certain fees in the amount of $500,000 ($150,000 allocated to Bank A, and $350,000 allocated to Bank B).

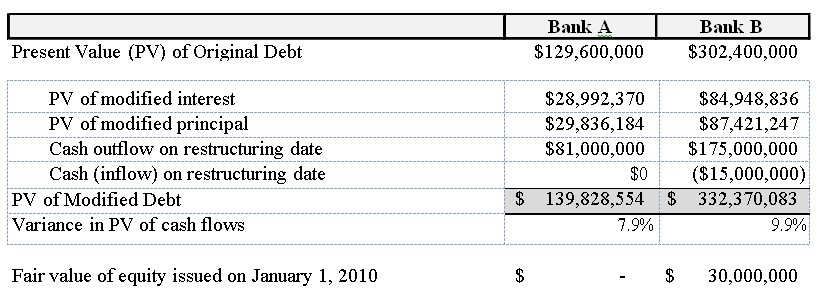

The Company calculated the present value of the cash flows under the terms of the new debt and the remaining cash flows under the original agreement on a creditor-by-creditor basis. Further, the Company used the same discount rate to calculate the present value of the cash flows under the terms of the new debt and the remaining cash flows of the Original Debt, which was equal to the effective interest rate of the Original Debt (approximately 5 percent for both Bank A and Bank B). The present value calculations are shown in the table below:

As noted above, the Company determined that the effective interest rate of the remaining cash flows under the terms of the Original Debt was approximately 5 percent. The Company performed a quantitative analysis of the Modified Debt and determined that the effective interest rate was approximately 6.45 percent and 8.78 percent for the Modified Debt held by Bank A and Bank B, respectively.

Required:

Prepare an accounting issues memorandum that addresses the following research questions (including ASC as proof):

1. Does this transaction represent a troubled debt restructuring?

2. Should Berkeley Co. apply extinguishment accounting to the restructuring of the original debt with Bank A and/or Bank B?

3. How should Berkeley Co. account for the fees paid to the creditors? To third parties?

Cash Inflow/OOutflow) Prepayment from sale of property Prepayment from issuance of New Term Loan Cash fees paid to Bank A for Restructuring Proceeds from New Term Loan Noncash Inflow/Coutflow) Fair value of equity issued on January 1, 2010 Net inflow (outflow) Bank A Bank R Total (75,000,000) (175,000,000) (250,000,000) (5,000,000) (5,000,000) (1,000,000) (1,000,000) 15,000,000 15,000,000 Bank A Bank B Total (30,000,000) (30,000,000) (81,000,000) (190,000,000) (271,000,000)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started