Answered step by step

Verified Expert Solution

Question

1 Approved Answer

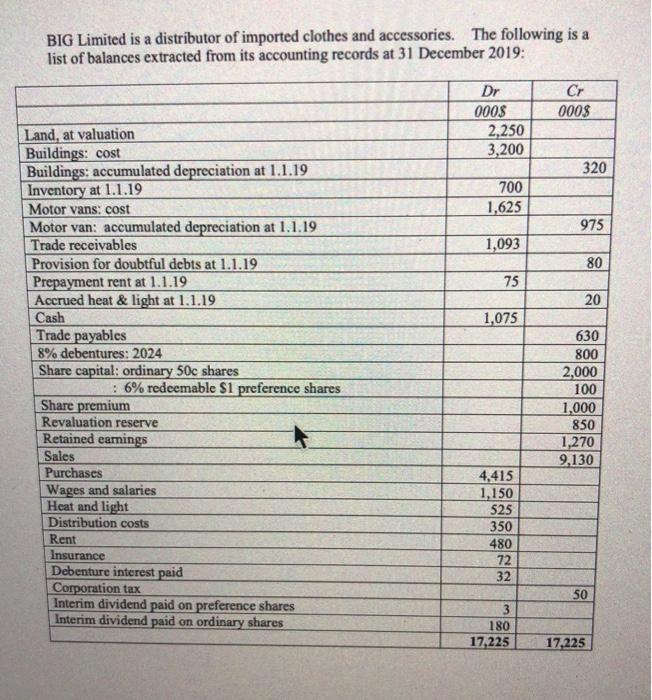

BIG Limited is a distributor of imported clothes and accessories. The following is a list of balances extracted from its accounting records at 31 December

