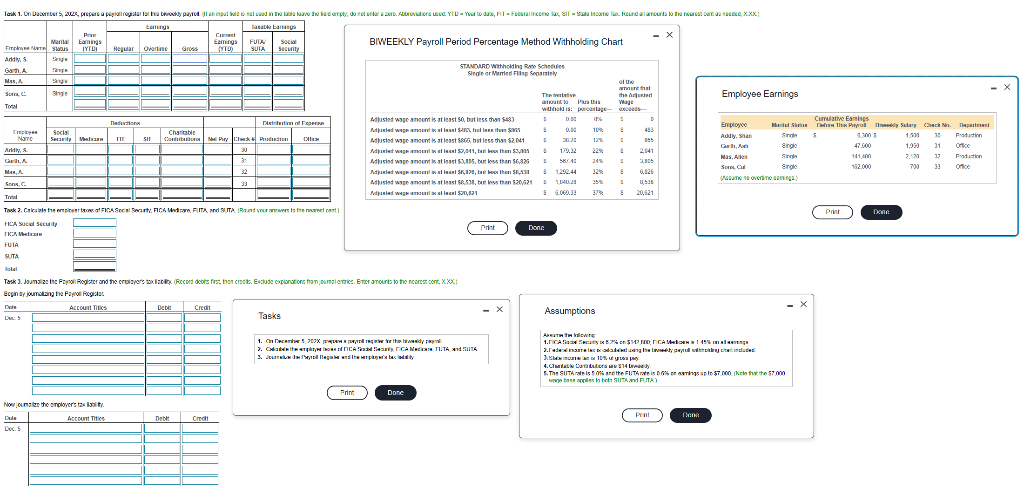

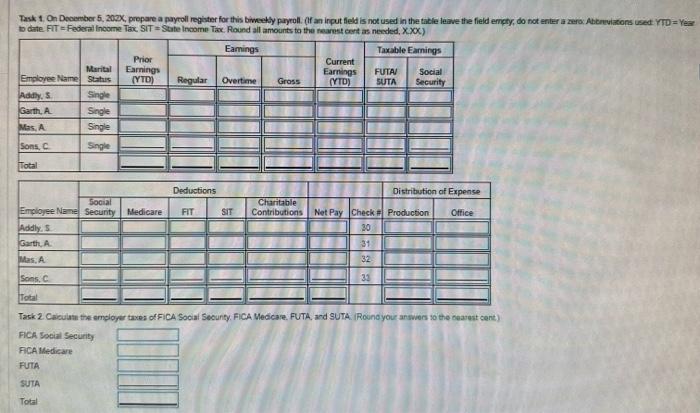

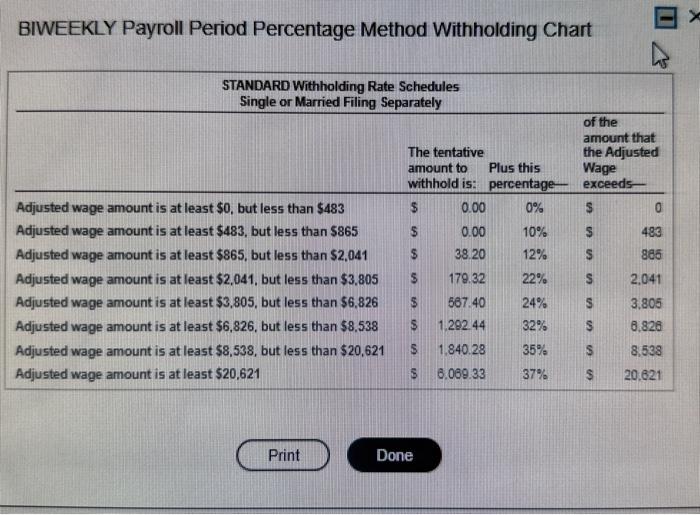

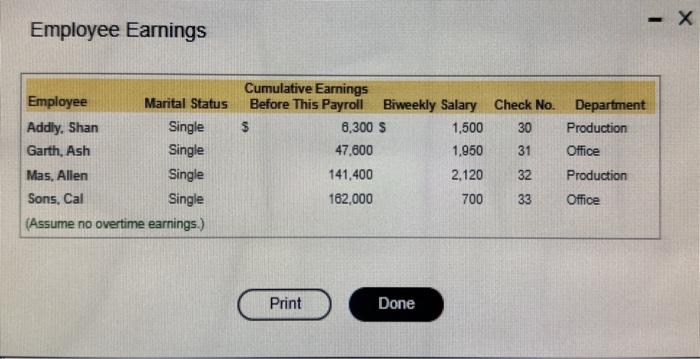

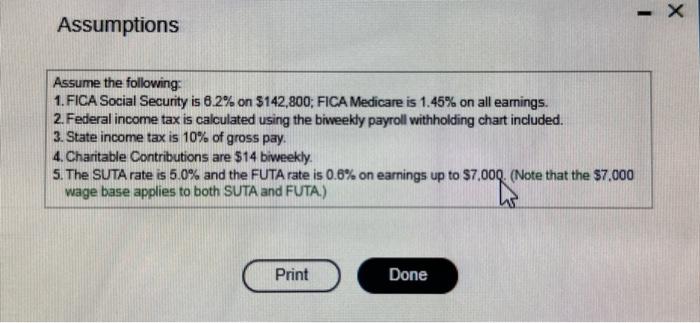

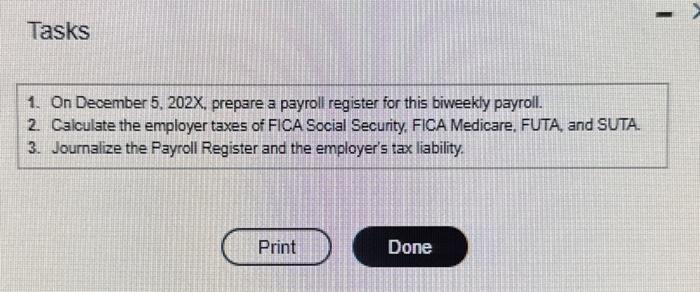

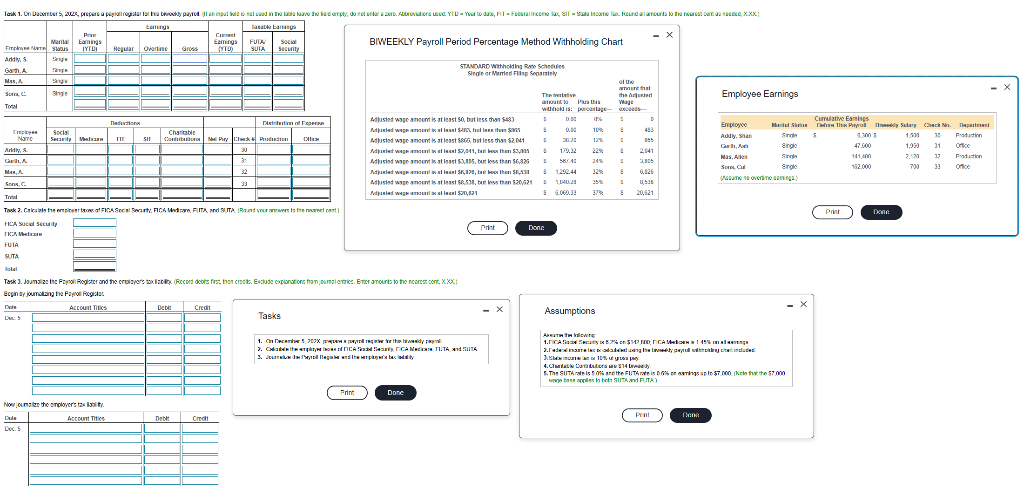

BIWEEKLY Payroll Period Percentage Method Withholding Chart Employee Earnings a7d vrur aneare is the nwevet rent t. Eustude coplanatione fon, Dertigtrice. ETher aTourts to the ncsrex ocnt, X.KX. Tasks Assumptions Tark 1. On Docember 5, 202X, propare a paycoll register for this biweehly payroll. (If an input feld is not used in the table leave the field empty, do not enter a aero: Abcrevikions used. YTD = Year to date. FT = Fedorsil Inoome Tax. SIT = Stabe Inoome Tax. Round all amounts ta the nearest cont as nended, X..OC) Wow ioumalien the enoloyei n tre liabolty BIWEEKLY Payroll Period Percentage Method Withholding Chart Employee Earnings Assumptions Assume the following: 1. FICA Social Security is 6.2% on $142,800; FICA Medicare is 1.45% on all earnings. 2. Federal income tax is calculated using the biveekdy payroll withholding chart included. 3. State income tax is 10% of gross pay. 4. Charitable Contributions are $14 biweekly. 5. The SUTA rate is 5.0% and the FUTA rate is 0.6% on earnings up to $7.000. (Note that the $7.000 wage base applies to both SUTA and FUTA.) Tasks 1. On December 5,202X, prepare a payroll register for this biweekly payroll. 