Question

Berkshire Inc. uses a periodic inventory system. At the end of 2020, it missed counting some inventory items, resulting in an inventory understatement by

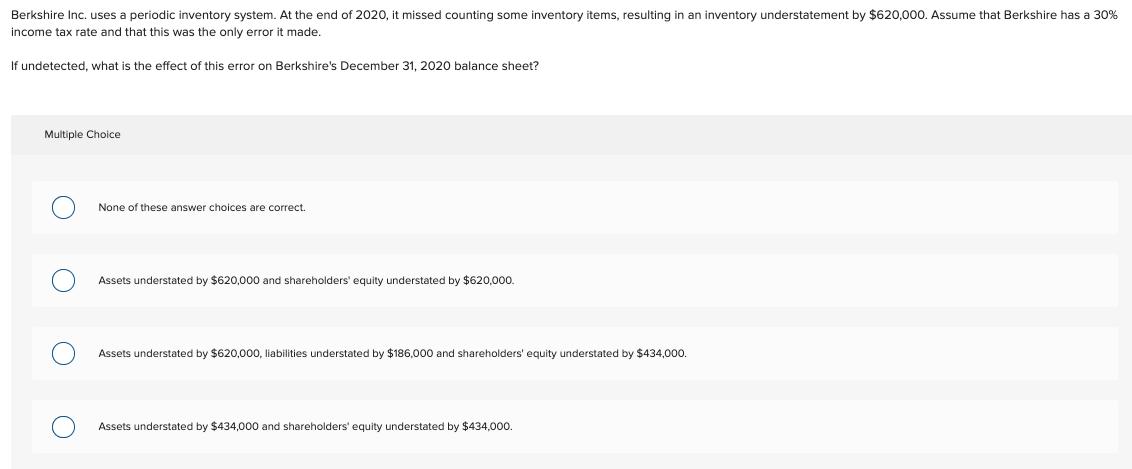

Berkshire Inc. uses a periodic inventory system. At the end of 2020, it missed counting some inventory items, resulting in an inventory understatement by $620,000. Assume that Berkshire has a 30% income tax rate and that this was the only error it made. If undetected, what is the effect of this error on Berkshire's December 31, 2020 balance sheet? Multiple Choice None of these answer choices are correct. Assets understated by $620,000 and shareholders' equity understated by $620,000. Assets understated by $620,000, liabilities understated by $186,000 and shareholders' equity understated by $434,000. Assets understated by $434,000 and shareholders' equity understated by $434,000.

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Assets understated by 620000 liabilities ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: David Spiceland, James Sepe, Mark Nelson, Wayne Thomas

8th edition

978-1259997525, 1259997529, 978-1259548185

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App