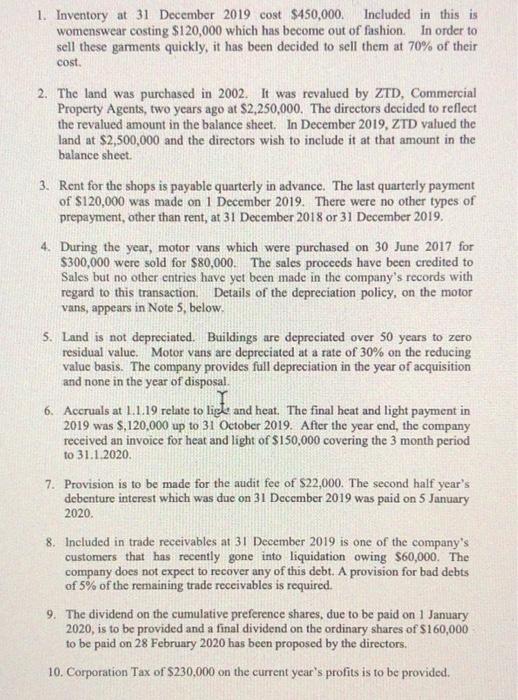

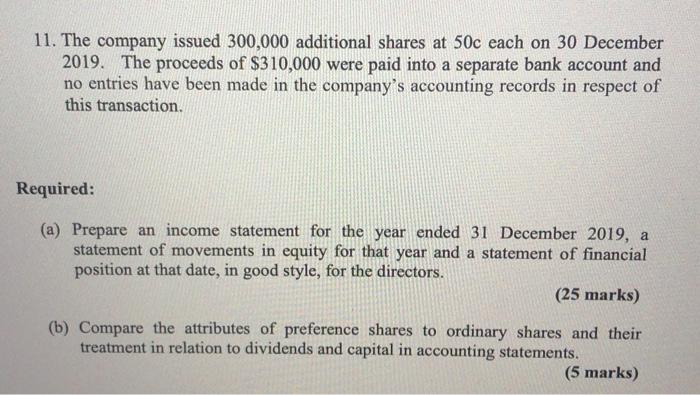

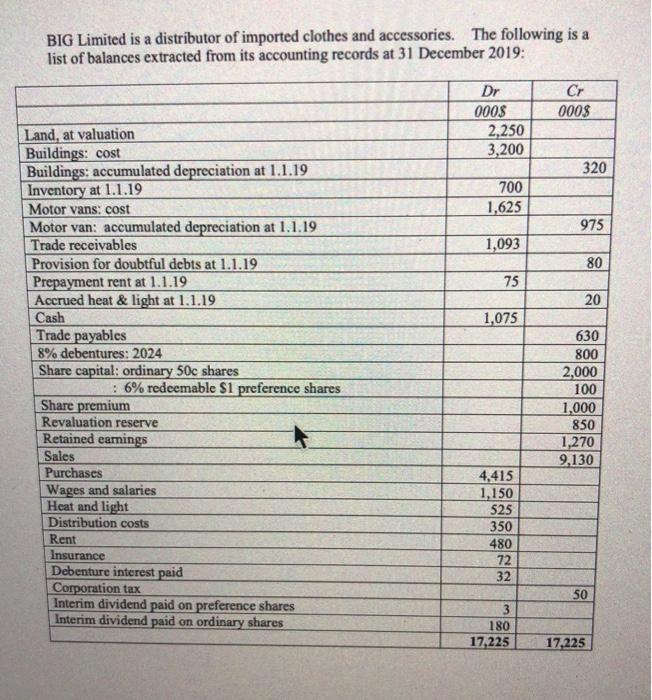

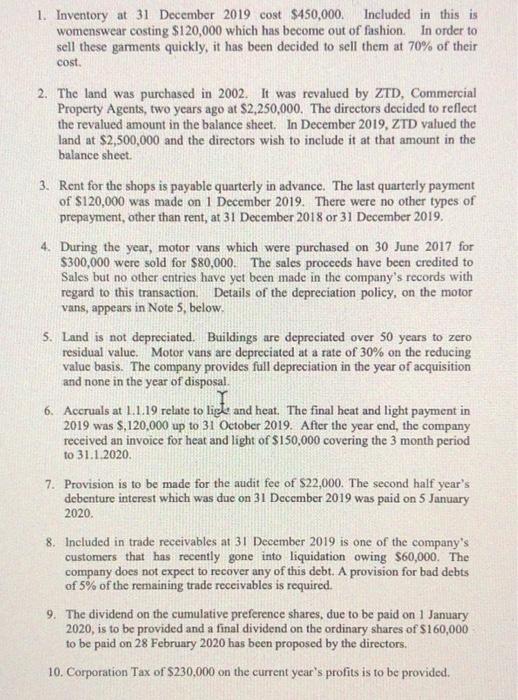

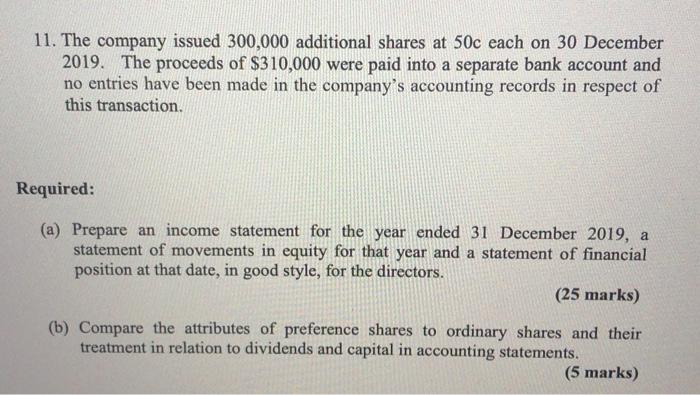

BIG Limited is a distributor of imported clothes and accessories. The following is a list of balances extracted from its accounting records at 31 December 2019: Cr 000$ Dr 000$ 2,250 3,200 320 700 1,625 975 1,093 80 75 20 1,075 Land, at valuation Buildings: cost Buildings: accumulated depreciation at 1.1.19 Inventory at 1.1.19 Motor vans: cost Motor van: accumulated depreciation at 1.1.19 Trade receivables Provision for doubtful debts at 1.1.19 Prepayment rent at 1.1.19 Accrued heat & light at 1.1.19 Cash Trade payables 8% debentures: 2024 Share capital: ordinary 50c shares : 6% redeemable S1 preference shares Share premium Revaluation reserve Retained earnings Sales Purchases Wages and salaries Heat and light Distribution costs Rent Insurance Debenture interest paid Corporation tax Interim dividend paid on preference shares Interim dividend paid on ordinary shares 630 800 2,000 100 1,000 850 1,270 9,130 4,415 1,150 525 350 480 72 32 50 3 180 17,225 17,225 1. Inventory at 31 December 2019 cost $450,000 Included in this is womenswear costing $120,000 which has become out of fashion. In order to sell these garments quickly, it has been decided to sell them at 70% of their cost. 2. The land was purchased in 2002. It was revalued by ZTD, Commercial Property Agents, two years ago at $2,250,000. The directors decided to reflect the revalued amount in the balance sheet. In December 2019, ZTD valued the land at $2,500,000 and the directors wish to include it at that amount in the balance sheet. 3. Rent for the shops is payable quarterly in advance. The last quarterly payment of $120,000 was made on 1 December 2019. There were no other types of prepayment, other than rent, at 31 December 2018 or 31 December 2019. 4. During the year, motor vans which were purchased on 30 June 2017 for $300,000 were sold for $80,000. The sales proceeds have been credited to Sales but no other entries have yet been made in the company's records with regard to this transaction. Details of the depreciation policy, on the motor vans, appears in Note 5, below. 5. Land is not depreciated. Buildings are depreciated over 50 years to zero residual value. Motor vans are depreciated at a rate of 30% on the reducing value basis. The company provides full depreciation in the year of acquisition and none in the year of disposal. 6. Accruals at 1.1.19 relate to ligte and heat. The final heat and light payment in 2019 was $120,000 up to 31 October 2019. After the year end, the company received an invoice for heat and light of $150,000 covering the 3 month period to 31.1.2020. 