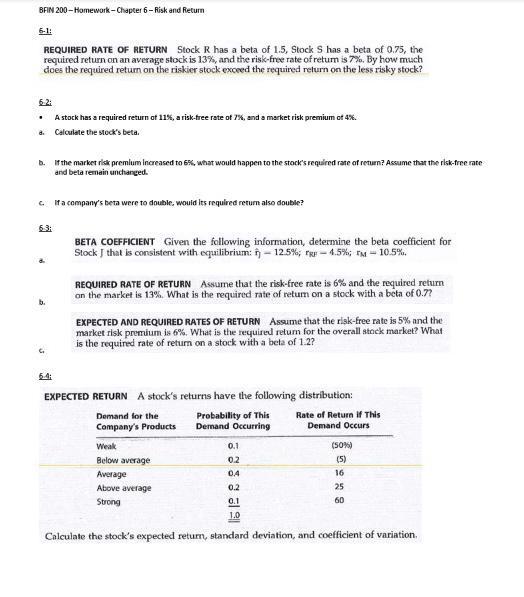

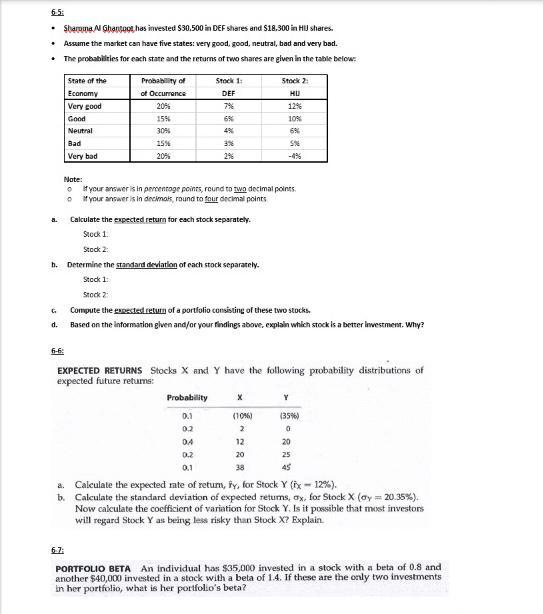

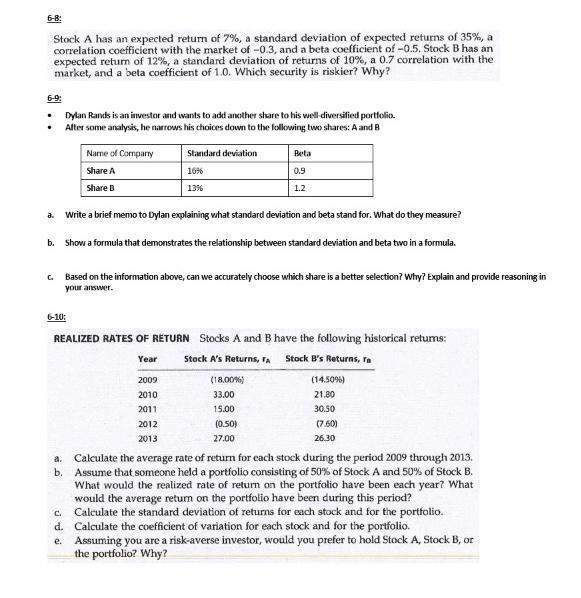

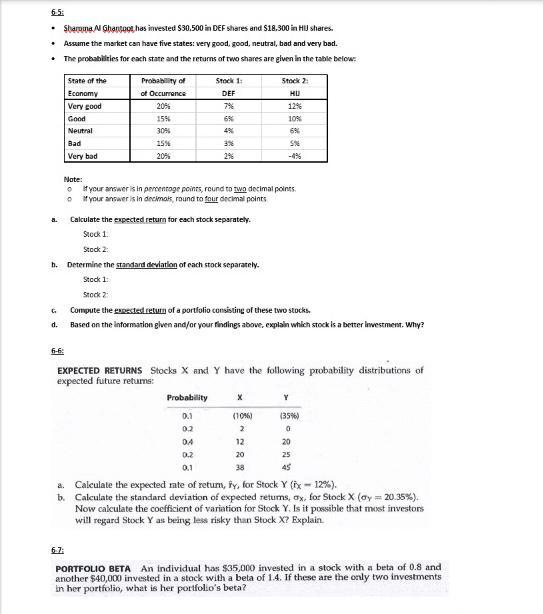

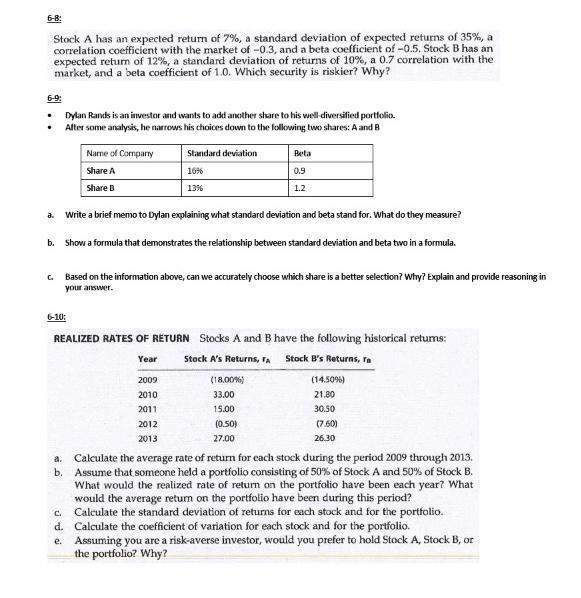

BFIN 200-Homework - Chapter 6 - Risk and Return 6-1: REQUIRED RATE OF RETURN Stock R has a beta of 1.5, Stock S has a beta of 0.75, the required return on an average stock is 13%, and the risk-free rate of retum is 7%. By how much does the required return on the riskier stock exceed the required return on the less risky stock? 6.2: Astock has a required return at 11%, a risk-free rate of 7%and a market risk premium of 4%. d. Calculate the Mock's beta . If the market risk premium Increased to 6%, what would happen to the stock's required rate of return? Assume that the risk-free rate and beta remain unchanged. la company's beta were to double woulid Its required retum also double? BETA COEFFICIENT Given the following information, determine the beta coefficient for Stock that is consistent with equilibrium: 11 - 12.5%; TR - 4.5%; t = 10.5%. b. REQUIRED RATE OF RETURN Assume that the risk-free rate is 6% and the required return on the market is 13% What is the required rate of retum on a stock with a bta of 0.72 EXPECTED AND REQUIRED RATES OF RETURN Assume that the risk-free rate is 5% and the market risk premium is 6%. What is the required return for the overall stock market? What is the required rate of return on a stock with a bete of 1.2? 6.4 EXPECTED RETURN A stock's returns have the following distribution: Demand for the Probability of this Rate of Return of This Company's Products Demand Occurring Demand Occurs Weak 0.1 (50% Below average 0.2 (5) Average 0.4 16 Above average 0.2 25 Strong 0.1 60 1.0 Calculate the stock's expected return, standard deviation, and coefficient of variation Sharona N Ghantoot has invested $30,500 in DEF shares and $18.300 in HI shares. Assume the market can have five states: very good, good, neutral, bad and very bad. The probabilities for each state and the returns of two shares are given in the table below: State of the Economy Very good Good Neutral Bad Very bad Probability of of Occurrence 205 1556 30% 1556 Stock 1: DEF 7% 6% 49 3% 296 Stock 2: HU 129 10% 69 SX Note: of your answer is in percentage points, round to wo decimal points If your answer is in decimal round to four decimal points Calculate the expected return for each stock separately. Stock 1. Stock 2: h. Determine the standard deviation of cach stock separately. Stock 1: Stock 2: Compute the restes return of a portfolio consisting of these two stocks. d. Based