2. Calculate the employer taxes of FICA Social Security, FICA Medicare, FUTA, and SUTA. 3. Journalize the Payroll Register and the employer's tax liability. BIWEEKLY Payroll Period Percentage Method Withholding Chart Employee Earnings a7d vrur aneare is the nwevet rent t. Eustude coplanatione fon, Dertigtrice. ETher aTourts to the ncsrex ocnt, X.KX. Tasks Assumptions Tark 1. On Docember 5, 202X, propare a paycoll register for this biweehly payroll. (If an input feld is not used in the table leave the field empty, do not enter a aero: Abcrevikions used. YTD = Year to date. FT = Fedorsil Inoome Tax. SIT = Stabe Inoome Tax. Round all amounts ta the nearest cont as nended, X..OC) Wow ioumalien the enoloyei n tre liabolty BIWEEKLY Payroll Period Percentage Method Withholding Chart Employee Earnings Assumptions Assume the following: 1. FICA Social Security is 6.2% on $142,800; FICA Medicare is 1.45% on all earnings. 2. Federal income tax is calculated using the biveekdy payroll withholding chart included. 3. State income tax is 10% of gross pay. 4. Charitable Contributions are $14 biweekly. 5. The SUTA rate is 5.0% and the FUTA rate is 0.6% on earnings up to $7.000. (Note that the $7.000 wage base applies to both SUTA and FUTA.) Tasks 1. On December 5,202X, prepare a payroll register for this biweekly payroll. 2. Calculate the employer taxes of FICA Social Security, FICA Medicare, FUTA, and SUTA. 3. Journalize the Payroll Register and the employer's tax liability