7. Provision is to be made for the audit fee of $22,000. The second half year's debenture interest which was due on 31 December 2019 was paid on 5 January 2020. 8. Included in trade receivables at 31 December 2019 is one of the company's customers that has recently gone into liquidation owing $60,000. The company does not expect to recover any of this debt. A provision for bad debts of 5% of the remaining trade receivables is required. 9. The dividend on the cumulative preference shares, due to be paid on 1 January 2020, is to be provided and a final dividend on the ordinary shares of $160,000 to be paid on 28 February 2020 has been proposed by the directors. 10. Corporation Tax of $230,000 on the current year's profits is to be provided. 11. The company issued 300,000 additional shares at 50c each on 30 December 2019. The proceeds of $310,000 were paid into a separate bank account and no entries have been made in the company's accounting records in respect of this transaction. Required: (a) Prepare income statement for the year ended 31 December 2019, a statement of movements in equity for that year and a statement of financial position at that date, in good style, for the directors. (25 marks) (b) Compare the attributes of preference shares to ordinary shares and their treatment in relation to dividends and capital in accounting statements. (5 marks) BIG Limited is a distributor of imported clothes and accessories. The following is a list of balances extracted from its accounting records at 31 December 2019: Cr 000$ Dr 000$ 2,250 3,200 320 700 1,625 975 1,093 80 75 20 1,075 Land, at valuation Buildings: cost Buildings: accumulated depreciation at 1.1.19 Inventory at 1.1.19 Motor vans: cost Motor van: accumulated depreciation at 1.1.19 Trade receivables Provision for doubtful debts at 1.1.19 Prepayment rent at 1.1.19 Accrued heat & light at 1.1.19 Cash Trade payables 8% debentures: 2024 Share capital: ordinary 50c shares : 6% redeemable S1 preference shares Share premium Revaluation reserve Retained earnings Sales Purchases Wages and salaries Heat and light Distribution costs Rent Insurance Debenture interest paid Corporation tax Interim dividend paid on preference shares Interim dividend paid on ordinary shares 630 800 2,000 100 1,000 850 1,270 9,130 4,415 1,150 525 350 480 72 32 50 3 180 17,225 17,225 1. Inventory at 31 December 2019 cost $450,000 Included in this is womenswear costing $120,000 which has become out of fashion. In order to sell these garments quickly, it has been decided to sell them at 70% of their cost. 2. The land was purchased in 2002. It was revalued by ZTD, Commercial Property Agents, two years ago at $2,250,000. The directors decided to reflect the revalued amount in the balance sheet. In December 2019, ZTD valued the land at $2,500,000 and the directors wish to include it at that amount in the balance sheet. 