on the information given and/or your findings above, explain which stock is a better investment. Why? EXPECTED RETURNS Stocks X and Y have the following probability distributions of expected future retums: Probability Y (104) (35%) 0.1 02 DA 0.2 0.1 2 12 0 20 25 45 20 a. Calculate the expected rate of return, ty, for Stock Y (ix - 12%). b. Calculate the standard deviation of expected retums, ox, for Stock X (oy = 20.35%). Now calculate the coefficient of variation for Stock Y. Is it possible that most investors will regard Stock Y as being less risky than Stock X? Explain PORTFOLIO BETA An Individual has $35,000 invested in a stock with a beta of 0.8 and another $40,000 invested in a stock with a beta of 1.4. If these are the only two investments in her portfolio, what is her portfolio's beta? 6-8: Stock A has an expected return of 7%, a standard deviation of expected returns of 35%, a correlation coefficient with the market of -0.3, and a beta coefficient of -0.5. Stock Bhas an expected return of 12%, a standard deviation of returns of 10%, a 0.7 correlation with the market, and a beta coefficient of 1.0. Which security is riskier? Why? 6-9: Dylan Rands is an investor and wants to add another share to his well diversified portfolio Alter some analysis, he narrows his choices down to the following two shares: A and B Name of Company Standard deviation Beta Share 16% 0.9 Share B 1396 1.2 a. Write a brief memo to Dylan explaining what standard deviation and beta stand for. What do they measure? b. show a formula that demonstrates the relationship between standard deviation and beta tuwo in a formula. C Based on the information above, can we accurately choose which share is a better selection? Why? Explain and provide reasoning in your answer. 6-10: REALIZED RATES OF RETURN Stocks A and B have the following historical retums: Stock A's Returns, A Stock B's Returns, Year 2009 2010 2011 2012 2013 (18,00%) 33.00 15.00 (0.50) 27.00 (14.5096) 21.30 30.50 (7.60) 26.30 a. Calculate the average rate of return for each stock during the period 2009 through 2013. b. Assume that someone held a portfolio consisting of 50% of Stock A and 50% of Stock B. What would the realized rate of return on the portfolio have been each year? What would the average return on the portfolio have been during this period? c. Calculate the standard deviation of returns for each stock and for the portfolio d. Calculate the coefficient of variation for each stock and for the portfolio e. Assuming you are a risk-averse investor, would you prefer to hold Stock A, Stock B, or the portfolio? Why