Answered step by step

Verified Expert Solution

Question

1 Approved Answer

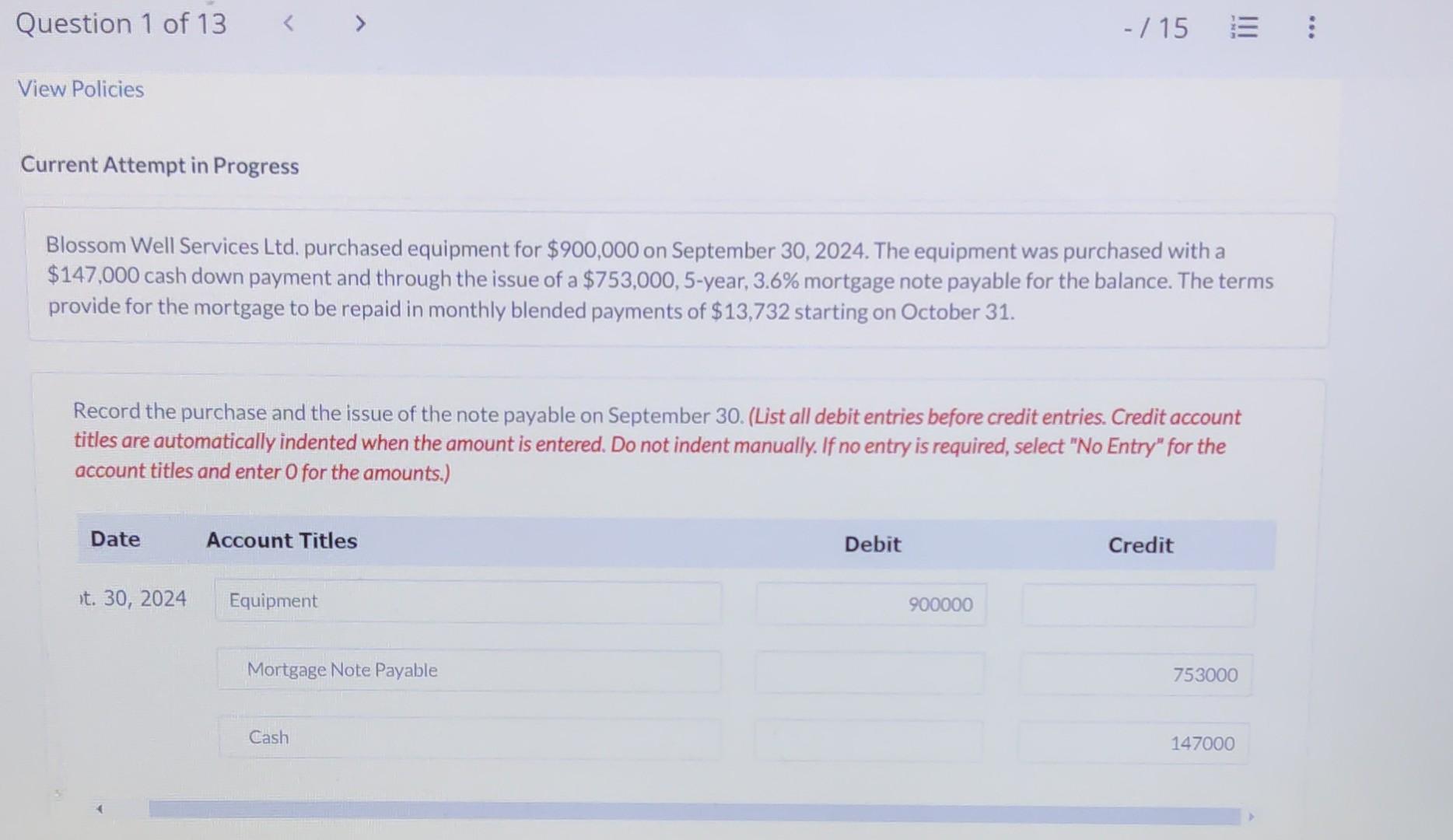

Blossom Well Services Ltd. purchased equipment for $900,000 on September 30, 2024. The equipment was purchased with a $147,000 cash down payment and through the

