Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Black, Brown, and Red corporations are considering a corporate restructuring that would allow them to file Federal income tax returns on a consolidated basis. Black

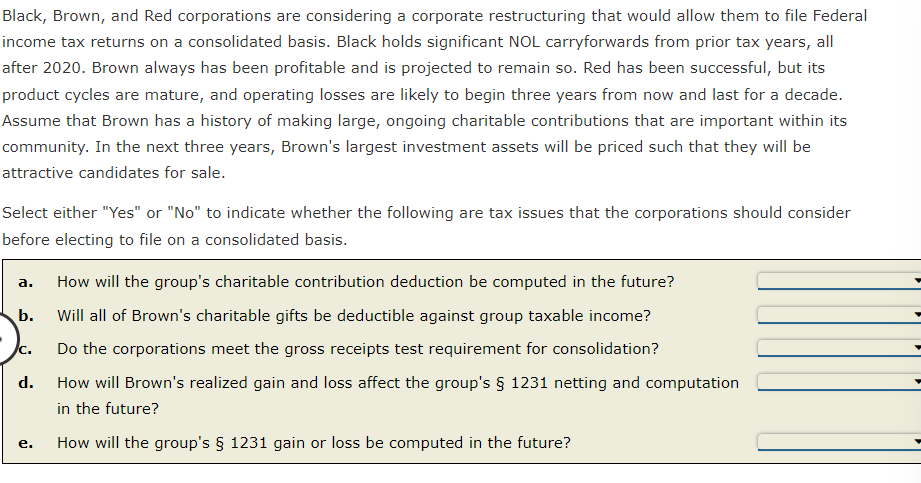

Black, Brown, and Red corporations are considering a corporate restructuring that would allow them to file Federal income tax returns on a consolidated basis. Black holds significant NOL carryforwards from prior tax years, all after 2020. Brown always has been profitable and is projected to remain so. Red has been successful, but its product cycles are mature, and operating losses are likely to begin three years from now and last for a decade. Assume that Brown has a history of making large, ongoing charitable contributions that are important within its community. In the next three years, Brown's largest investment assets will be priced such that they will be attractive candidates for sale. Select either "Yes" or "No" to indicate whether the following are tax issues that the corporations should consider before electing to file on a consolidated basis. a. How will the group's charitable contribution deduction be computed in the future? b. Will all of Brown's charitable gifts be deductible against group taxable income? c. Do the corporations meet the gross receipts test requirement for consolidation? d. How will Brown's realized gain and loss affect the group's 1231 netting and computation in the future? e. How will the group's 1231 gain or loss be computed in the future

Black, Brown, and Red corporations are considering a corporate restructuring that would allow them to file Federal income tax returns on a consolidated basis. Black holds significant NOL carryforwards from prior tax years, all after 2020. Brown always has been profitable and is projected to remain so. Red has been successful, but its product cycles are mature, and operating losses are likely to begin three years from now and last for a decade. Assume that Brown has a history of making large, ongoing charitable contributions that are important within its community. In the next three years, Brown's largest investment assets will be priced such that they will be attractive candidates for sale. Select either "Yes" or "No" to indicate whether the following are tax issues that the corporations should consider before electing to file on a consolidated basis. a. How will the group's charitable contribution deduction be computed in the future? b. Will all of Brown's charitable gifts be deductible against group taxable income? c. Do the corporations meet the gross receipts test requirement for consolidation? d. How will Brown's realized gain and loss affect the group's 1231 netting and computation in the future? e. How will the group's 1231 gain or loss be computed in the future Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started