3. Rent for the shops is payable quarterly in advance. The last quarterly payment of $120,000 was made on 1 December 2019. There were no other types of prepayment, other than rent, at 31 December 2018 or 31 December 2019. 4. During the year, motor vans which were purchased on 30 June 2017 for $300,000 were sold for $80,000. The sales proceeds have been credited to Sales but no other entries have yet been made in the company's records with regard to this transaction. Details of the depreciation policy, on the motor vans, appears in Note 5, below. 5. Land is not depreciated. Buildings are depreciated over 50 years to zero residual value. Motor vans are depreciated at a rate of 30% on the reducing value basis. The company provides full depreciation in the year of acquisition and none in the year of disposal. 6. Accruals at 1.1.19 relate to ligte and heat. The final heat and light payment in 2019 was $120,000 up to 31 October 2019. After the year end, the company received an invoice for heat and light of $150,000 covering the 3 month period to 31.1.2020. 7. Provision is to be made for the audit fee of $22,000. The second half year's debenture interest which was due on 31 December 2019 was paid on 5 January 2020. 8. Included in trade receivables at 31 December 2019 is one of the company's customers that has recently gone into liquidation owing $60,000. The company does not expect to recover any of this debt. A provision for bad debts of 5% of the remaining trade receivables is required. 9. The dividend on the cumulative preference shares, due to be paid on 1 January 2020, is to be provided and a final dividend on the ordinary shares of $160,000 to be paid on 28 February 2020 has been proposed by the directors. 10. Corporation Tax of $230,000 on the current year's profits is to be provided. 11. The company issued 300,000 additional shares at 50c each on 30 December 2019. The proceeds of $310,000 were paid into a separate bank account and no entries have been made in the company's accounting records in respect of this transaction. Required: (a) Prepare income statement for the year ended 31 December 2019, a statement of movements in equity for that year and a statement of financial position at that date, in good style, for the directors. (25 marks) (b) Compare the attributes of preference shares to ordinary shares and their treatment in relation to dividends and capital in accounting statements

