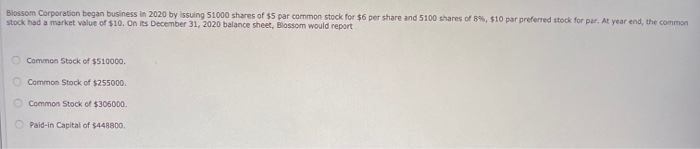

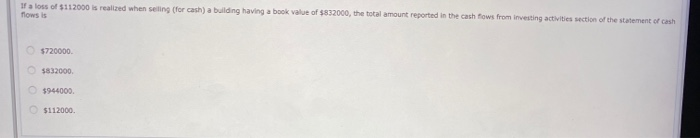

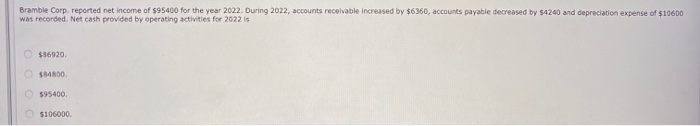

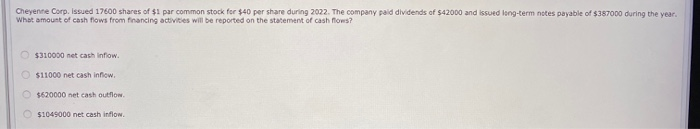

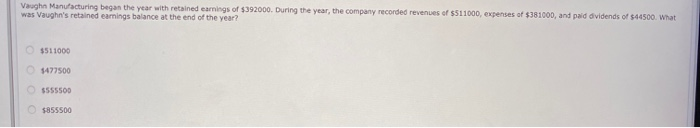

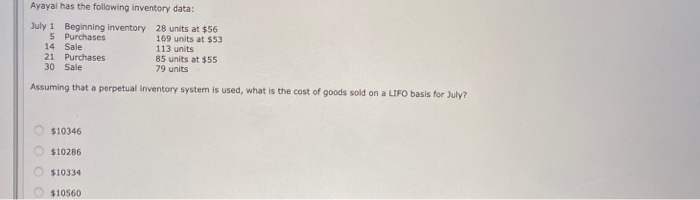

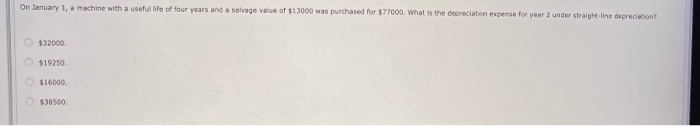

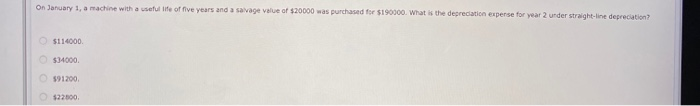

Blossom Corporation began business in 2020 by issuing 51000 shares of $5 par common stock for $6 per share and 5100 shares of 8%, $10 par preferred stock for par. At year end, the common stock had a market value of $10. On its December 31, 2020 balance sheet, Blossom would report Common Stock of $510000 Common Stock of $255000. Common Stock of $306000 Paid-in Capital of 5448800 If a loss of $112000 is realized when seiling (for cash) a building having a book value of $832000, the total amount reported in the cash flows from investing activities section of the statement of cash Mows is $720000 5832000 5944000 $112000 Bramble Corp. reported net income of $95400 for the year 2022. During 2022, accounts receivable increased by $6360, accounts payable decreased by $4240 and depreciation expense of $10600 was recorded. Net cash provided by operating activities for 2022 is $86920 C$4800 595400 $106000 Chevenne Corpswed 17600 shares of $1 par common stock for $40 per share during 2022. The company paid dividends of $42000 and issued long-term notes payable of $387000 during the year. What amount of cash flows from financing activities will be reported on the statement of cash flows? $310000 net cash inflow. $11000 net cash innow. $620000 net cash outflow $1049000 net cash inflow Vaughn Manufacturing began the year with retained earnings of $392000. During the year, the company recorded revenues of $511000, expenses of $381000, and paid dividends of $44500. What was Vaughn's retained earnings balance at the end of the year? $511000 $477500 $555500 $855500 Ayayal has the following inventory data: July 1 Beginning inventory S Purchases 14 Sale 21 Purchases 30 Sale 28 units at $56 169 units at $53 113 units 85 units at $55 79 units Assuming that a perpetual inventory system is used, what is the cost of goods sold on a LIFO basis for July? $10346 $10286 $10334 $10560 On January 1, a machine with a useful life of four years and a salvage value of $13000 was purchased for $77000. What is the depreciation expense for year 2 under straight line depreciation? $32000. $19250 $16000 $38500 On January 1, a machine with a ful life of five years and a savage value of $20000 was purchased for $190000. What is the depreciation experse for year 2 under straight-line deprecation? $114000 $34000 391200 22000