Answered step by step

Verified Expert Solution

Question

1 Approved Answer

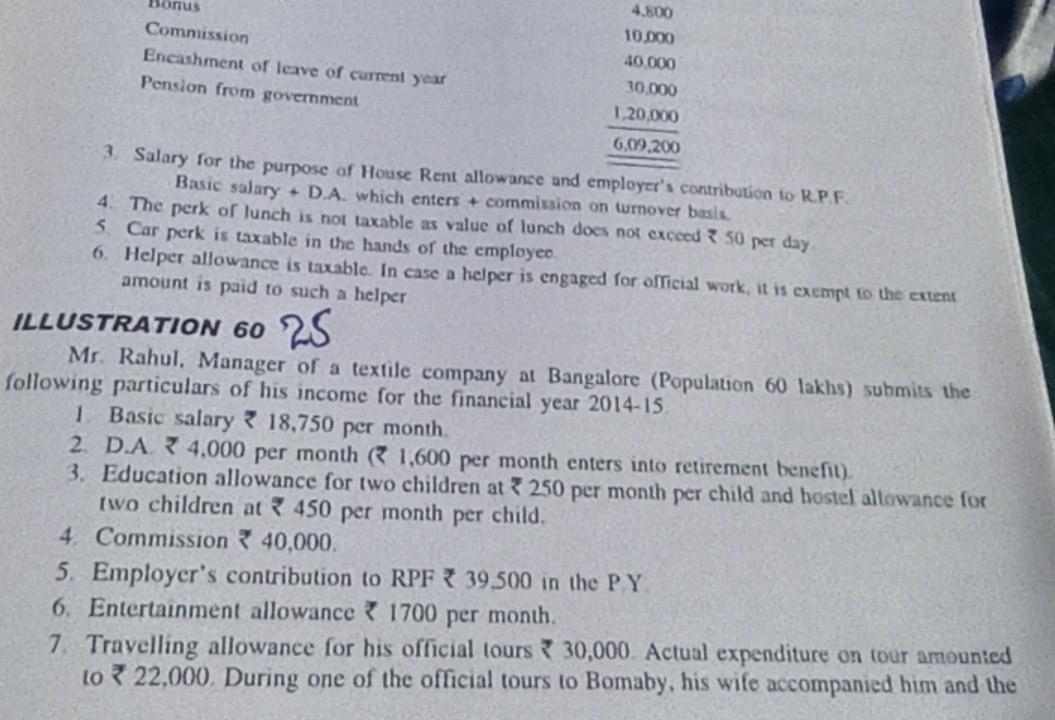

Bonus Commission Encashment of leave of current year Pension from government 4.500 10.DOO 40.000 30.000 1.20,000 6,09.200 3. Salary for the purpose of House Rent

Bonus Commission Encashment of leave of current year Pension from government 4.500 10.DOO 40.000 30.000 1.20,000 6,09.200 3. Salary for the purpose of House Rent allowance and employer's contribution to RPF Basic salary - D.A. which enters + commission on turnover basis 4. The perk of lunch is not taxable as value of lunch does not exceed 50 per day 5. Car perk is taxable in the hands of the employeo 6. Helper allowance is taxablo. In case a helper is engaged for oicial work, it is exempt to the extent amount is paid to such a helper ILLUSTRATION 60 25 Mr. Rahul. Manager of a textile company at Bangalore (Population 60 lakhs) submits the following particulars of his income for the financial year 2014-15 1 Basic salary 18,750 per month 2. D.A ? 4,000 per month ( 1,600 per month enters into retirement benefit). 3. Education allowance for two children at 250 per month per child and hostel allowance for two children at 450 per month per child. 4. Commission 40,000. 5. Employer's contribution to RPF 39.500 in the P Y. 6. Entertainment allowance 1700 per month. 7. Travelling allowance for his official tours 30,000. Actual expenditure on tour amounted to 22.000. During one of the official tours to Bomaby, his wife accompanied him and the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started