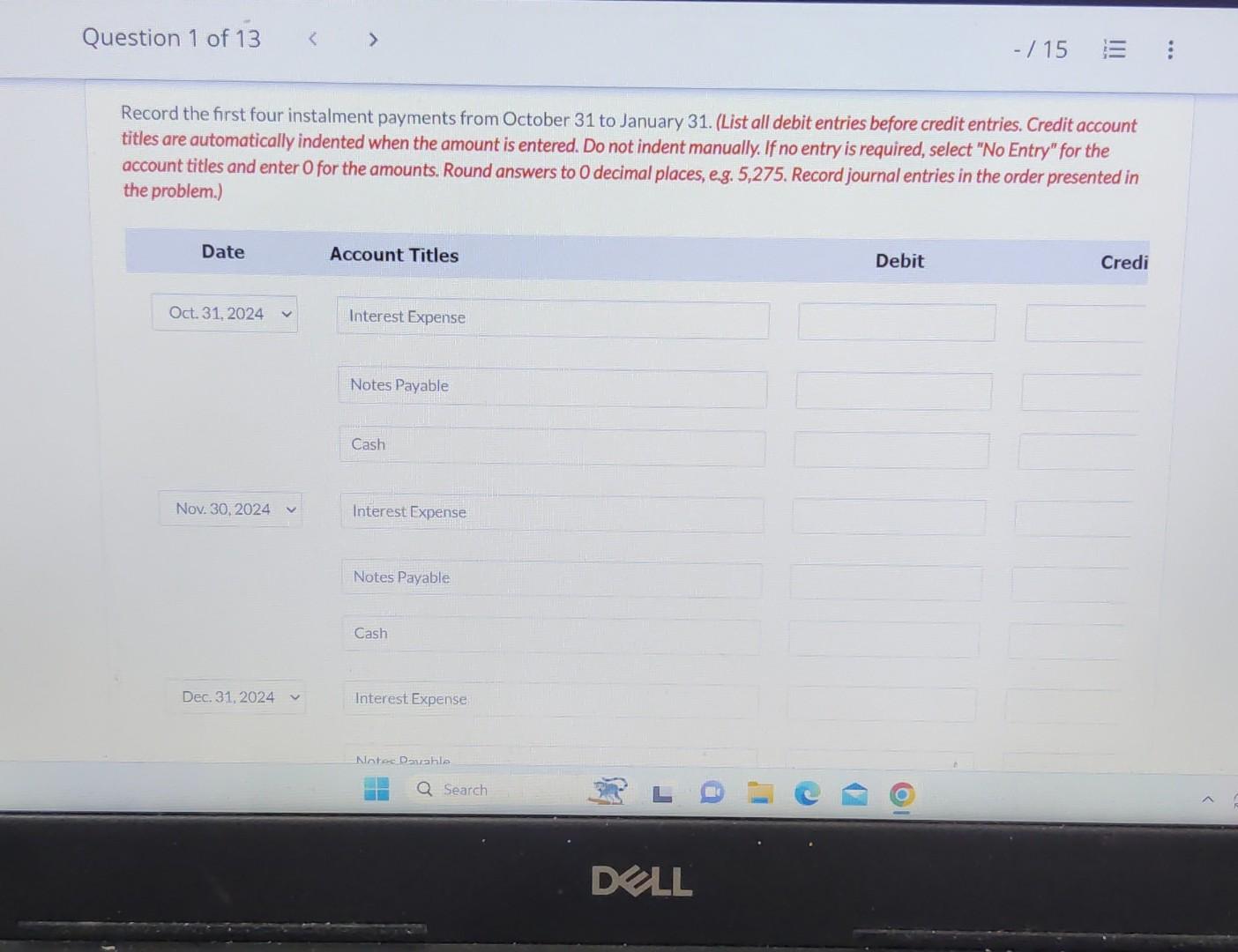

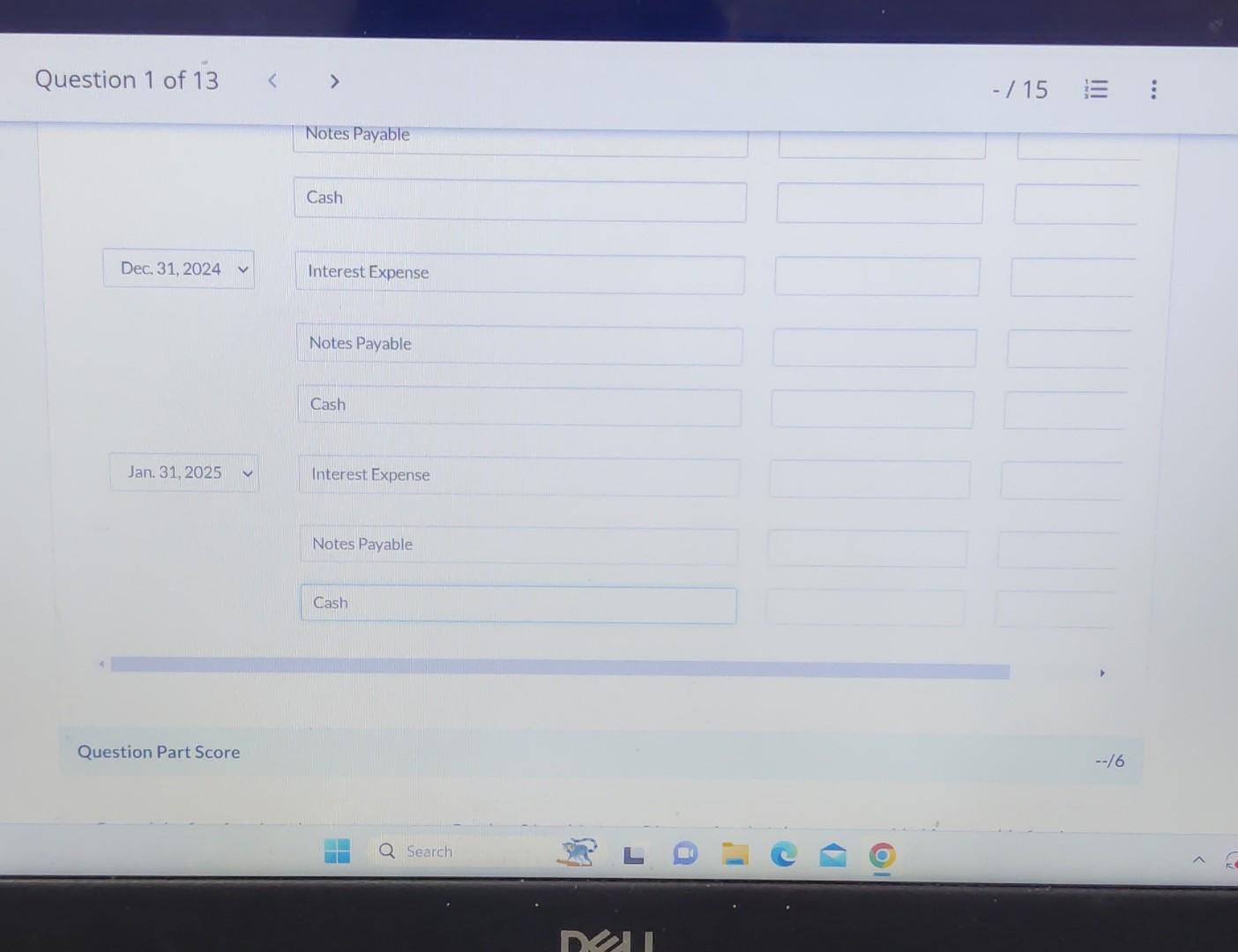

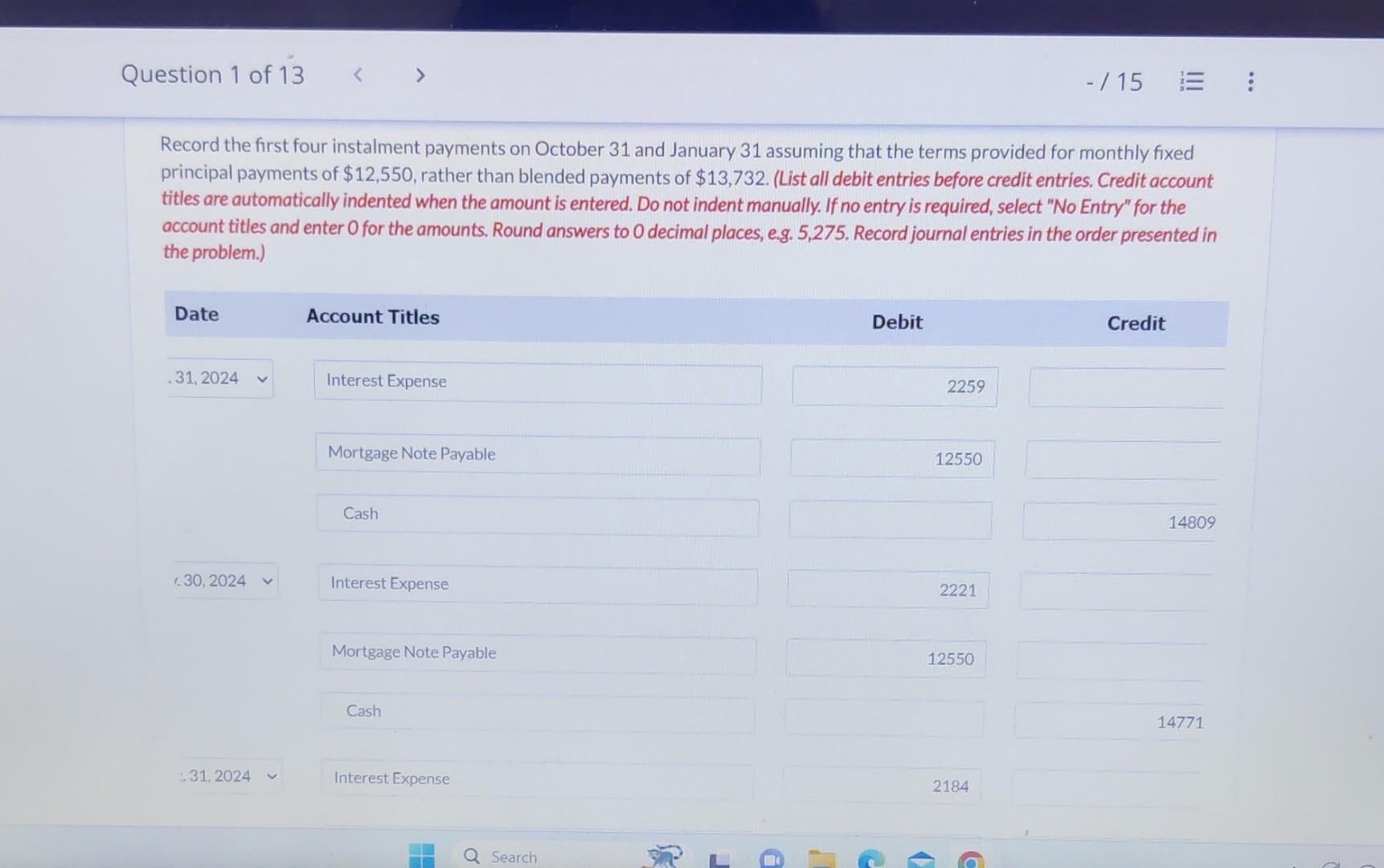

Blossom Well Services Ltd. purchased equipment for $900,000 on September 30, 2024. The equipment was purchased with a $147,000 cash down payment and through the issue of a $753,000,5-year, 3.6% mortgage note payable for the balance. The terms provide for the mortgage to be repaid in monthly blended payments of $13,732 starting on October 31 . Record the purchase and the issue of the note payable on September 30. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Record the first four instalment payments from October 31 to January 31. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275. Record journal entries in the order presented in the problem.) Question 1 of 13 /15 Record the first four instalment payments on October 31 and January 31 assuming that the terms provided for monthly fixed principal payments of $12,550, rather than blended payments of $13,732. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275. Record journal entries in the order presented in the problem.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started