Question

BGRI Incorporated is a U.S. based clothing manufacturing who acquired 100 percent interest in Dingo's Dots Corporation an Australian manufacturer and supplier of fine linens

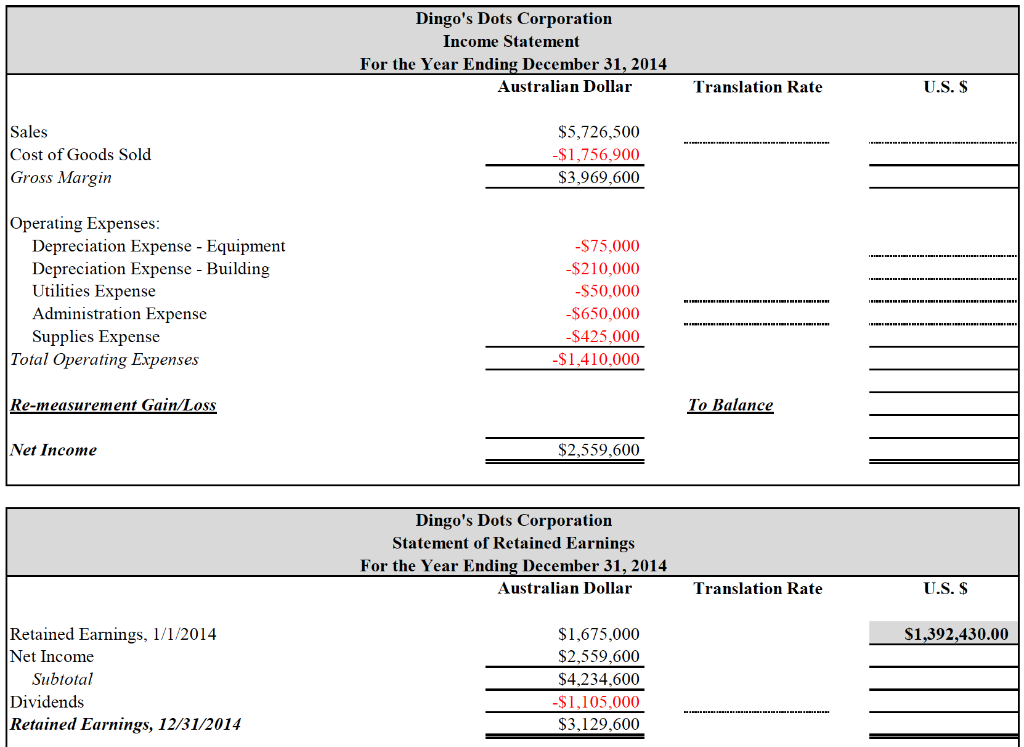

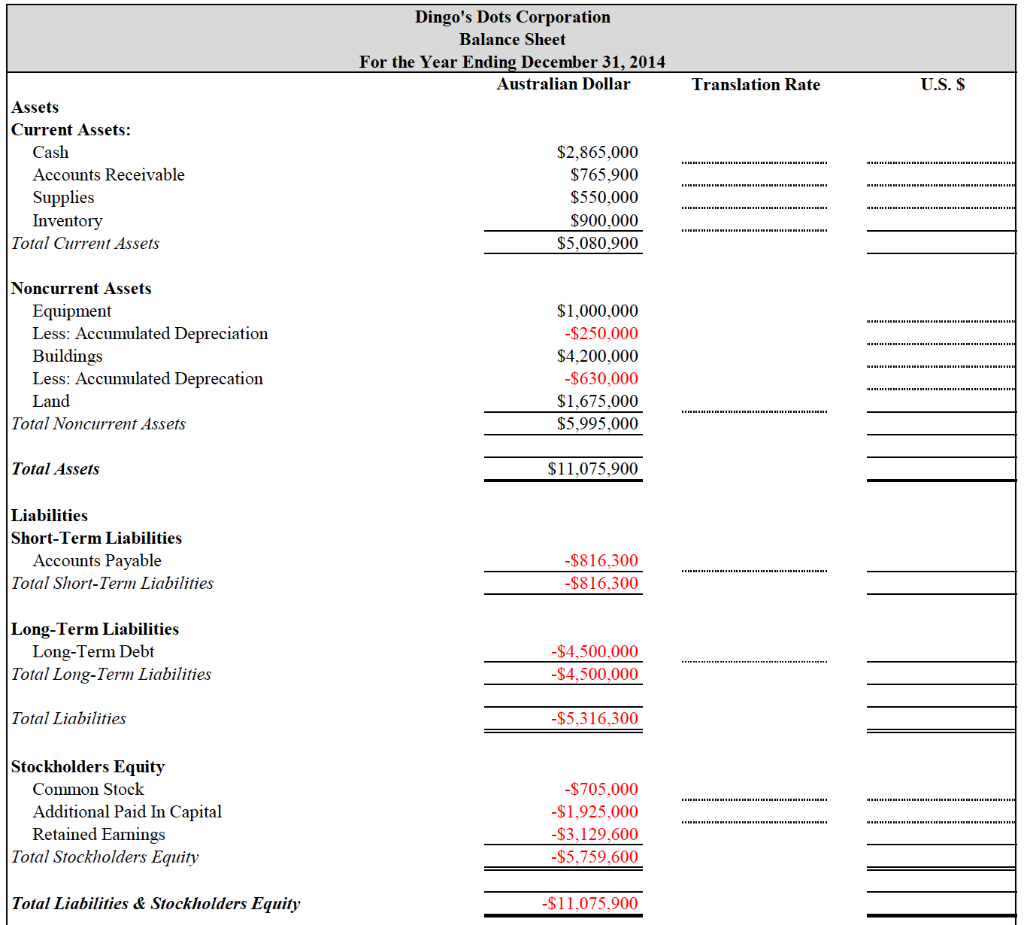

BGRI Incorporated is a U.S. based clothing manufacturing who acquired 100 percent interest in Dingo's Dots Corporation an Australian manufacturer and supplier of fine linens back on December 31, 2012. During that time the exchange rate for the Australian Dollar (AUD) was $0.90. Dingo's Dots financial statements as of December 31, 2014, two years later are given below.

The January 1, 2014 beginning Supplies on hand of $300,000(AUD) was acquired on November 20, 2013 when the exchange rate was $0.93. Purchase of Supplies were acquired uniformly during 2014. The December 31, 2014 Supplies on hand of $550,000(AUD) was acquired in the latter part of 2014 when the exchange rate was $0.76.

The January 1, 2014 beginning Inventory of $500,000(AUD) was acquired on December 1, 2013 when the exchange rate was $0.94. Purchase of inventory were acquired uniformly during 2014. The December 31, 2014, ending inventory of $900,000(AUD) was acquired in the latter part of 2014 when the exchange rate was $0.76.

All fixed Assets were on the books when the subsidiary was acquired except for the following:

|

| Acquisition Price | Acquisition Date | Exchange Rate on Date of Transaction | Straight-Line Depreciation Depreciable Life | First Year of Depreciation |

| Equipment | $200,000(AUD) | June 30, 2013 | $0.92 | 10 | Half Year |

| Building | $950,000(AUD) | January 5, 2013 | $0.89 | 25 | Full Year |

Dividends were declared and paid on November 15, 2014 when the exchange rate was $0.77.

Other exchange rates for $1 AUD follow:

| January 1, 2014 | $0.95 |

| January 1-December 31, 2014 Average | $0.85 |

| December 31, 2014 | $0.75 |

The U.S. Dollar is the functional Currency.

A.) Calculate December 31, 2014 re-measurement balance for supplies expense and cost of goods sold using the information given.

B.) Calculate December 31, 2014 re-measurement balances for fixed assets, depreciation and accumulated depreciation for the fixed assets identified using the information given.

C.) Calculate December 31, 2014 re-measurement gain/loss using the information given. The Net Monetary Liabilities at 1/1/14 is $2,775,000.

D.) Translate Dingo's Dots Corp Australian Dollar Financial Statements in the templates below at December 31, 2014 using the information provided.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started