Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bob retired five years ago. He has chosen to withdraw $15,000 a year from his fully taxable 401(k) retirement plan at work each year.

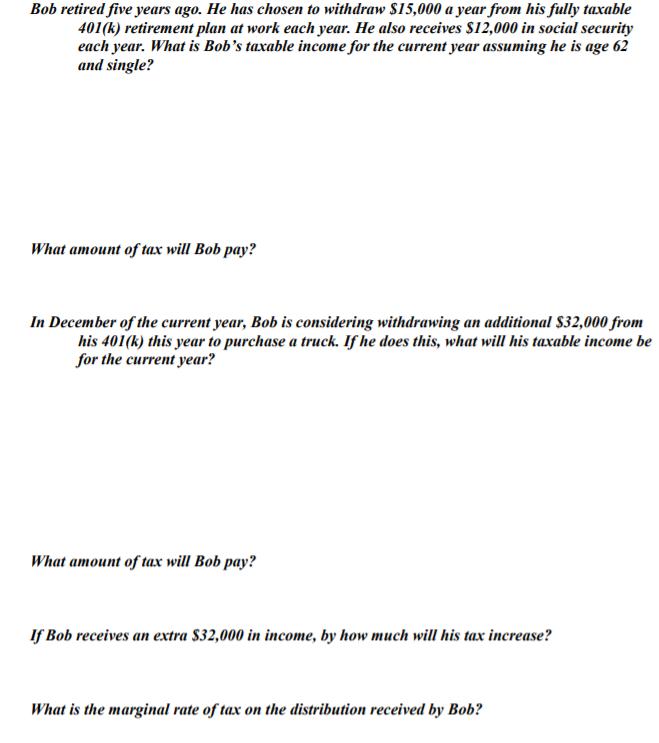

Bob retired five years ago. He has chosen to withdraw $15,000 a year from his fully taxable 401(k) retirement plan at work each year. He also receives $12,000 in social security each year. What is Bob's taxable income for the current year assuming he is age 62 and single? What amount of tax will Bob pay? In December of the current year, Bob is considering withdrawing an additional $32,000 from his 401(k) this year to purchase a truck. If he does this, what will his taxable income be for the current year? What amount of tax will Bob pay? If Bob receives an extra $32,000 in income, by how much will his tax increase? What is the marginal rate of tax on the distribution received by Bob?

Step by Step Solution

★★★★★

3.30 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a 27000 15000 plus 12000 is 27000 b 1800 27000 less the standard deduction 6...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started