BIG Limited is a distributor of imported clothes and accessories. The following is a list of balances extracted from its accounting records at 31 December 2019: Cr 000$ Dr 000$ 2,250 3,200 320 700 1,625 975 1,093 80 75 20 1,075 Land, at valuation Buildings: cost Buildings: accumulated depreciation at 1.1.19 Inventory at 1.1.19 Motor vans: cost Motor van: accumulated depreciation at 1.1.19 Trade receivables Provision for doubtful debts at 1.1.19 Prepayment rent at 1.1.19 Accrued heat & light at 1.1.19 Cash Trade payables 8% debentures: 2024 Share capital: ordinary 50c shares : 6% redeemable S1 preference shares Share premium Revaluation reserve Retained earnings Sales Purchases Wages and salaries Heat and light Distribution costs Rent Insurance Debenture interest paid Corporation tax Interim dividend paid on preference shares Interim dividend paid on ordinary shares 630 800 2,000 100 1,000 850 1,270 9,130 4,415 1,150 525 350 480 72 32 50 3 180 17,225 17,225 1. Inventory at 31 December 2019 cost $450,000 Included in this is womenswear costing $120,000 which has become out of fashion. In order to sell these garments quickly, it has been decided to sell them at 70% of their cost. 2. The land was purchased in 2002. It was revalued by ZTD, Commercial Property Agents, two years ago at $2,250,000. The directors decided to reflect the revalued amount in the balance sheet. In December 2019, ZTD valued the land at $2,500,000 and the directors wish to include it at that amount in the balance sheet. 3. Rent for the shops is payable quarterly in advance. The last quarterly payment of $120,000 was made on 1 December 2019. There were no other types of prepayment, other than rent, at 31 December 2018 or 31 December 2019. 4. During the year, motor vans which were purchased on 30 June 2017 for $300,000 were sold for $80,000. The sales proceeds have been credited to Sales but no other entries have yet been made in the company's records with regard to this transaction. Details of the depreciation policy, on the motor vans, appears in Note 5, below. 5. Land is not depreciated. Buildings are depreciated over 50 years to zero residual value. Motor vans are depreciated at a rate of 30% on the reducing value basis. The company provides full depreciation in the year of acquisition and none in the year of disposal. 6. Accruals at 1.1.19 relate to ligte and heat. The final heat and light payment in 2019 was $120,000 up to 31 October 2019. After the year end, the company received an invoice for heat and light of $150,000 covering the 3 month period to 31.1.2020. 7. Provision is to be made for the audit fee of $22,000. The second half year's debenture interest which was due on 31 December 2019 was paid on 5 January 2020. 8. Included in trade receivables at 31 December 2019 is one of the company's customers that has recently gone into liquidation owing $60,000. The company does not expect to recover any of this debt. A provision for bad debts of 5% of the remaining trade receivables is required. 9. The dividend on the cumulative preference shares, due to be paid on 1 January 2020, is to be provided and a final dividend on the ordinary shares of $160,000 to be paid on 28 February 2020 has been proposed by the directors. 10. Corporation Tax of $230,000 on the current year's profits is to be provided. 11. The company issued 300,000 additional shares at 50c each on 30 December 2019. The proceeds of $310,000 were paid into a separate bank account and no entries have been made in the company's accounting records in respect of this transaction. Required: (a) Prepare income statement for the year ended 31 December 2019, a statement of movements in equity for that year and a statement of financial position at that date, in good style, for the directors. (25 marks) (b) Compare the attributes of preference shares to ordinary shares and their treatment in relation to dividends and capital in accounting statements. (5 marks) BIG Limited is a distributor of imported clothes and accessories. The following is a list of balances extracted from its accounting records at 31 December 2019: Cr 000$ Dr 000$ 2,250 3,200 320 700 1,625 975 1,093 80 75 20 1,075 Land, at valuation Buildings: cost Buildings: accumulated depreciation at 1.1.19 Inventory at 1.1.19 Motor vans: cost Motor van: accumulated depreciation at 1.1.19 Trade receivables Provision for doubtful debts at 1.1.19 Prepayment rent at 1.1.19 Accrued heat & light at 1.1.19 Cash Trade payables 8% debentures: 2024 Share capital: ordinary 50c shares : 6% redeemable S1 preference shares Share premium Revaluation reserve Retained earnings Sales Purchases Wages and salaries Heat and light Distribution costs Rent Insurance Debenture interest paid Corporation tax Interim dividend paid on preference shares Interim dividend paid on ordinary shares 630 800 2,000 100 1,000 850 1,270 9,130 4,415 1,150 525 350 480 72 32 50 3 180 17,225 17,225 1. Inventory at 31 December 2019 cost $450,000 Included in this is womenswear costing $120,000 which has become out of fashion. In order to sell these garments quickly, it has been decided to sell them at 70% of their cost. 2. The land was purchased in 2002. It was revalued by ZTD, Commercial Property Agents, two years ago at $2,250,000. The directors decided to reflect the revalued amount in the balance sheet. In December 2019, ZTD valued the land at $2,500,000 and the directors wish to include it at that amount in the balance sheet. 3. Rent for the shops is payable quarterly in advance. The last quarterly payment of $120,000 was made on 1 December 2019. There were no other types of prepayment, other than rent, at 31 December 2018 or 31 December 2019. 4. During the year, motor vans which were purchased on 30 June 2017 for $300,000 were sold for $80,000. The sales proceeds have been credited to Sales but no other entries have yet been made in the company's records with regard to this transaction. Details of the depreciation policy, on the motor vans, appears in Note 5, below. 5. Land is not depreciated. Buildings are depreciated over 50 years to zero residual value. Motor vans are depreciated at a rate of 30% on the reducing value basis. The company provides full depreciation in the year of acquisition and none in the year of disposal. 6. Accruals at 1.1.19 relate to ligte and heat. The final heat and light payment in 2019 was $120,000 up to 31 October 2019. After the year end, the company received an invoice for heat and light of $150,000 covering the 3 month period to 31.1.2020. 7. Provision is to be made for the audit fee of $22,000. The second half year's debenture interest which was due on 31 December 2019 was paid on 5 January 2020. 8. Included in trade receivables at 31 December 2019 is one of the company's customers that has recently gone into liquidation owing $60,000. The company does not expect to recover any of this debt. A provision for bad debts of 5% of the remaining trade receivables is required. 9. The dividend on the cumulative preference shares, due to be paid on 1 January 2020, is to be provided and a final dividend on the ordinary shares of $160,000 to be paid on 28 February 2020 has been proposed by the directors. 10. Corporation Tax of $230,000 on the current year's profits is to be provided. 11. The company issued 300,000 additional shares at 50c each on 30 December 2019. The proceeds of $310,000 were paid into a separate bank account and no entries have been made in the company's accounting records in respect of this transaction. Required: (a) Prepare income statement for the year ended 31 December 2019, a statement of movements in equity for that year and a statement of financial position at that date, in good style, for the directors. (25 marks) (b) Compare the attributes of preference shares to ordinary shares and their treatment in relation to dividends and capital in accounting statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started