Question

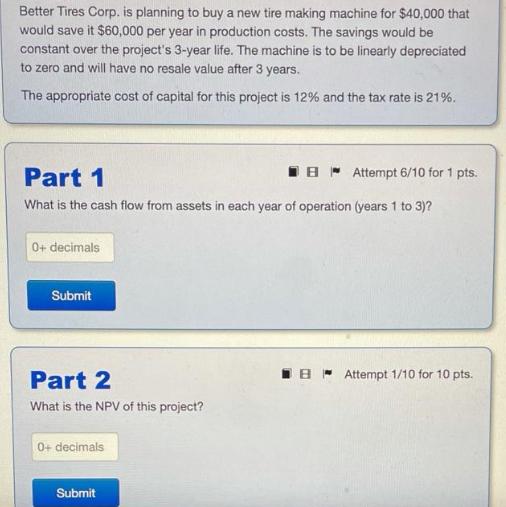

Better Tires Corp. is planning to buy a new tire making machine for $40,000 that would save it $60,000 per year in production costs.

Better Tires Corp. is planning to buy a new tire making machine for $40,000 that would save it $60,000 per year in production costs. The savings would be constant over the project's 3-year life. The machine is to be linearly depreciated to zero and will have no resale value after 3 years. The appropriate cost of capital for this project is 12% and the tax rate is 21%. Part 1 IB - Attempt 6/10 for 1 pts. What is the cash flow from assets in each year of operation (years 1 to 3)? 0+ decimals Submit I B - Atempt 1/10 for 10 pts. Part 2 What is the NPV of this project? 0+ decimals Submit

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

C D E F 1 3 Particular Year 1 Year 2 Year 3 4 Savings in Prod...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Spreadsheet Modeling And Decision Analysis A Practical Introduction To Management Science

Authors: Cliff T. Ragsdale

5th Edition

324656645, 324656637, 9780324656640, 978-0324656633

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App